Published in The Daily Star on Sunday 5 January 2020

Why is private sector credit growth sinking?

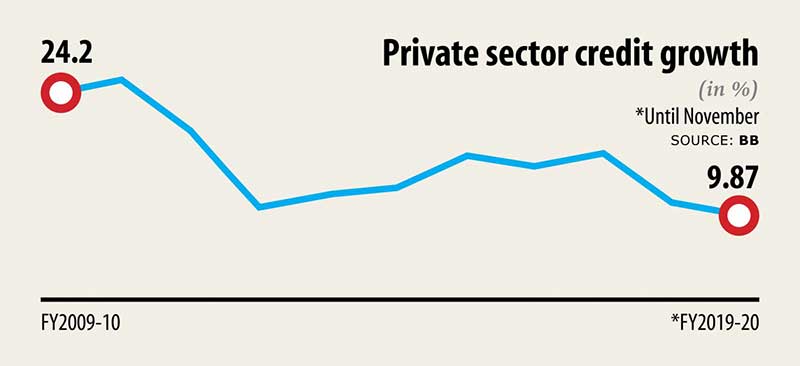

Now the lowest since 2008

Businesses and bankers often blame political instability for sliding private sector credit growth. But it was calm as the smoothest waters on the political front last year after the polls on December 30, 2018 and yet the slide did not stop.

In November last year, private sector credit growth dropped to 9.87 percent, which is the lowest since 2008 at least. Bangladesh Bank’s data goes as far back as 2008.

The Daily Star spoke with at least 16 people, ranging from economists to bankers, from business leaders to humble entrepreneurs to get to the bottom of the reason for the downward trend of private sector credit growth over the last 21 months.

The Daily Star spoke with at least 16 people, ranging from economists to bankers, from business leaders to humble entrepreneurs to get to the bottom of the reason for the downward trend of private sector credit growth over the last 21 months.

Banks’ capacity to give out loans is contracting for a large volume of default loans, said Faruq Mainuddin Ahmed, managing director of Trust Bank.

Lenders have to keep a good amount of fund in the form of provisioning against their default loans.

“Banks’ funds are getting stuck and there has been no strong measures to recover them from habitual defaulters. So, credit growth is on the decline despite a stable situation on the political front,” Ahmed said.

As of September last year, default loans in banks stood at Tk 116,288 crore, up 23.82 percent from nine months earlier.

Md Arfan Ali, managing director of Bank Asia, echoed the same.

Besides, the country’s overall business situation has been going through a slowdown for months, which had a negative impact on both export and import, he said.

“The exchange rate of taka against the US dollar is relatively higher than our peers’ currencies, which is discouraging exporters,” Ali added.

But Rubana Huq, president of the Bangladesh Garment Manufacturers and Exporters Association, said the double-digit interest rate on lending is the core problem for borrowers.

A large number of entrepreneurs are shying away from banks because of the high interest rates, which would not be viable for their businesses.

Lenders are usually interested in giving out loans to big businesses, sidestepping the small and medium entrepreneurs, she said.

“As a result, credit growth is nosediving,” Huq added.

A Chattogram-based mid-range entrepreneur, on condition of anonymity, said he has been trying to get both working capital and term loans from banks in the last few years but failed.

“Banks seek excessive collateral against their financing although I have a good track record with banks. I have been importing raw materials for years and adjust the LCs [letters of credit] on time,” said the entrepreneur, who owns a small garment factory and also imports equipment for the construction sector.

There is no scope to get finance in line with the banks’ requirement for collateral, he said.

“As a result, I am unable to expand my business,” he added.

At least four mid-level officials of banks who work in the credit department said lenders typically reject loan applications if businesses fail to provide at least 80 percent collateral against their proposed loans.

Banks earlier offered loans by taking 40 percent or 50 percent collateral if businesses showed a good track record, they said.

Bangladesh’s ease of doing business index is far from ideal and that has hit private sector credit growth, said Fahmida Khatun, executive director of the Centre for Policy Dialogue.

“Although Bangladesh advanced 8 notches in the World Bank’s ease of doing business ranking to 168 out of 190 countries, this is not enough to give a boost to businesses.”

Inadequate infrastructure, corruption and bureaucratic complexities discourage businesses from going for expansion by taking bank loans, Khatun said.

Private sector credit growth might face more challenges in the days ahead because of the excessive government borrowing from banks, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

As of November 21, it borrowed 90 percent (Tk 42,607 crore) of the target set for this fiscal year.

If the credit demand from the private sector goes up now, banks will face some problems entertaining their applications, he added.

The government has recently asked banks to fix the interest rate for lending at 9 percent, which will force lenders to take on a cautious stance in giving out fresh loans, said Rahman, also the immediate past chairman of the Association of Bankers, Bangladesh, a forum of managing directors of banks.

“Banks may not enjoy any profit from retail lending if they impose 9 percent interest rate,” he added.

Ahsan H Mansur, executive director of the Policy Research Institute, echoed the same. Banks will be unable to disburse loans to the small- and medium-sized enterprises (SME) sector if the 9 percent interest rate is implemented, he said.

Lenders’ cost of supervisory and monitoring on SME loans is higher than that of their other credit products, said Mansur, also the chairman of Brac Bank, whose speciality is this segment.

“So banks will not disburse loans to the SME sector as per requirement.”

The declining credit growth will ultimately hit GDP growth in the days to come, he said.

“Credit growth will pick up only if default loans can be recovered,” he said, adding that the government should not intervene in banks’ operations if it wants to ensure a sound financial sector.