Published in The Daily Star on Sunday, 20 April 2014.

NBR’s tax receipts remain sluggish

Growth slowest in seven years

Sohel Parvez

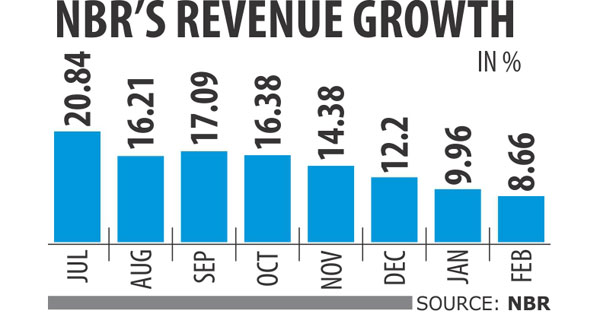

Revenue collection remained sluggish in the first eight months of the fiscal year, with the National Board of Revenue recording the lowest year-on-year growth in tax receipts for the period in the last seven years.

Between July and February, collections rose 8.66 percent year-on-year to Tk 68,344 crore, according to data from NBR.

Lower receipts from customs as well as falling collection growth in VAT and income tax, the two major sources of revenue, caused the slowdown in revenue collection.

“Falling growth reflects the fall in domestic demand,” said Ahsan H Mansur, executive director of Policy Research Institute.

During the period, VAT collections grew 13.29 percent to Tk 26,192 crore, while the pace of income tax collection growth slowed to 14 percent. Receipts from customs fell 0.86 percent to Tk 20.863 crore.

“The collection of tax at source has fallen as development activities are yet to pick up. Collection of advance income tax from exports and imports was also less than expected,” a senior official of NBR said, seeking to remain unnamed.

The increased tax rebate privileges for investment also caused a fall in income tax collection, he said, adding that if the current pace of collection continues, it will not be possible to achieve the revised revenue target.

Subsequently, the NBR last month revised down fiscal 2013-14’s collection target by 8 percent to Tk 125,000 crore.

Mansur said tax collection might improve in the coming months due to political stability, pick-up in imports and increased remittance inflows. But, it may not be enough to achieve the revised target.

“Economic activities will not shoot up overnight to facilitate tax collection growth,” said Towfiqul Islam Khan, research fellow of Centre for Policy Dialogue.

He said the government should fix the next fiscal year’s revenue collection target considering the current fiscal year’s collection.

“Tax target should be realistic to ensure fiscal balance,” Khan said.