Syed Yusuf Saadat

Research Associate, Centre for Policy Dialogue

E-mail: saadat@cpd.org.bd

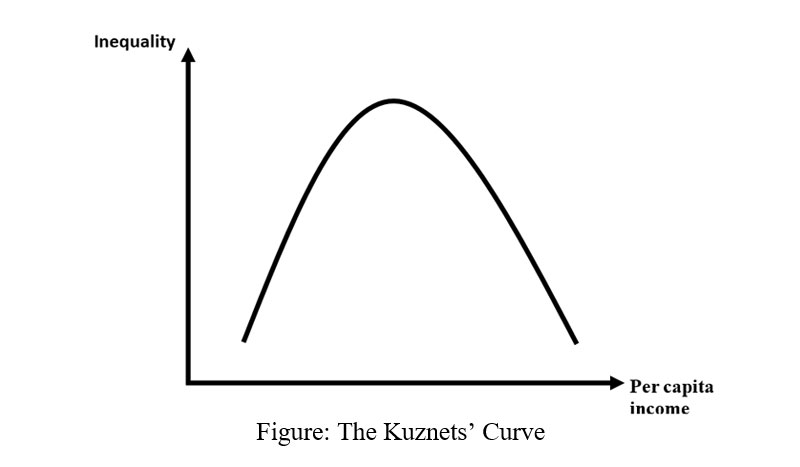

Simon Kuznets, the winner of the 1971 Nobel Memorial Prize in Economic Sciences, suggested that in the early stages of development income inequality tends to rise, whilst in the latter stages of development, income inequality tends to fall. Hence, if we plot a graph of income inequality against gross domestic product (GDP) per capita, we will see that it forms an inverted “U” shape. Such a graph is called the Kuznets’ curve.

The Kuznets’ curve is the product of some serious empirical work on the part of Kuznets. It is based on the data of US federal income tax returns over a 35 year period from 1913 to 1948, as well as Kuznets’ own estimates. Kuznets’ inverted “U” hypothesis appears in most development economics textbooks and is of considerable significance. There are primarily two reasons behind its importance. First, the inverted “U” hypothesis is grounded upon a firm statistical foundation. Kuznets’, like Pareto, reached his conclusions from the analysis of real data. Second, the inverted hypothesis highlights the notion that the relationship between income inequality and per capita income is non-linear. This non-linear characteristic is a critical point that needs to be considered when studying income inequality and economic growth.

Nevertheless, Kuznets’ did not specify any detailed mechanism by which his inverted “U” hypothesis was supposed to occur. His theory was optimistic in terms of assuming that income inequality would automatically decrease during the advanced stages of economic development, regardless of the policies pursued by the government or other external factors.

French economist Thomas Piketty vehemently criticized Kuznets’ conclusions, particularly the inverted “U” hypothesis. Piketty believed that the Kuznets curve was misleading, and extrapolating the curve with new data would lead to vastly different results. Piketty went on to argue that the Kuznets curve had only succeeded in deluding economists and had distracted them away from research on the topic of inequality. Whilst Kuznets used time series data for the United States over a 35 year period, Piketty extended that period to 100 years and showed that income share held by the top 1% of the population followed a “U” shaped curve.

Interestingly, Piketty’s analysis revealed that inequality in the United States soared right before the Great Depression of the 1930s, as well as before the Financial Crisis of 2007. From this we may imply that excessively high levels of inequality may lead to economic instability that can potentially trigger off an economic disaster. On the other hand, periods of relatively low inequality are usually associated with periods of stable growth and economic recovery. For example, during the period 1947-1977, also known as “The Great Prosperity”, the United States experienced arguably the largest economic expansion in history, all under the backdrop of low inequality.

Piketty explained that the fall in inequality in the United States between the two world wars was mainly because of the destruction of capital. On the other hand, the sharp rise in inequality that began in the United States starting in the 1970s was due to several factors such as the crackdown on labor unions, the end of the gold standard, and the deregulation of financial markets. Piketty’s work did not directly invalidate Kuznets’ findings. On the contrary it showed that Kuznets’ conclusions were only accurate for the period that he studied, and could not be generalized for other periods. Hence, inequality is by no means a temporary problem and rise in per capita income does not inevitably lead to fall in income inequality.