A formulaic budget of the old structure has been proposed without addressing the challenges like volatile external trade and bank crisis. There is no action plan for implementing the budget either. It is a budget of musing the past without any step necessary for promoting an inclusive society based on equity, justice, fairness and good governance. In spite of some positive initiatives like enhancing safety net coverage, imposing the tax on importing rice, the budget does not look social equality focused, reports CPD in its analysis of the proposed budget for 2018-2019.

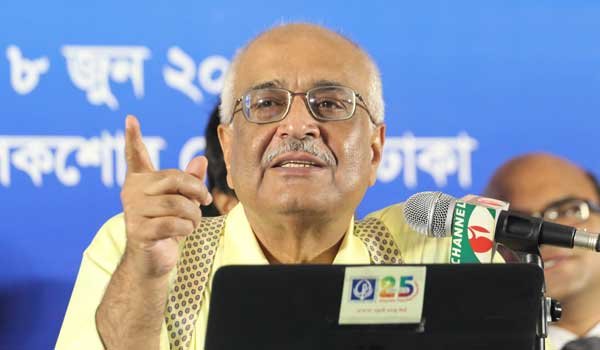

CPD presented its analysis of the proposed National Budget FY2018-19 on Friday, 8 June 2017 at La Vita Hall, Lakeshore Hotel, Dhaka. Following the presentation of the proposed budget by the Hon’ble Finance Minister at the National Parliament on the day before, the analysis was prepared overnight as part of CPD’s flagship programme, Independent Review of Bangladesh Economy (IRBD). Following welcome remarks from CPD’ Executive Director, Dr Fahmida Khatun, the analysis of the budget was presented by Dr Debapriya Bhattacharya, Distinguished Fellow, CPD. Like every year, the media briefing was broadcasted live by Channel I to reach the mass people.

The budget does not have any directive towards strengthening revenue collection, managing the pressure on the macroeconomy and effectively delivering public expenditure. Like the previous years, revenue collection will mainly base on indirect tax. CPD had earlier recommended that the minimum limit for the tax exempted income bracket be raised considering the increase in living costs and to protect real income. However, the budget has kept the thresholds unchanged. On the contrary, the percussive benefit for the high-income group has raised from 47500 Tk. to 550000 TK.

Increased VAT on purchasing of apartments smaller than 1100 square feet will affect the middle class. Allocation in education and health are low as always. This in no way will contribute to improving citizen’s competence required for productivity increase.

Education, health, and housing are basic needs, which need to be fulfilled for achieving a just society serving everyone’s interest. But the proposed budget has distinctive signals of serving those who possess wealth and power. Considering the dire crisis in the banking sector, one would have thought that more stringent fiscal measures will be put in place to discipline the banks with low-performance efficiency. However, instead of taking measures they were rewarded by reducing the corporate tax rate by 2.5 percent. The economy will bear the adverse consequences of such bad policies.

Education, health, and housing are basic needs, which need to be fulfilled for achieving a just society serving everyone’s interest. But the proposed budget has distinctive signals of serving those who possess wealth and power. Considering the dire crisis in the banking sector, one would have thought that more stringent fiscal measures will be put in place to discipline the banks with low-performance efficiency. However, instead of taking measures they were rewarded by reducing the corporate tax rate by 2.5 percent. The economy will bear the adverse consequences of such bad policies.

Corporate tax rates on registered banks, insurance companies have been reduced from 40 percent to 37.5 percent, and on unregistered ones from 42.5 to 40 percent. There is no logical, economic or administrative justification that informs such reductions. This incentive in no circumstances will impact the interest rates in the banking sector which could have positive implications for private sector investment. It will only increase profit margins for the owners.

It is dispiriting that the proposed budget gives a signal of condescending the higher upper class who finance elections and also the poor who comes under focus during election time. On the other hand, the middle class’s interest is noticeably ignored for they do not have a voice yet. This is a calculation of political economy, commented Dr. Debapriya.

Check out also: CPD’s Immediate Reaction on National Budget FY2018-19