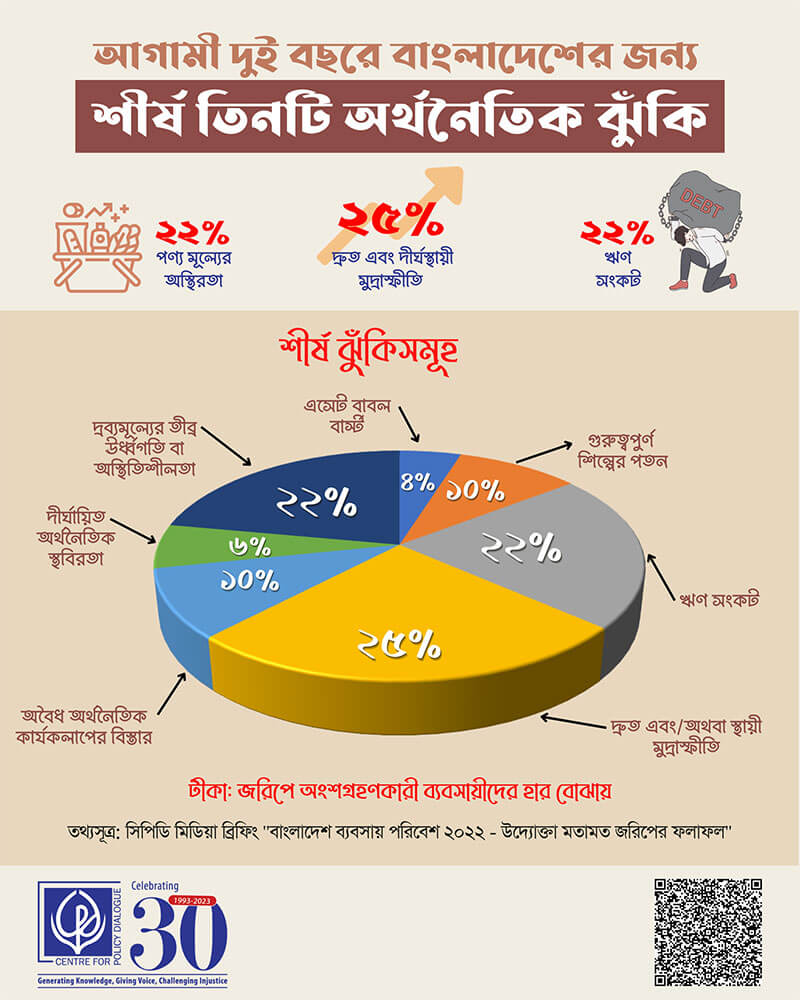

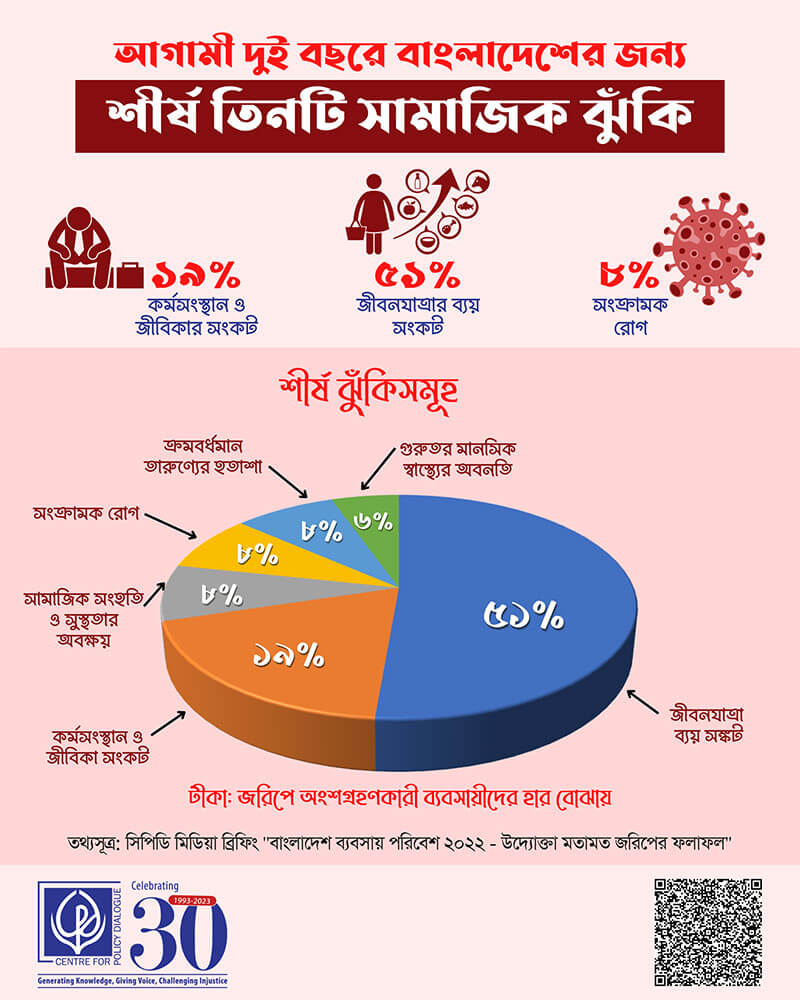

Bangladesh’s business environment did not show progress during 2021-22 – either it was stagnated, or it was deteriorated compared to the previous year. Corruption remains the most problematic factor for doing business in the country, as it did in earlier years. Businesses are facing troubles from multiple other factors including poor infrastructure, limited access to financing, and ineffective bureaucracy. A number of emergent challenges have made overall business environment more complex which include high inflation, foreign currency instability, and policy instability. The severity of problems is higher for small and medium scale enterprises making them difficult to operate competitively in the domestic market. The government should put necessary discounts on those structural and emergent concerns and their associated risks in formulating and implementing different policies, strategies, plans and operations targeting long term competitiveness, productivity enhancement, sustainability and ensuring green growth and clean development.

These observations emerged at a media briefing on ‘Bangladesh Business Environment 2022: Findings from Entrepreneurs’ Perception Survey, organised by the Centre for Policy Dialogue (CPD) on 29 January 2023. CPD presented the findings from the ‘Executive Opinion Survey (EOS)’ which was conducted during April-July, 2022. The survey had been carried out as part of CPD’s partnership with the World Economic Forum.

Dr Fahmida Khatun, Executive Director, CPD, chaired the session and said, “The current business situation in the world is unstable. We have the pressure of inflation on one side, then there is the crisis caused by the Ukraine-Russia war, also there are geopolitical factors because of which the global economy is going through a recession.”

During the keynote presentation, Dr Khondaker Golam Moazzem, Research Director, CPD, highlighted the ten pillars of the business environment, namely- (i) Institution, (ii) Infrastructure, (iii) Safety and Security, (iv) Financial system, (v) Trade and Investment, (vi) Competition, (vii) Business Operations, Governance and Innovation, (viii) Building Human Capital, (ix) Working and Employment, and (x) Managing the Economic Recovery and Risks, underscored the recent findings and shared some policy recommendations.

Institutional inefficiencies and weaknesses are the most challenging components of doing business in Bangladesh. Apart from a few indicators, the overall performance has further deteriorated during 2022. These include weak performances of institutions dealing with export and import, taxes, licenses and registration and utility services (gas, electricity and water etc.). These issues disproportionately affect small and medium enterprises (SMEs). Hence necessary institutional reform is required to increase transparency, accountability, and efficiency in dealing with private enterprises. In this context, political parties should commit to these reforms in their Election Manifestos for the next general election. Apart from that, businessmen over the years positively acknowledged the government’s long-term vision for economic development, which has continued in 2022.

Surprisingly, businessmen still suffer from poor infrastructure despite having substantial investments over the last decade though some positive changes are discerned. A major focus should be provided on improvement in efficiency in infrastructural logistic facilities, urban city development with less pollution and traffic, and clean energy development. Public investment with the support of development partners and foreign direct investment (FDI) needs to focus on green city development, clean energy development, waste management, and industrial pollution control.

Entrepreneurs are also concerned about issues related to safety and security, such as organised crime, inadequate services provided by law enforcement agencies, and social and political instability. These issues require urgent attention, particularly as the country approaches a national election. To improve services provided by law enforcement agencies, institutional reform is necessary.

The financial sector needs major overhauling. It could be initiated as part of complying with International Monetary Fund (IMF) loan conditionality. These may include, among others, amendment of the bank company act, lifting the cap on lending rate to ensure better access to finance for SMEs, transparency in outstanding loans, effective oversight role of the Central Bank, Security and Exchange Commission (SEC) and Insurance Development and Regulatory Authority (IDRA).

The business environment has grown increasingly uncompetitive due to inadequate corporate governance practices, weak regulatory oversight, and a lack of ethical corporate behaviour. The Competition Commission, Division of Consumer Rights Protection under the Ministry of Commerce, the Central Bank, the National Board of Revenue, and the Ministry of Finance should actively promote fair competition in the market. Companies with dominant market power should be closely monitored to ensure that their operations do not restrict competition in various segments of the market and supply chains. In this context, it is essential to establish inclusive supply chains with the participation of small and medium-sized enterprises at all levels of the value chain. To monitor the activities of key market players, business-related information should be maintained in an integrated data system.

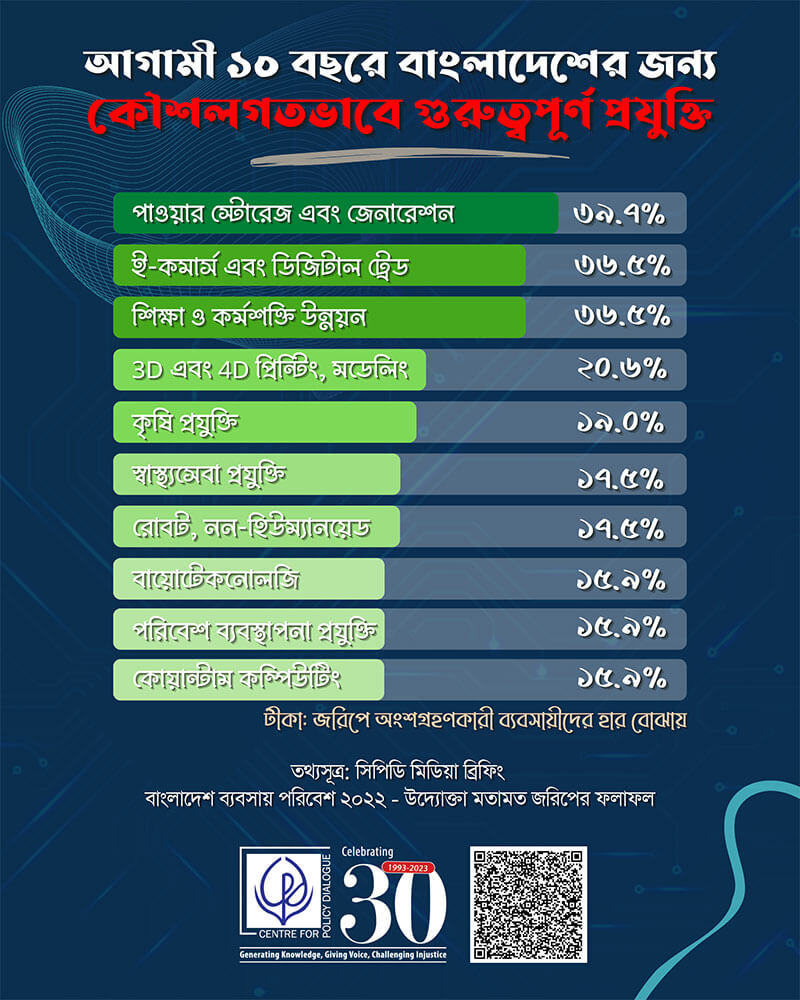

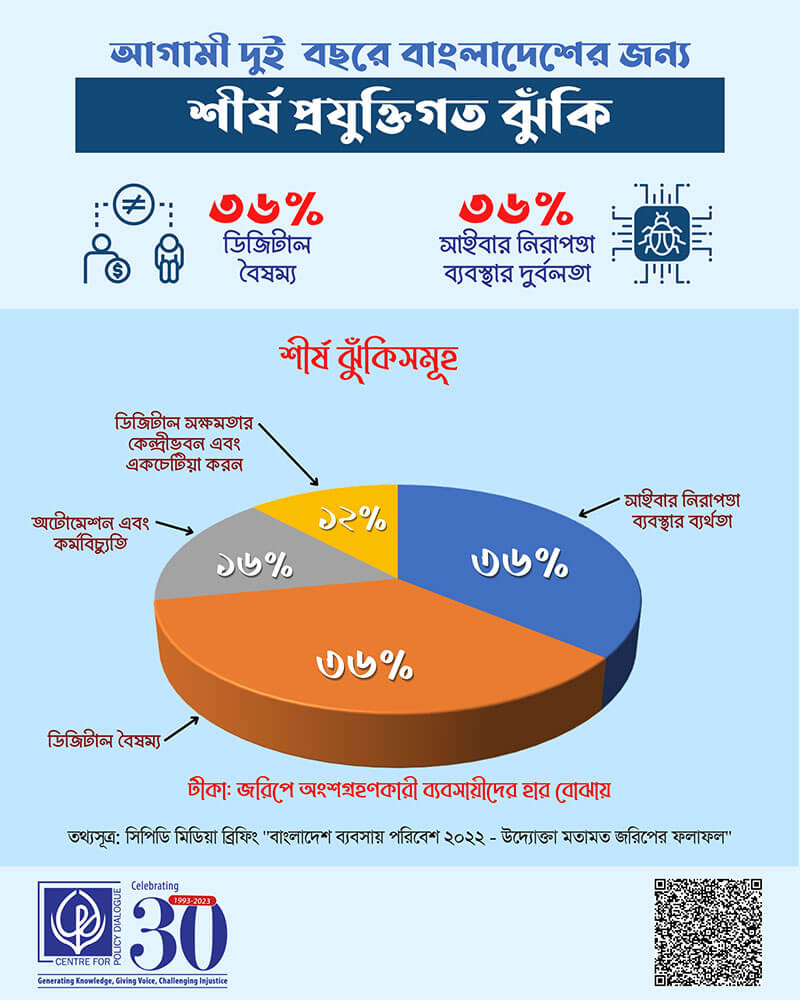

A thorough review of ‘Digital Bangladesh’ related activities is needed to identify the successes, weaknesses and challenges. Such a gap analysis will help to better design the activities under the new initiative of the government called ‘Smart Bangladesh’. The survey identified major technological breakthrough for Bangladesh during the next 10 years. A number of technological breakthroughs would happen in case of energy, digital trade, 3D/4D technologies, agriculture and health technologies. FDI should get priority along with local private investment. In this context, major breakthroughs will be required in innovative ideas, competitive infrastructure, legal infrastructure, fiscal space and skill development and talent hunting.

The briefing was followed by a Q&A session with journalists from print and electronic media. The Research Director responded to the questions and said that the government should take initiatives to ensure that SMEs get included in the business operations along with that of large enterprises. It should be evaluated how much of the austerity measures have been implemented by the government. “Subsidies should be provided in a targeted way to the poor. Otherwise, it will deplete the National Reserves,” said the Executive Director. She concluded the Q&A session by thanking the journalists.