Originally posted in The Daily Star on 13 March 2023

The inflation in our domestic market is largely related to the supply and prices of different types of fuel used in major economic activities.

Bangladesh, like many other net-energy-importing countries, has been facing persistent high inflation in the last one year of the Russia-Ukraine war. The inflation in our domestic market is largely related to the supply and prices of different types of fuel (e.g. gas, diesel, octane, furnace oil, LNG and coal) used in major economic activities, which are significantly affected due to the massive disruptions in global energy supply chain caused by this war.

With the depletion of domestic natural gas reserves, Bangladesh’s energy market has become increasingly dependent on imported energy – mainly petroleum, LNG, and coal. Hence, price unpredictability in the global energy market automatically impacts our energy sector as well as our economy as a whole. The Russia-Ukraine war has aggravated the global energy market crisis both in terms of supply and prices, which have multidimensional adverse impacts on developing countries like Bangladesh.

The government uses two specific policy instruments to manage international oil price volatility: a) by passing part of the additional import expenditure on to the consumers in the form of enhanced energy tariff; and b) by accommodating part of the additional expenditure in the form of subsidies. Energy prices at both wholesale and retail levels are determined by Bangladesh Energy Regulatory Commission (BERC), an autonomous body operated under the Ministry of Power, Energy and Mineral Resources. Unfortunately, through a recent amendment, the government took the responsibility to adjust said prices directly, restricting BERC’s independence in the price-setting mechanism.

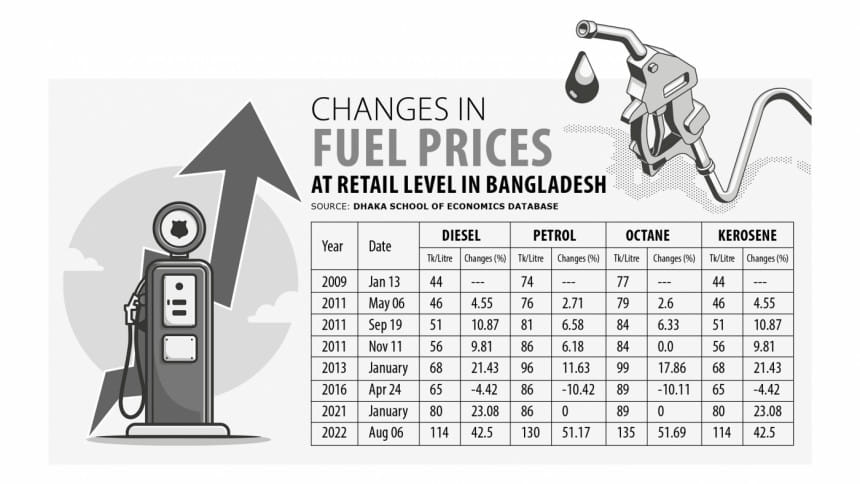

Over the last 10 years, fuel prices have been changed only seven times – that is, they are not adjusted regularly. In fact, the International Monetary Fund (IMF) reported in March 2012 that the government was expected to adopt an automatic adjustment formula by December 2012 that would ensure full pass-through of changes in international prices, but that did not happen. Under the new understanding between the government and the IMF in 2022, the energy ministry will adopt a market-based price setting mechanism by December 2023.

The table above shows the changes in fuel prices in the past 10 years. Except for 2016, fuel prices have been increasing periodically. The highest increase was affected on August 6, 2022, when fuel prices rose by 40-50 percent. According to the interviews with stakeholders conducted for this study, this price hike was a direct impact of the rising international fuel prices due to the Ukraine war.

If we look at the pattern of price adjustment in Bangladesh as shown in the figure below, there has been a lagged adjustment to petrol prices when compared to world prices. The blue line depicts the price of petrol in the country (in taka), while the other lines show movements in prices (in US dollars per barrel) of crude oil. The pump-level fuel prices are generally adjusted, as is evident from the data, when the international price of petrol hovers around $100 per barrel for four to six months, and mostly fuel prices move upwards rather than downwards in the country. When the Bangladesh Petroleum Corporation (BPC) and other regulatory agencies start making huge losses due to rising import costs, prices are generally revised in Bangladesh.

But there are very few examples of domestic downward adjustments of fuel prices by the BPC in view of its profit-making trends. BPC generally targets a five percent margin or mark-up in their pricing strategy, but sometimes the organisations make more than the five percent margin or supernormal profits. According to the key informant interviews (KIIs) involving energy experts, the BPC alone earned almost Tk 40,000 crore as profits over the last seven to eight years. According to the BPC, these profits were deposited to the government coffer, and now they’re more or less at the break-even point due to a sudden increase in the international fuel prices.

Whatever formula is applied for the calculation of fuel prices is never revealed by the relevant organisations to the public and is treated as confidential information. However, the variables that are considered for adjustment are import level duties, VAT, import costs, handling charge at the company level, marketing commission for the company that markets, losses due to transportation, carrying/evaporation loss, etc.

Many countries trade in futures and options and also go for longer-dated futures contracts in order to hedge transaction risks of volatile fuel prices. The BPC or other government agencies responsible for importing fossil fuels do have some long-term commitments with different oil-exporting countries, but more contracts of this nature with predetermined prices (where trading occurs in the future at prices fixed at an earlier date) would be very useful.

A rigorous analysis (through the estimation of an error correction model) of data collected from the regulatory bodies responsible for energy pricing (mentioned earlier) and the Bangladesh Bank database reveal that the rise in diesel price had the most telling impact not only on food and non-food inflations, but also on most of the components of the consumer price index (CPI). This might be due to the fact that most of the public transport in Bangladesh runs on diesel; hence, changes in diesel price have both short-term and long-term effects on the whole economy.

Upward changes in fuel prices also affect the sub-groups of CPI, such as gross rent, fuel and lighting, education and entertainment, transport and communication, etc. In most cases, the impact of the initial price hike continues throughout, and it sustains in the long run – albeit at a lower rate of impact. The long-term impacts of fuel price hike on all of the components of consumer spending are not clear cut, but it is crystal clear that the increase in consumer spending due to fuel price hikes do not decrease much in the next year or so, at least.

There is also evidence (as per the interviews conducted by the CPD) that transportation costs such as fare for taxis and buses, etc jump upwards at a very high rate following an increase in pump-level oil prices, and food prices as well as the prices of some other commodities are also increased by the concerned suppliers/vendors/retailers citing rising production costs. Ironically, when oil prices are lowered at the domestic level in response to the reduced international prices, which has happened only once or twice in the past 10 years or so, transportation costs don’t go down pro rata to maintain an equivalent state, and food prices don’t go down either. Hence, each and every sector should have better coordination with government agencies, with a parameter or formula in place for price adjustment.

In order to better handle these issues, the state-owned bodies who are responsible for determining the quantity of imports, energy pricing, etc should analyse the links between the economy and the energy sector, both at the disaggregated and the aggregate levels as a prerequisite for energy pricing. Given that the exact formulae applied for price calculation are treated as confidential, there is a need for better transparency and responsiveness regarding energy pricing. The energy ministry could take lessons from other countries such as India about how the retail energy prices are adjusted with the international market prices and how they are maintained at the sectoral level.

Many countries trade in futures and options and also go for longer-dated futures contracts in order to hedge transaction risks of volatile fuel prices. The BPC or other government agencies responsible for importing fossil fuels do have some long-term commitments with different oil-exporting countries, but more contracts of this nature with predetermined prices (where trading occurs in the future at prices fixed at an earlier date) would be very useful.

The government should also diversify its energy base by putting more focus on renewable energy. This would help in ensuring energy security, as it is a more stable source. Bangladesh should also give proper focus to fiscal measures such as introduction or expansion of feed-in tariffs and renewable portfolio standards (RPS), which have been successful in attracting green investment in other countries.

Dr Khondaker Golam Moazzem is research director and project director of the ‘CPD Power and Energy Studies’ at the Centre for Policy Dialogue (CPD).

Abeer Khandker is a visiting research associate at CPD.