Published in The Daily Star on Thursday, 2 June 2016

Promises for tax reforms fall through

Sohel Parvez

Four years ago, when Finance Minister AMA Muhith unveiled his plan to modernise the tax revenue system to ease taxpayers’ hassle, many believed that better days are on way.

Four years ago, when Finance Minister AMA Muhith unveiled his plan to modernise the tax revenue system to ease taxpayers’ hassle, many believed that better days are on way.

Today, four years on, taxpayers still do not have much to celebrate, as save for a few promises, all remained unfulfilled.

By now, the tax system was supposed to be fully automated enabling taxpayers to file returns, pay taxes online and thus get relief from visiting tax offices. It is yet to materialise.

The tax administration is eyeing the next fiscal year to open the scope for online returns filing — a facility Muhith had promised to fulfil by 2014.

This is one of various commitments made by the finance minister in his past budget speeches to modernise the revenue system through automation and reforms.

The underlying goal of all the initiatives was to accelerate revenue growth and raise Bangladesh’s tax-GDP ratio so that the state can spend more for the advancement of the nation from its own coffer.

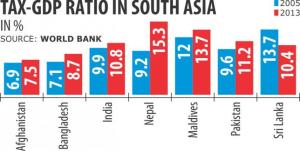

Bangladesh’s tax-GDP ratio, a measure of a state’s capacity to finance its programmes, is one of the lowest in the world. In South Asia, it is just above Afghanistan, according to the World Bank. In his budget speech in fiscal 2011-12, Muhith unveiled the ‘NBR Modernisation Plan’ for 2011-16, which aimed to raise the tax-GDP ratio to 13 percent by 2016.

The ratio stands at 8.73 percent this fiscal year, according to official data. Analysts said faster reforms and modernisation of the tax policy and tax administration would have yielded higher revenue collection than the current trend.

It would have allowed the government to spend more for financing development programmes and social sectors.

However, the pace of reforms and modernisation of the revenue system has been slow — a trend that raises questions about the government’s commitment to reforms and the taxmen’s willingness to accept the change.

“There is resistance both within and outside against reforms. People from both inside and outside the NBR want to maintain the status quo,” said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

“The government should send a strong message that we are in business.”

Strong political commitment and enforcement are needed to speed up the pace of revenue related reforms. “Without this, reforms cannot be successful.”

While there has been progress in VAT reforms, questions remain as to whether the new VAT law would become effective from fiscal 2016-17.

Passed in 2012, the new VAT law was originally supposed to take effect from July 2015. But the deadline was shifted to July this year in the face of opposition from businessmen and a lack of preparation by the NBR.

Now, it looks like there might be further delays as resistance to the new law still remains among the business community and a section of revenue officials.

The government’s commitment to the new law is debatable because questions have been raised as to whether it will be implemented in July at all, he said.

“That’s not a very good indication of a serious resolve in addressing the structural problem with the NBR,” Mansur added.

The VAT law is not the only one; take the case of a new income tax law.

The tax authority first drafted the Direct Tax law in 2010-11 with support from the International Finance Corporation, and Muhith pledged to place the bill at the parliament by 2012.

Since then, the draft legislation, termed the Direct Tax Code, has been revised several times.

Recently, the NBR has taken a fresh bid to design an income tax law that is attuned to Bangladesh’s socioeconomic reality, after discouraging feedbacks on the latest draft of the Direct Tax Code.

Mansur said there has been no reform related to the framing of a new direct tax law, although there has been automation in some areas.

“I agree that there will be e-filing, but what does it mean? This reform is going to take place without any substance.”

The tax administration plans to introduce e-filing of returns by retaining the same procedure as before, which is territory-based and not on functional lines.

“They have just automated the existing system. This will not bring any real benefit as the power of a tax officer in a territory will continue as before.”

The NBR should have simplified the business process, Mansur said. “A complete overhaul of tax administration was needed and not just the automation of the existing system.”

Muhith in his budget speech for fiscal 2013-14 said the government wants to set up another Large Taxpayers Unit (LTU) in Chittagong like the one in Dhaka with a view to transforming the existing territory type tax administrative structure into a functional one.

Similar functional type of administration will also be introduced in Rajshahi and Khulna the following year, he said in the budget speech.

The NBR last year opened the LTU in Chittagong as an extended office of the one in Dhaka by transferring 45 corporate files along with its directors under its jurisdiction, according to the latest annual review done under the Tax Administration, Compliance and Taxpayer Services (TACTS) project.

“But it came only after much influencing during the TACTS project,” said the review, which was posted on the website of the UK government’s Department for International Development, which funded the project.

The tax authority, however, decided not to go ahead with the plan to roll out a functional organisation in Khulna zone, said the review.

In a review of TACTS in 2015, it said the establishment of pilot LTUs demonstrated the benefits of a functional form of organisation — a point which many taxmen do not agree with.

Mansur said the government is yet to show enough political commitment that is needed to achieve the goal.

“Reforms may be costly in the short run, but it will be very enriching. You will be able to realise the returns on capital. That’s what politicians need to understand.”

“And if we fail to completely overhaul the direct and indirect taxes, our expectation for revenue growth — increase in tax-GDP ratio every year — would not be realised.”

If so, the government will be unable to find funds to reach its political and social goals, such as poverty reduction, Mansur added.

Despite sluggish reforms in various areas, there has been an improvement in some areas in recent years.

A potential taxpayer can get taxpayer identification number (TIN) online without visiting any office or spending any money.

As promised, the NBR has opened “taxpayers’ information and service centres” in all divisional cities to help people get TINs.

The manpower and field offices of NBR have also been increased.

Towfiqul Islam Khan, research fellow of the Centre for Policy Dialogue, said the enactment of relevant acts and placing institutional, administrative, logistics and technological efforts are critical for Bangladesh to substantially raise the level of government revenue.

“Delays in the implementation of reform initiatives hurt the objectives of augmenting domestic resources,” he said, while urging the government to get the associated stakeholders on board to successfully implement any reform.

“While formulating and implementing reform agenda, it is important to discuss, debate and raise awareness among the stakeholders.”