Published in Dhaka Tribune on Tuesday, 18 March 2014.

Cashing in the cow

Khaleda Akhter, Nadee Naboneeta Imran

The intertwined fate of the export sector and the rationale for government subsidy

Bangladesh owes its growth of the past two decades to the success of the export sector that has been the driving wheel of the economy and has earned Bangladesh the proud label of being one of the fastest growing economies in the world. In spite of the phenomenal growth and strength it has rendered to the economy, the mighty sector has not been free from blows and shocks that it handled with utmost resilience.

The recent past has been another dismal scene for the sector with political disruptions, global economic crisis and other unwanted incidents threatening to bring the industry to its knees. However, to the relief of the economy, the sector has stood strong against the wind and succeeded to maintain a sturdy growth.

In the backdrop of all the shocks, the government of Bangladesh has planned to cooperate and compensate the exporters for their losses through various cash and non-cash measures. In this article, we aim to look into the rationale of such incentives and their effectiveness.

Let’s take a look at the current export scene before going into the rationale for providing government incentives.

The significant export growth of 15.08% during July to January of Fiscal Year 2014, compared to the corresponding period of FY2013 was a big achievement given the political turbulence that created unwanted supply-side glitches during that period.

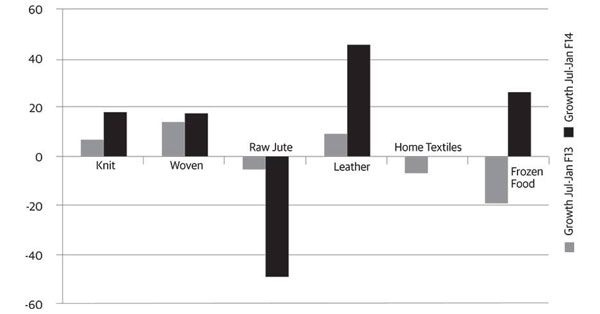

The RMG sector along with other growing export sectors like leather, shrimp, footwear and pharmaceuticals have contributed meaningfully to the growth of the export sector during the first seven months of FY2014 compared to the match period of FY2013. The fall of raw jute export has been drastic (-21.24%) over July to January of FY2014 compared to the same time last year.

Graph 1 shows the growth of the different export commodities in FY2014 and FY2013 (July-January).

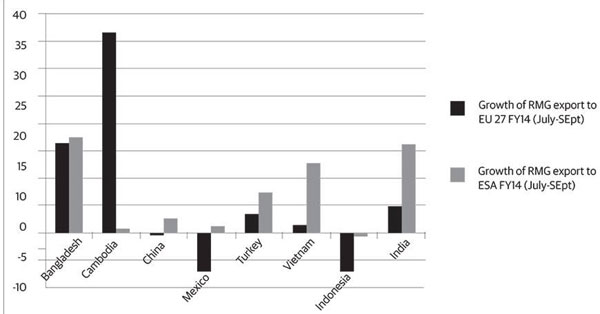

Market decomposition analysis shows that the robust growth of RMG sector can be traced from the export growth to the US and EU markets. In between July to October of FY2014 the exports from Bangladesh to US markets rose by 17.6% compared to its corresponding period in FY2013 closely followed by India and Vietnam.

On the other hand, Bangladeshi RMG exports to EU markets grew by 16.6% between July to September of FY2014 compared to matched period last year. However, trade with India over the concerned period has experienced a sharp decline (-31.72%) hinting at the mighty impact of the political turbulence on trade relation between these two neighbouring nations heavily dependent on the roads and land routes for their trades (Graph 2).

The list of disruptions caused due to these political shutdowns include but is not limited to lower production, order cancellation, shipment delay, higher transportation cost, high cost of doing business and other losses incurred by vandalism. The blockades severely hindered the smooth flow of raw materials and capital machineries to and from the ports leading to delayed production process, missed deadlines, cancelled orders and congestion related problems both at the ports and warehouses.

The transport cost escalation was reflected directly through the higher cost of doing business for the exporters and loss of profitability. There are also cases of inability to get transport for goods on time even at high prices due to the vandalism during hartals and blockades. The higher cost of doing business teamed with lost capacity forced many firms to shut down during this period.

Although a perfect figure for losses incurred by the export sector is unavailable, we can certainly conclude that the exporters had higher costs during this crisis. A common fear among the stakeholders in the aftermath of the tarnished reputation and missed deadlines that have already spurted out in the form of cancelled orders and orders shifted to other countries.

Exporters have assumed 30-40% declines in orders received in the apparel sector. BGMEA estimates a total loss of USD 5.56m due to order cancellations. Further, cases have been reported of orders being shifted to Vietnam, India and Indonesia.

In the face of the current situation and the roars of demand emancipating from various export groups the government has extended its hands of cooperation by offering some incentives to the export oriented industries like cash subsidy, loan rescheduling and reduction at tax source.

Among the notable initiatives are Bangladesh Bank’s scheme to provide loan upto $10m from Export Development Fund (EDF) at a rate of 1.5% and a 3% subsidy on export loans to encourage export sector. The government itself has decided to reduce tax at source from 0.80% to 0.30% for the apparel and textile sector, provide cash incentives for the apparel sector against telegraphic transfer (TT) and provide cash subsidy worth Tk25.92bn to several export sectors.

The jute and jute products sector will receive Tk3.47bn as cash incentive in the FY2013-2014 while agro based and agro processed products will enjoy 20% cash incentive followed by leather industry which will receive 15%, shrimp and fisheries 10% and home textile 5%. A stimulus package for the exporters in general is under discussion but has not seen daylight as yet.

The economic argument in favour of subsidisation is that if an important industry may run into serious temporary difficulties and be in danger of ceasing operations, then the government can subsidise the industry with direct cash support or loan guarantees. The broad argument in favour of these policies for the export sector is given below:

Reduce the loss in the export sector

Offset high cost of doing business in the short term, and

Higher export earnings

Advancing export sector through incentives might increase the output as well as the aggregate demand in the economy. These initiatives can help export oriented sectors to reduce the losses due to the crisis and to boost the export earnings in near future. However, the initiatives have several implications for the economy in the long run. Government cash subsidy will lead to an expansionary fiscal policy, which will raise the government expenditure.

Since the government needs to go for expansionary fiscal policy, it is implicit that the pressure of this expenditure either has to be borne out by the public in terms of higher taxes or the government needs to borrow from public and private sources to support these measures. Loan rescheduling and other facilities also create severe pressure in the banking sector of the economy. Reductions of taxes also have negative impact on the government earnings.

The fiscal incentives/measures do have higher opportunity cost as the government has limited resources. Hence, increased allocation for export sector might reduce the allocation from other priority sectors such as infrastructure, health or education which have higher implications on poverty reduction for Bangladesh.

Theoretically, under flexible exchange rates, expansionary fiscal policy is ineffective in bringing about the desired goals. However, Bangladesh as a growing economy with a booming export sector may not face total offsetting of next exports due to interest rate increase rendering the expansionary fiscal policy partially, even if not totally, effective.

Several country experiences showed that the notion of higher output due to the subsidy may be less than optimal because of underlying market failures. Therefore, these supportive measures for the exporters need to have an economic efficiency rationale; and a social equity perspective should also be taken into account.

Social equity has its own importance in the context of Bangladesh’s economy due to the number of poor and disadvantaged people and the strong presence of the informal sector in the economy. Total concentration on the RMG sector when devising the incentives may have implicit flaws in that other potential export sectors like shrimp and fisheries, leather, footwear and bicycle may need more impetus than the existing giants.

More concentration on these growing sectors may help create a more diversified and well-balanced export sector with reduced burden on the RMG sector. Providing subsidies to large sectors might also deprive the small and medium scale enterprises.

Therefore, it is needless to mention that the selection criteria of the exporters from varied industries need to be transparent ºand accountable. Political patronage should not be given any consideration while giving cash subsidy, tax reduction, and loan rescheduling benefit to promote the export sector.