Professor Mustafizur Rahman on politics impacting economic outlook, published in The Daily Star on Tuesday, October 22, 2013.

Political unrest to hurt economic outlook

Analysts say capital flight increases in election year

Sajjadur Rahman

The impending street agitation in the run-up to the next national election would take a heavy toll on the economy, analysts said.

“Generally, capital flight increases in election year. But this will not be reflected in the current year’s gross domestic product, but on the country’s future economic potential,” said Mustafizur Rahman, executive director of Centre for Policy Dialogue.

Quoting the Global Integrity Report, Rahman said $1.4 billion on average was moved out of the country every year for the past 10 years.

At the same time, businesses and professionals are increasingly becoming worried about the lack of progress on the political front regarding the national election.

They are concerned that if the agitation intensifies, it would hurt the manufacturing and services sectors, the lifelines of the economy. In fiscal 2012-13, the manufacturing sector contributed 31.99 percent and services sector almost half — 49.30 percent — to the economy.

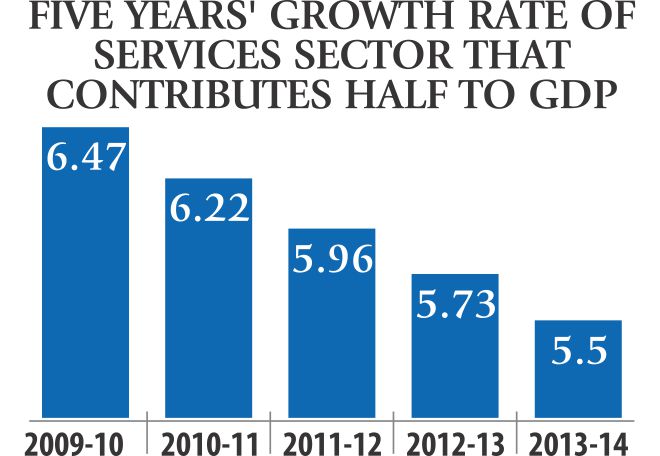

Meanwhile, the Asian Development Bank in its latest economic outlook has already forecasted that the growth of the country’s services sector will go down to 5.5 percent in the current fiscal year from fiscal 2012-13′s 5.7 percent.

The industrial sector’s growth was also predicted to drop to 8.2 percent this year from 9 percent a year ago.

“Agitation will affect the manufacturing sector and its spillover impact will hurt the services sector, be it trucking, banking or insurance,” said Ahsan H Mansur, executive director of Policy Research Institute. But it will be the retail sector that would be hurt the most by street agitation.

Rahman of the CPD said political unrest will have short-, medium- and long-term impact on the economy. In the short-term, he said trade and commerce and investment will be affected and there will be disruption in transportation that will escalate costs.

In the medium-term, the country will miss more and more export orders and foreign investments, which are expected to come to the country due to a rise in cost in China. And, the long-term effect will be on the economic prospect.

“Bangladesh has the potential to grow by 8-10 percent, which is being undermined for political uncertainties,” said the CPD boss.