Originally posted in The Daily Star on 14 December 2022

High cost of living takes a toll on bank deposits

The deposit growth in banks of Bangladesh has slowed as many people saw their capacity to save dwindle amid the higher cost of living.

The deposit situation has aggravated further as a section of savers preferred to invest in alternative areas, namely property after they became frustrated by a very low-interest rate offered by banks and the withdrawal of savings by a section of people to cope with elevated inflation.

The development is said to limit banks’ capacity to lend and do business.

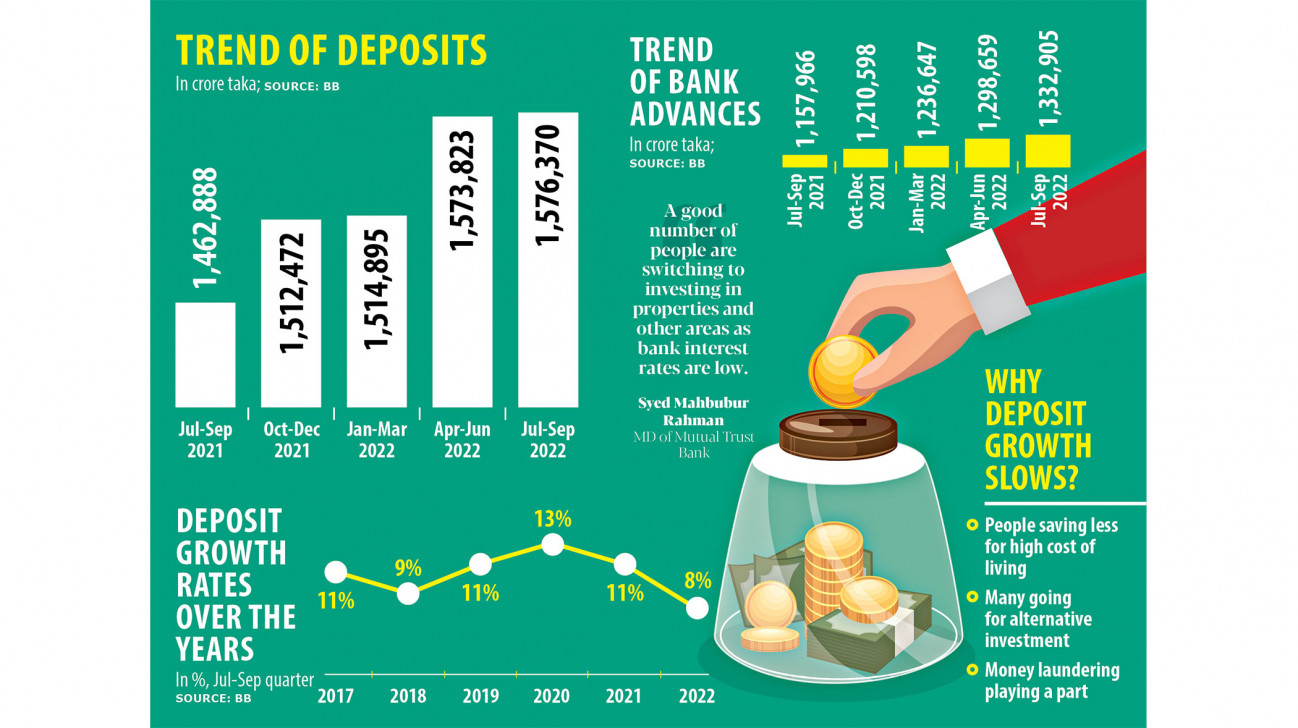

Data released by the Bangladesh Bank showed that total deposits of the scheduled banks increased 8 per cent year-on-year to Tk 157,63,70 crore during the July-September quarter of 2022, the lowest deposit growth in five years.

On a quarter-to-quarter basis, overall deposits ticked up only 0.16 per cent in the third quarter of 2022 from Tk 15,73,823 crore in April-June, according to the Quarterly Scheduled Bank Statistics released by the BB on Monday.

“The middle-income and fixed-income people are struggling owing to the higher inflation. Many families have had to withdraw their savings to cope with the higher consumer prices. It is also seen in the trend of sales of savings certificates,” said Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), a think tank.

Inflation, a measure of change in the prices of a basket of goods and services consumed by a typical consumer, has remained at an elevated level for the last several months, due to a surge in prices of commodities in the global market and the fast depletion of the foreign currency reserves.

As a result, after touching a 10-year high at 9.52 per cent in August, it eased in the last three months. In November, inflation was 8.85 per cent, official data showed.

Md Mahiul Islam, head of retail banking at Brac Bank Ltd, said inflation has affected the savings of the middle class.

Apart from the inflation-induced impact, the overall economic activity has slowed, affecting the income of many people, including small business owners, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank Ltd.

“Bank accounts with more than Tk 1 crore deposit have declined. A good number of people are also switching to investing in properties and other areas as the interest rates offered by banks are low,” he said, citing the property price increase.

Central bank data showed that the weighted average rate of interest on deposits was 4.13 per cent in the July-September quarter, up slightly from 4.09 per cent in the same three-month period last year.

In April-June, the weighted average deposit rate was 3.98 per cent, much lower than the inflation rate.

Banks bought nearly $6.5 billion from the central bank to settle import bills for clients, which has also affected the overall deposits. On the other hand, credit disbursement has increased, said MTB’s Rahman.

“A liquidity crisis is going on as a large amount of liquidity has gone to the central bank’s vault for the purchase of foreign currencies by banks,” said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

He also linked the slowdown in the deposit growth to money laundering and the illegal money transfer through hundi.

“People now have to keep more money in their pockets for the higher inflation to buy goods and services,” he said.

“Many are withdrawing funds from banks because of the loss of confidence caused by loan irregularities in various banks.”

Earlier this month, Ahmad Kaikaus, then former principal secretary of the prime minister, said a rumour was spread that banks do not have enough funds.

“This prompted the general public to withdraw about Tk 50,000 crore from the banking system.”

The fall in deposit growth means banks will not be able to lend. It has a serious impact on the financial sector and the economy, Mansur said.

CPD’s Fahmida echoed the former official of the International Monetary Fund.

“Banks will not have loanable funds to run business. It will affect their profitability,” she said.