Originally posted in The Daily Star on 22 March 2024

NRBC branch covered up capital flight

Dr Debapriya Bhattacharya, a Distinguished Fellow at the Centre for Policy Dialogue, said it shows that the bank’s governance does not look after depositors’ interest.

“It must be established whether these kinds of forced loans are within the prudential guidelines,” he noted.

The economist also termed it “a failure in governance” on the part of the central bank.

“The central bank has done audit after audit on this bank but it does not follow through and there are no judicial outcomes,” he said.

NRB Commercial (NRBC) Bank has often made headlines for alleged money laundering, loan irregularities, over-expenditure and recruitment anomalies. In 2017, Bangladesh Bank had to intervene to dissolve the bank’s board and remove its managing director Dewan Mujibur Rahman over a loan scandal involving Tk 700 crore. The then chairman Farasath Ali had to resign from the board. Both Mujibur and Farasath were banned from bank directorship for two years by the BB, and the board was subsequently restructured. The new board is headed by a chairman against whom allegations of irregularities were already rife, and the bank continues to be dogged by anomalies. A six-month investigation by The Daily Star based on hundreds of pages of documents reveals numerous irregularities and even gun toting inside the bank.

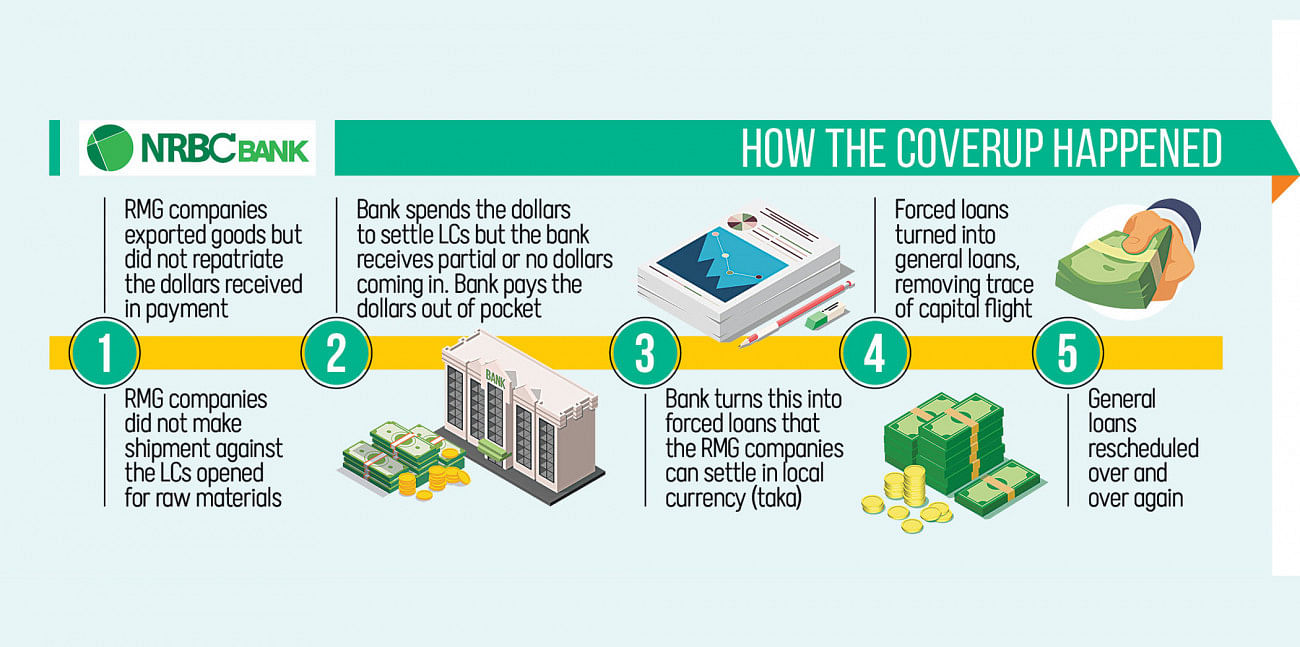

The second installment of this four-part series tells the story of how the bank’s Uttara branch sought to hide the trail of capital flight in the name of RMG export.

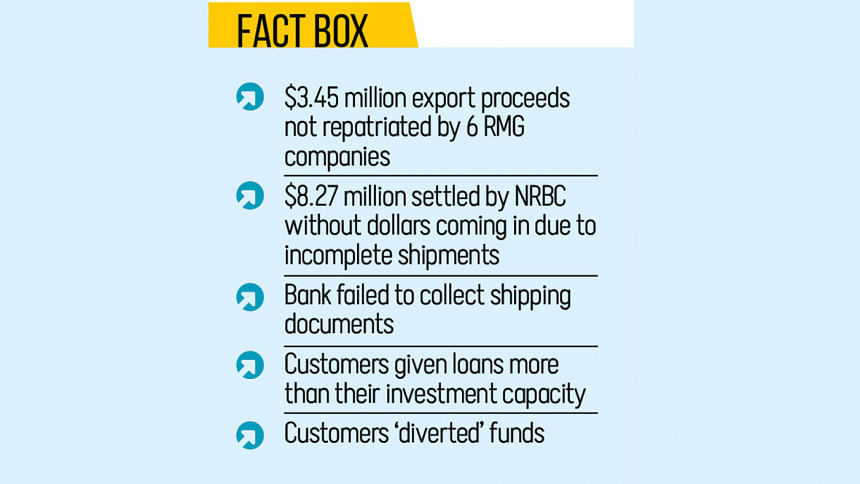

Export proceeds worth at least $3.45 million (Tk 34.41 crore) were not repatriated by six customers of NRB Commercial Bank’s Uttara branch, and the branch concealed the trail of the capital flight, according to the bank’s internal audit and case documents.

Google News LinkFor all latest news, follow The Daily Star’s Google News channel.

Additionally, five of these companies failed to make any exports at all against LCs worth $8.27 million (Tk 90 crore), leaving the bank grappling with dollars going out and none coming back in.

The amount was later turned into forced loans by the branch over the last four years, according to the bank’s internal audit report dated August 19, 2021.

Meeting minutes show that these forced loans were then converted into general loans to be rescheduled again and again, thereby covering up the tracks.

These companies, one of which is linked to Adnan Imam, the chairman of the bank’s executive committee, collected bills against the orders without submitting shipping documents, while the money from exports never came.

“It has been observed quite a few times that the branch made payments of their back-to-back LC bills by creating Foreign Documentary Bills Purchase loan accounts, whereas these bills should have been settled through relevant export proceeds,” says the audit report obtained by The Daily Star.

On July 11 last year, the Anti-Corruption Commission (ACC) sued 11 officials of the bank over swindling Tk 78.6 crore from the bank and laundering Tk 5.97 crore using a sweater factory called Ixora Apparels, one of the six companies accused of not repatriating export proceeds.

Asked about the overall condition of NRBC, Bangladesh Bank Executive Director and Spokesperson Md Mezbaul Haque said there have been multiple investigations into the bank and that actions are taken when required.

ADNAN’S LINK TO IXORA

Company registration documents show Ixora is linked to Adnan Imam, who along with current NRBC Chairman Tamal Parvez was previously investigated and removed from the bank’s board over alleged money laundering through disguised loans.

Both have denied the money laundering allegations, and said the claims by “a vested group were false and motivated”.

Adnan also denied having any link with Ixora.

According to the ACC investigation, Ixora Apparels exported 12 consignments of garments to the UK worth Tk 5.97 crore in 2018-2020, but did not remit the earnings.

The RMG maker is the 19th largest borrower of the bank, shows a memo from the bank’s credit risk management division dated December 26, 2023.

The memo also shows that the company has had Tk 119 crore of its loans rescheduled till 2027 and 2028. But even after the regularisation, it has defaulted on instalments, with its overdue outstanding balance standing at about Tk 6 crore.

The company began banking with NRBC in August 2016.

When it took its first loan the same year, its owners were one Ruhul Amin Bhuiyan, who owned 40 percent of the share, and one Masud Rana who owned another 40 percent. Their wives owned 10 percent each. Both Ruhul and Masud are accused in the ACC case.

In 2021, the company changed hands, giving 83 percent ownership to another company called Vibranium.

According to Vibranium’s company registration documents, its chairman is Badrul Hasan Patwary. He is the company secretary of a firm called Genex Infosys whose chairman is Adnan Imam.

Vibranium was set up with a paid-up capital of only Tk 10 lakh. Less than two weeks after its incorporation in 2019, Vibranium proceeded to buy a company that owns 78,164 square feet of factory floor and over 800 pieces of capital machinery that produces over 8,000 pieces of clothing per day, according to the company’s website.

NRBC renewed the company’s composite loan limit at least eight times, thrice after Patwary assumed ownership.

Patwary has not been charged by the ACC, although its investigation found that the client availed loan one after another but did not return the borrowed money.

“The loan was given even though the client’s transactions were not satisfactory,” said the ACC probe report.

In June 2023, Bangladesh Bank gave the company an extension up till September 2023 to adjust export proceeds worth $358,273 against the five orders from 2018 to 2020.

Contacted, Adnan Imam said, “Ixora Apparels is a client of NRBC Bank and in no way related to me. I was advised that Ixora went through financial struggles during the pandemic, like many other businesses at that time, and the bank has supported Ixora like any other normal business that required support. I am also advised that Tk 5.97 crore has been fully repatriated to Bangladesh. The ACC has investigated the matter and has found no issue.”

MISSING DOLLARS

Polygon Fashion Ltd is another company that failed to repatriate export proceeds worth $8,33,928 or Tk 9.15 crore, according to a 2021 report by the bank’s Internal Control and Compliance Division (ICCD).

It also failed to make shipments, and could not settle LCs worth $3.27 million, which were opened to import raw materials for production.

In 2023, Polygon was the number one defaulting borrower of the bank. In November last year, its total outstanding loans stood at Tk 87.7 crore, and the bank had to file claims at the Money Loan Court (Artha Rin Adalat).

The bank’s Uttara branch then turned the liability of the Gazipur-based company into 74 forced loans.

Polygon was over-financed although the company was likely incapable of availing such amounts of loan, the ICCD report said, adding, “As a result, the customer could not utilise funds properly and he had the opportunity to divert funds elsewhere and he may have diverted funds.”

Before approving a loan, it is required by the bank to collect the customer’s credit reports based on the value of the invoice. But during inspection, the audit team found that credit reports of some buyers were not available.

In addition, the team found that the bank did not collect all the original shipping documents as proof of shipments being made.

The ICCD report concluded that the liability has reached such a level that Polygon would not be able to pay it back. The loan was rescheduled in November 2021.

At the time of the ICCD report in 2021, Blessing Knitwear Ltd was the 20th largest borrower of the bank, having a loan of Tk 115.4 crore.

NRBC Bank’s Hungry Top Managers: 20 plates of rice, 118 plates of curries for a lunch of 4!

Read more

20 plates of rice, 118 plates of curries for a lunch of 4!

Its export proceeds worth $661,085 (Tk 7.2 crore) were not repatriated to the bank. It also failed to pay the bank an additional $2.33 million (Tk 25 crore) as it did not complete shipments against several other LCs.

“It has been observed that the branch allowed undue facility to the customer against incomplete documents without confirming shipping [sic] or having original authenticated bill of lading,” the report said.

These unrepatriated proceeds were turned into forced loans, and the company may have diverted the fund elsewhere, the report noted.

On December 22, 2022, all of the liabilities were rescheduled into general loans.

Inside Knit Composite Ltd did not repatriate $301,191 or Tk 3.3 crore, again forcing the bank to turn the liability into forced loans, which the ICCD found “totally unexpected”.

During the factory visit, the ICCD team did not see any stock of goods against the LC.

“It appears that the customer was free to open back-to-back LCs, and to sell those stock of goods on the local market at will,” said the report.

In addition, the company did not complete other shipments, leaving the bank with an LC bill of $0.9 million (Tk 9.7 crore) and no incoming dollars.

Minutes of a meeting of the bank’s credit risk division dated December 24, 2023, show the bank rescheduled the forced loans to improve the bank’s “ability to adopt new customers by reducing capital requirement of the bank” and its “market reputation”.

5F Apparels did not repatriate $1.2 million (Tk 13.2 crore), said the report, adding that the bank allowed the customer loans against incomplete shipping documents.

The company also left the bank short of $0.7 million (Tk 7.6 crore) because it did not complete shipments.

“The branch negotiated without any shipping documents and original bill of lading, and consequently no shipment was executed against this bill,” said the report.

While the bank converted the amount into forced loans, the company may have diverted the fund elsewhere, it said.

Minutes of the 129th board meeting held on November 20, 2021, show 24 forced loans worth Tk 12.23 crore were turned into general loans for a period of 10 years.

Relux Fashion Ltd did not repatriate $85,820 or Tk 94 lakh and the liability was turned into forced loans. In addition, incomplete shipments resulted in an unmet LC obligation of $0.8 million (Tk 9 crore) for the bank.

“Excess finance was allowed exceeding the value of export LCs violating export policy. Therefore, the export proceeds will be inadequate to settle back-to-back obligations,” said the ICCD report.

However, NRBC Bank’s board meeting minutes from April 12, 2023, show the forced loans were rescheduled for five years by converting them into general loans, wiping out the capital flight from record.

The Daily Star reached out to all these RMG companies via phone calls and emails. Only Polygon responded. Its Managing Director MD Shariful Islam said the company incurred forced loans as a result of the Covid-19 pandemic.

“There were instances where the shipments were made, but the buyers refused to accept them. In another case, the buyer received the shipment but did not pay us. This resulted in forced loans,” he said.

NRBC Chairman Tamal Parvez, also known as Parvez Tamal, said when he took over the bank in 2017, he inherited a legacy of bad clients.

“These are depositors’ money and I am trying to recover it. I have to nurse these and recover the money anyhow. I take responsibility for these disguised (benami) loans and I will recover them,” he told The Daily Star in an interview for this story.

He said that when he took over, over half the loans that the bank had given out were unsecured overdraft loans – meaning there were no assets attached to them.