Originally posted in The Financial Express on 4 January 2024

BD needs fresh start on socioeconomic front to heal ills

Bangladesh would need a fresh start on socioeconomic front to heal accumulated ills with decisive reformative actions after the forthcoming polls, as leading economists think entrenched uncertainties may not all clear with elections.

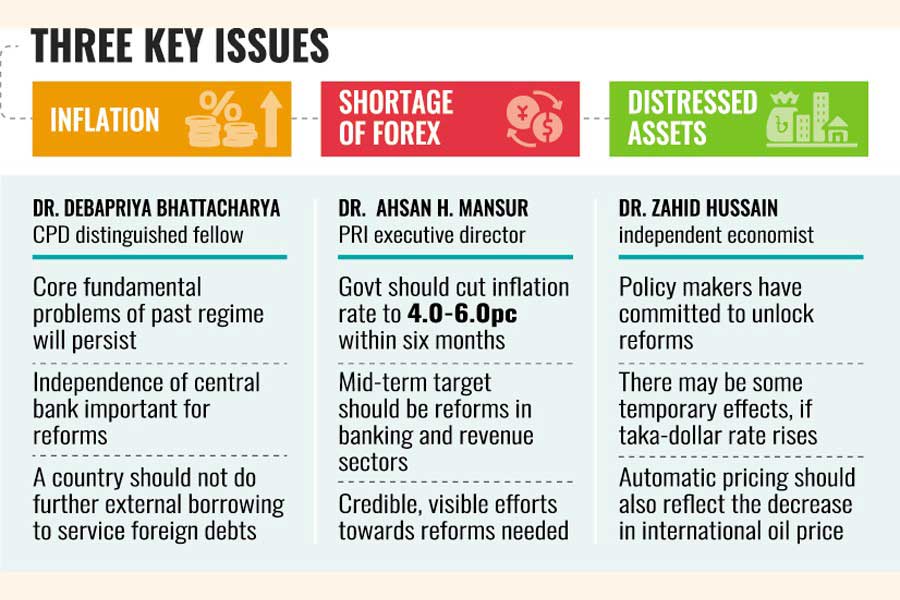

The most pressing problems currently confronting the nation are inflation, shortage of foreign exchange and stressed assets in the financial sector, they said while suggesting the to-do tasks for the next government.

Much will depend on the ability to manage the risks and the will to face resistance from insiders and outsiders who may find the nitty-gritty of reforms problematic, the economists told The Financial Express (FE), with the election-which itself looks challenging amid opposition disputes-now round the corner.

The economists think Bangladesh may achieve the targets for third instalment of IMF loan but for this reason there is need for visible efforts.

They have said many people think that a fresh start on the socioeconomic front would come once the new government is formed after the upcoming general election.

“But I don’t see that immediately happening as such a so-called new beginning will be a continuum of the past because the core fundamental problems of the earlier regime will persist in coming years,” says Dr Debapriya Bhattacharya, a distinguished fellow at the Centre for Policy Dialogue (CPD).

He thinks the possible solutions to the problems depend on the extent to which the government will be capable of exercising democratic accountability on the entrenched interest groups and individuals. These groups and individuals had earlier resisted reforms and thus “indulged in corruption and malgovernance”.

About the economic challenges ahead, Dr Bhattacharya says the upcoming national elections will not generate the required political momentum that is necessary to alleviate the existing challenges to democratic accountability.

“Rather the government will be hamstrung due to the prevailing negative macroeconomic trends,” the economist told The FE during an exchange of views on the pre-and post-poll situations in the country.

He strikes an alert note: “This situation will be further aggravated by the evolving sub-optimal investment-employment nexus. As such, fiscal year 2023-24 will end with lower GDP growth than that of the preceding year.”

When his attention was drawn to Sri Lanka’s quick economic recovery from doldrums triggered by political upheavals in recent times, the CPD distinguished fellow said the fundamental difference between Lanka and Bangladesh is that the island economy demonstrated full political commitment and national consensus regarding its reform programmes, “whereas in Bangladesh our policy approach had been much less rigorous and coordinated”.

Indeed, the governor of the Sri Lankan Central Bank, who came to Bangladesh recently at CPD invitation, “reminded us that the independence of the central bank is critical to undertaking robust economic reforms”.

However, such independence depends not on what is written in the statutes but on the attitude and mindset of the policy leaders. He also cautioned that a country should not do further external borrowing to service foreign debts.

“Bangladesh’s reality speaks for itself in this regard,” the country’s noted economist said in conclusion drawn from a comparative review of the situations in the two South Asian nations.

Executive director of the Policy Research Institute of Bangladesh (PRI) Dr Ahsan H. Mansur told the FE that the new government would inherit some macroeconomic problems, such as reserves shortage, higher inflation and poor resource mobilisation.

“The first thing is to contain inflation within the six months-the rate of inflation must come down within 4.0-6.0 per cent,” he said about the top priority as people pay through their nose for wayward market conduct mostly held responsible for high prices of most commodities.

And mid-term target should be reform in banking and revenue sectors, he maintained.

“The mid-term target must be conducting reforms in the banking sector and revenue sector, otherwise Bangladesh will face serious troubles,” cautions Dr Mansur, who had once served the IMF-a Bretton Woods institution meant to govern global monetary affairs.

On the Sri Lanka syndrome of economic woes and quick rebound, Dr Mansur said Bangladesh should do what the island nation did to recover its economy.

“We must be able to conduct reforms or move as Sri Lanka did for salvaging its economy from plunges.”

Dr Mansur mentions that Bangladesh Bank achieved a milestone in achieving IMF target on foreign- exchange reserves set for last December in a swift policy change.

“This happened as Bangladesh started buying dollars instead of selling. So this is right direction…”

The economist told the FE that Bangladesh may get the third tranche of IMF loan from an agreed package despite the fact that the conditions are hard to meet.

“They (IMF team) must look at Bangladesh’s move to implement the reforms, If Bangladesh lags behind to some extent, they will consider.”

Dr Mansur underscores the urgency of credible and visible efforts towards implementing reform programmes.

Dr Zahid Hussain, an independent economist of Bangladesh, who had also served another of the twin Bretton Woods institutions-the World Bank-recalls that macro-policy makers in government have gone on record committing to unlock reforms in macroeconomic management, financial regulation, business climate, infrastructure and the green transition, among others, after the election will be over.

“It is not realistic to expect them to deliver immediately after the election,” he told the FE, in view of the depths and dimensions of the onerous tasks.

He lists inflation, shortage of foreign exchange and stressed assets in the financial sector as the most pressing tasks currently to deal with.

“The relevant institutions in government know what the right policies are. Their ability to act on these will be a function of their autonomy and willingness to move decisively on getting the basics right on the reform programmes already committed to,” says Dr Hussain.

He notes that no country can ever “replicate” the change of guards in frontline economic institutions of another country.

“Whether change of guards will change the behaviour of the key economic institutions depends on the capability, constraints, and the vision of the new guards.”

He draws an instance from the Lankan turnaround to emphasise that without enabling conditions the new guards in Sri Lanka would have struggled.

“The question really is whether the right guards will find the place and the conditions to deliver. Only future can tell.”

Dr Hussain makes it clear that a switch to market-based exchange may not make as large a difference to prices as generally perceived because a part of it is already baked in.

“Importers buying foreign exchange at informal market rates have sure passed it on to their buyers already. Yet there may be some temporary effects if the taka-dollar rate rises beyond its current level in the parallel market.”

He mentions that international oil prices have been soft recently. The application of the automatic pricing formula may mean some increase in price to cover the taka depreciation since the last petroleum price adjustment. At the same time, it should also reflect the decrease in international oil price since the last adjustment.

Dr Hussain thinks excepting the net international reserve-performance criteria and the tax-revenue Indicative Target, all other conditions will not be too difficult to meet.

“Bangladesh Bank, Finance Ministry, NBR, the Energy Ministry and the BBS together can deliver those. It is hard to figure how the net international reserves can meet the end-March target without generating a large surplus between inflows and outflows.”

He feels that some sizable lumpy inflows will be needed. “A switch to market-driven exchange rates can help. The revenue target may be relatively less hard, but still very challenging.”

He expects that the government and the Fund team are likely to find ways of mending the breaches to get the third tranche disbursed on time.