Published in The Daily Star on Tuesday, 26 April 2016

FDI picture mixed

Rejaul Karim Byron and Md Fazlur Rahman

Investment by the existing foreign companies picked up in Bangladesh in 2015 but new FDI slipped despite the relative political calm.

Overall, foreign direct investment rose 31 percent year-on-year to $2.7 billion last year, according to data on gross FDI from the central bank.

Foreign investment is split into three categories: equity, reinvestment of earnings and intra-company loan.

Equity or new investment declined 1.17 percent from a year earlier to $758 million in 2015, while reinvestment of earnings increased 15 percent to $1.14 billion.

Intra-company loans more than doubled year-on-year to $795 million in 2015, showed Bangladesh Bank figures. Although existing companies are making investment, fresh FDI is not coming as fast as the government is expecting.

Economists blamed the perennial infrastructural bottlenecks and administrative barriers for the fall in fresh FDI.

Zahid Hussain, lead economist of the World Bank’s Dhaka office, said new investment in the form of equity is not coming.

“This is because there has not been any significant change in Bangladesh’s investment scenario. The fundamental barriers that have been holding back new investment have not seen new visible improvement apart from the power sector.”

The problems with roads and highways, ports and land have remained the same.

Hussain said foreign investors take into account what the World Economic Forum, the International Finance Corporation’s Ease of Doing Business and the Logistics Performance Index are saying about Bangladesh.

But Bangladesh has not improved significantly in these rankings, particularly in the sectors critical for the economy, he said.

“That is why new equity is not coming to Bangladesh — it is nothing surprising. It is not true in case of only foreign investment. Local investment is also not picking up,” said the WB economist.

In the latest WB’s ranking of the ease of doing business, Bangladesh’s position dropped two rungs to 174 out of 189 countries due to stalled regulatory reforms.

The overall private investment rate has gone down in terms of gross domestic product, according to the latest figures from the Bangladesh Bureau of Statistics.

Bangladesh’s ranking is very low in case of getting electricity connection, property registration, contract enforcement and dispute settlement.

Alternative systems to resolve dispute and recover defaulted money are not functioning properly, said Hussain.

About the increase in intra-company loans, he said it is difficult to say why it went up. Hussain said there has been some progress in the preparatory work for the special economic zones by way of signing contracts.

“But if you don’t develop them, investment will not come. We can’t give an example of one special economic zone that is ready for investors to come.”

The WB economist said investors must have confidence that agreements signed with the government will be honoured during the contract period; otherwise, they get scared.

He said Bangladesh has large workforce, access to sea and a third-generation of entrepreneur class.

“We will have been able to use these strengths if we could remove our structural constraints,” Hussain added.

Khondaker Golam Moazzem, additional research director of the Centre for Policy Dialogue, said there have been some structural changes in foreign investment in the last few years. In some cases, it is encouraging.

The current flow of foreign investment is positive at a time where local investment is not picking up at an adequate level.

Reinvestment and intra-company loans have gone up. “It is a positive sign that existing companies are investing. At the same time, it has to be kept in mind that new investment is not coming, which is a matter of concern.”

The economist thinks there is a deficit in the congenial environment that can bring in more new investors from overseas.

He said foreign investors are largely interested in making small-sized investments. But in most cases, a congenial environment is missing.

They face various administrative barriers, and there is also disrupted supply chain. “We have to improve the supply chain so they can get their inputs in time and make timely shipments.”

Moazzem said the entities entrusted to provide services to investors are not well-prepared yet. “There is weakness at state-run Board of Investment.”

He said Japanese investors had raised a number of issues, and detailed discussions were held about them. But the investors have not received positive response.

Sometimes, foreign investment-friendly decisions are not taken, he said, adding that because of tussle over KEPZ, many overseas investors have returned.

In a programme in Dhaka on Sunday, Abdul Matlub Ahmad, president of the Federation of Bangladesh Chambers of Commerce and Industry, said he felt ashamed of the tussle over KEPZ.

“This gives a message to international investors that Bangladesh does not keep its promises. When we meet businesspeople abroad they also talk about it.”

The FBCCI will take a step to make an arrangement for the two sides to sit to find an amicable solution. “I will definitely talk to the government about the issue.”

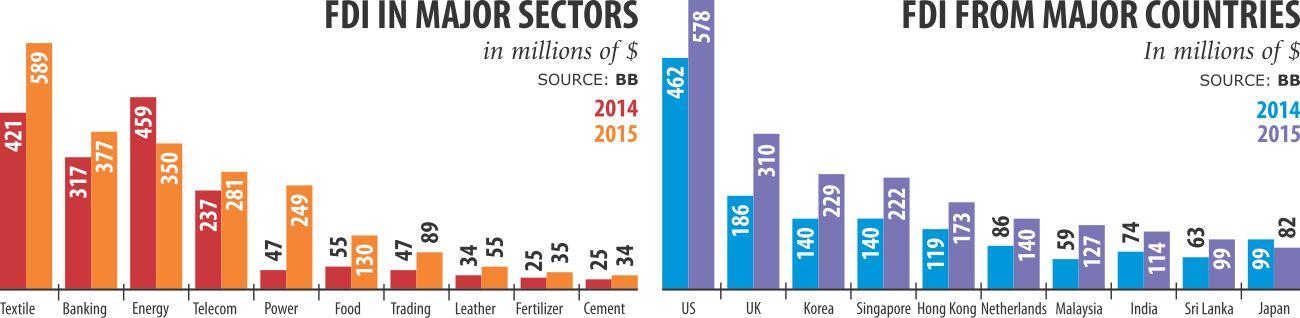

Sector-wise, textile and weaving topped the list in attracting FDI, toppling energy sector, which is growing at 40 percent.

FDI to the power sector rose five times last year compared to 2014.

Moazzem said in the past, service sector led the foreign investment. But it is gradually moving towards manufacturing sector.

The amount and growth of foreign investment in the manufacturing sector have gone up in the last several years, which will create more jobs and use local inputs. It is ultimately benefitting the economy, he said.

The US, the UK, and South Korea topped the list of countries sending FDI to Bangladesh.

Bangladesh is seriously thinking about providing SEZ to investors from China, India and Japan. But FDI from China and Japan has not picked up yet.

In fact, FDI from Japan declined, while India’s investors brought in $114 million to Bangladesh, up 56 percent year-on-year.

China’s FDI in Bangladesh in 2015 stood at $57 million against $47 million a year earlier.

“Emerging investing countries such as India are showing interest in investing in Bangladesh. If there is significant improvement in infrastructure in the coming years, more investments will come to Bangladesh,” said Moazzem.