Published in The Financial Express on Saturday, 12 April 2014.

Private investment frustratingly low

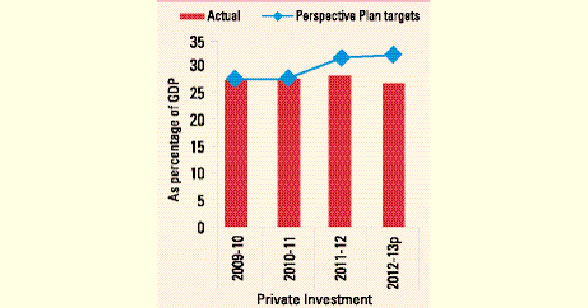

The economists who specialise in trade and finance also pointed out that the growth in private investment in recent years remained much lower than the target set in the country’s Perspective Plan of 2021.

According to the finance division, private investment was in conformity with the target set in the Perspective Plan up to fiscal year (FY) 2010-11 at 20 per cent of the GDP. It went down in 2011-12.

The growth in the actual private investment, however, remained almost stagnant during FYs 2011-12 and 2012-13 at around 19 per cent of GDP.

They hinted that the actual private investment would show substantial decline at the end of the current FY 2013-14 that has witnessed restive politics during the final months of 2013.

They found dearth of industrial land, insufficient power and transport structure and inefficiency of the investment promoting agencies as the main barriers to investment.

They noted that Bangladesh now needed a lasting peaceful environment for boosting private investment that had remained stuck at around 19 per cent of the GDP over the past few years.

They, however, said public investment was rising in recent years due to a boost to the rate of Annual Development Programme implementation.

Ahsan H Mansur, executive director at the Policy Research Institute of Bangladesh (PRI), said: “In my view, Bangladesh’s most critical issue right at this moment is the slow pace of investment.”

Mr. Mansur said the efforts in terms of growth, employment and poverty alleviation would not yield the expected results without accelerating investment.

Mr Mansur said there were many reasons behind the slow growth in the actual private investment in the country.

He said different indicators issued by the global lending agencies in the recent period have been showing that the pace of investments, both local and foreign, is decreasing.

Mr. Mansur was critical of the Board of Investment (BoI), saying the public investment promoting agency now needs a massive reform to make it an effective office of investment promotion.

“The government should take reform measures in the BoI to promote investment,” Mr. Mansur noted.

Dr. Mustafa K Mujeri, director general at the Bangladesh Institute of Development Studies (BIDS), termed the stagnancy in investment as the biggest issue for the government saying the government now needed to take massive efforts to boost investment.

“As I view it, micro efforts will not work any more. It needs massive efforts,” Mr. Mujeri said.

He also said the prevailing environment in terms of ‘political stability’ would not help promote private investments.

“Actually, when the investors will see a lasting peaceful environment, then they will invest.”

Dr Khandker Moazzem, an additional director at the Centre for Policy Dialogue (CPD), viewed that the sluggishness in demand for goods in the domestic market was one of the key reasons for slow investment in the country. He said not only the political trouble in 2013, but also the slow growth in remittance had slowed down investment.

Mr Moazzem said the government should announce a detailed programme in terms of policy and infrastructure to attract private investment.

However, according to BoI, the investment proposals in terms of their values in the recent years had fallen significantly.

The proposals registered with the BoI for joint ventures and 100 per cent foreign investments fell by 40 per cent in 2012-13 compared to the corresponding period in 2011-12.

The proposal for local investment registered with the BoI fell by more than 16 per cent. The month-to-month investment also fell in February last compared to that in the previous month of January in 2014.