Published in The Daily Star on Wednesday, 13 July 2016

Jute goods exporters get tax benefits

Sohel Parvez

The government has given tax benefits to jute goods exporters to support the industry that has been facing sluggish demand abroad.

From this fiscal year, jute goods manufacturers will pay 10 percent corporate tax on their export earnings until fiscal 2019-20, down from 15 percent previously.

Exporters will also enjoy 0.6 percent source tax on their export proceeds, as they did last year, until June 30, 2019, according to two separate orders by the National Board of Revenue.

The move comes at a time when the jute industry has been suffering sluggish demand for sacks, bags and yarn, owing mainly to the prolonged crisis in the Middle East, a major destination of locally grown and processed natural fibre.

“It will be a relief for jute goods exporters,” said Khondaker Golam Moazzem, additional research director of the Centre for Policy Dialogue.

The jute sector, which involves about 40 lakh farmers and about 2 lakh workers, processes 50 lakh bales of raw jute out of the average local production of 75 lakh bales a year.

About 90 percent of the jute goods are shipped abroad.

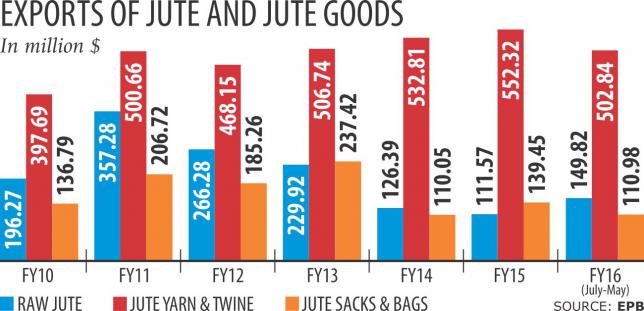

Of them, jute yarn and twines account for 65 percent of the sector’s total export receipts of over $850 million, according to data from the Export Promotion Bureau and Bangladesh Jute Spinners Association.

The EPB is yet to release the export data for fiscal 2015-16, but the July-May figures show that exports earnings from jute yarn and twines declined 0.55 percent year-on-year to $502 million, while exports of jute sacks and bags fell 16 percent to $110 million.

The prices of jute goods have fallen amid slow demand for the crisis in the Middle East, said Shahidul Karim, secretary general of BJSA.

On the other hand, the production cost has risen for high prices of raw jute because of lower production but increased demand, particularly due to the enforcement of compulsory use of jute sacks for packaging various commodities.

Moazzem urged the government to put more focus on the domestic market for jute goods to ensure a vibrant manufacturing sector.

“In this context, the strict implementation of mandatory packaging law for the use of jute goods for agricultural products and further expansion of list of products by adding other agricultural products are immensely important.”

The competitive pricing of jute goods manufactured by public and private jute mills needs to be ensured as well.

Besides, private and public jute mills, which are not in a position to reopen due to huge losses or debt, need to be considered for alternate investment opportunities in other potential manufacturing industries, he added.