Originally posted in The Daily Star on 12 October 2022

Worsening electricity supply fresh blow to industries

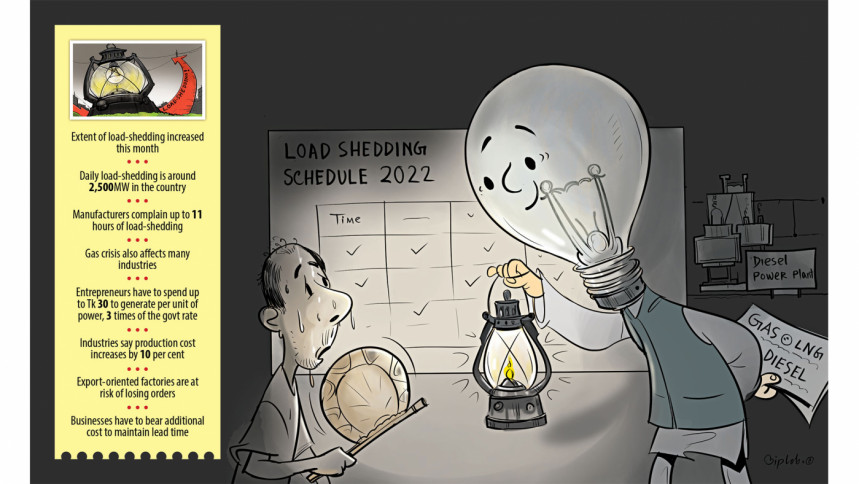

Industries, already under huge pressure for the fall in gas supply and higher input costs, have been hit with power outages in the last few days, which have raised the production cost and may force factories to cut output.

Due to a gas and fuel shortage, many power plants in Bangladesh are not operating to their usual capacity. This is hurting the manufacturing industry.

For example, Igloo Ice Cream, a popular ice cream brand in Bangladesh, now has to spend Tk 4.70 to produce a litre of ice cream, up from Tk 4.54 in 2021, owing to higher diesel costs.

“Due to the load-shedding, the production cost has increased by Tk 0.16 per litre of ice cream,” said Shamim Ahmed, chief operating officer of the company.

Igloo, which holds a 33 per cent stake in the market and is the leading brand in the segment, produces 1.5 lakh litres of ice cream per day. This means it has to spend an additional Tk 24,000 per day to keep the factory operational.

Now, our production units witness at least eight hours of load-shedding every day whereas it was at best four hours just a few days ago.

Shamim Ahmed, Chief Operating Officer of Igloo Ice Cream

According to Ahmed, the company has had to maintain an alternative source of power using gas to continue production. Sometimes the flow of gas drops, disrupting production since the supply of electricity is a must to maintain a cold temperature.

“Now, our production units witness at least eight hours of load-shedding every day whereas it was at best four hours just a few days ago.”

The ice cream industry is not the only segment that is facing the power crisis. In fact, all manufacturing sectors, including the export-oriented ones, have been suffering for the severe load-shedding for the last three to four days.

According to the Bangladesh Power Development Board, there is a power shortage of about 2,500 megawatts a day.

The regular power outages have increased the cost of production and the workforce has remained unutilised for several hours, according to industry insiders.

Monjurul Alam, director for global business development at Beacon Pharmaceuticals, said the sector has been facing an acute gas crisis for the last three months. This has hampered production and sent the cost of manufacturing higher.

“Earlier we spent Tk 80 lakh against gas for the generation of power to ensure an interrupted supply of electricity. But now we have to spend Tk 4.8 crore as we rely on diesel to generate power.”

Beacon has already suspended its production at the injection unit due to a lack of uninterrupted power supply, he said.

“This will affect the export of pharmaceutical products as manufacturers will not be able to ship goods on time.”

Amid the worsening power situation, Beacon decided not to accept an export order worth $1 million from the UK yesterday, according to Alam.

RFL Group’s Habiganj industrial park is also facing a power crisis.

“Now we have to spend Tk 15 against electricity to manufacture one tonne of plastic finished products. The electricity to produce the same products would cost us Tk 12 during normal times,” said RN Paul, managing director of the conglomerate.

Due to a lack of gas supply, the group can’t maintain the lead time for export delivery. “As a result, the export of plastic goods might decline,” Paul warned.

M Shahadat Hossain, managing director of Towel Tex Ltd, said the company has been suffering 10 to 11 hours of power outages every day for the last few days.

The company needs 400 litres of diesel per day to run the factory and the cost has gone up to Tk 43,600.

“If I run the factory with the electricity from the national grid, it costs Tk 10.69 per unit whereas it is now costing around Tk 30 since I have to generate power using diesel,” said Hossain, also the chairman of Bangladesh Terry Towel & Linen Manufacturers & Exporters Association.

Because of the inadequate power supply, the industry is finding it difficult to maintain lead time and is set to suffer reduced profit margins.

“Entrepreneurs have kept their factories up and running so that they can retain buyers and don’t lose export orders,” said Hossain.

Irfan Uddin, general secretary of the Bangladesh Ceramic Manufacturers and Exporters Association (BCMEA), said the production cost has increased due to the load-shedding and the gas crisis.

The government has stopped the import of liquefied natural gas (LNG) to protect the foreign currency reserves from depleting amid a sharp rise in import bills driven by the escalated costs in the global commodities market.

According to the BCMEA, the gas bill accounts for 12 per cent of the total input cost of producing ceramic products and 80 per cent of factories are dependent on gas-based captive power plants.

At least 25 out of 70 factories in the ceramic sector have been suffering from an acute gas crisis for more than three months, said Irfan.

“Even, factories are not getting gas for 12 hours a day and this is hindering the production of the factories. As a result, the sector has faced a 40 per cent output loss.”

Debasish Singha, head of export of Danish Biscuit, owned by Partex Star Group, said the biscuit manufacturing industry is facing reduced production and increased cost.

Besides, raw materials go to waste if the power supply stops during the production of biscuits, he said.

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, said the current load-shedding scenario is directly affecting the manufacturing sector of Bangladesh.

“If the situation persists, manufacturers will have to cut production. Then, the industrial contribution to the gross domestic product will decline.”

The industrial sector accounts for 37.07 per cent of Bangladesh’s GDP.

Bangladesh is not the lone country that is facing a gas and power crisis. Rather, all energy-importing nations are in trouble as energy prices have rocketed owing to the Russia-Ukraine war.

“A stable gas supply is important for the industrial sector. But the situation is not favourable for the government due to the Ukraine war,” said Moazzem, suggesting the government give attention to exploring gas locally.

The worsening power situation is also threatening the macroeconomy.

“Export growth is expected to slow as economic conditions in the key export markets deteriorate, while rolling blackouts, gas rationing, and rising input costs weigh on manufacturing output,” said the World Bank on Thursday.

It has slashed its economic growth projection for Bangladesh for the current fiscal year to 6.1 per cent from 6.7 per cent made in June,

BCMEA’s Irfan hopes that the situation would improve by November as the government has assured them of an uninterrupted gas supply as winter approaches. Electricity consumption falls during winter.