Published in The Daily Star on Wednesday 30 January 2019

Bangladesh Bank cuts private sector credit growth target

Ibrahim Hossain Ovi and Mehedi Hasan

Monetary Policy unveiled for the January-June period

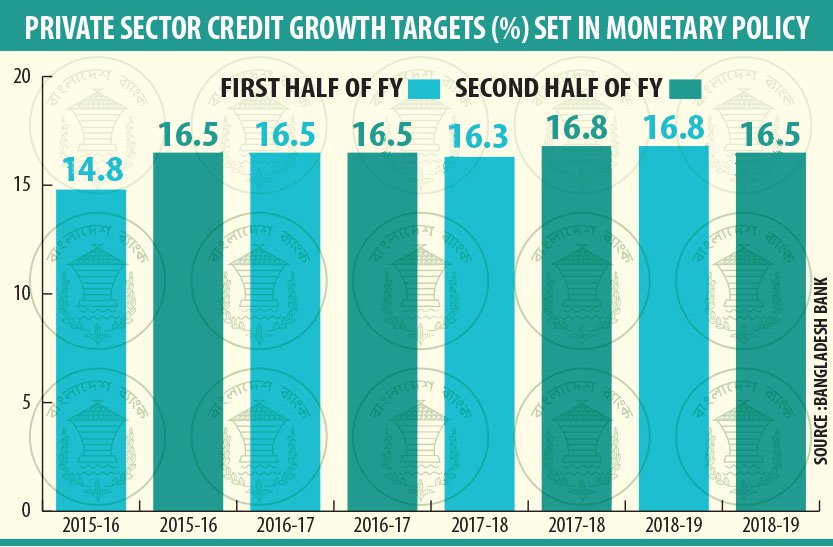

Bangladesh Bank (BB) on Wednesday announced its monetary policy for the second-half (H2) of the current fiscal year (FY2018-19), reducing private sector credit growth to 16.5%.

Central bank Governor Fazle Kabir announced the monetary policy at his office in Dhaka.

The policy for H2 (January-June) of FY2018-19, the BB set ceilings for broad money (M2), domestic credit (DC), private sector credit growth, and public sector credit growth at 12%, 15.9%, 16.5%, and 10.4%, respectively.

According to the policy statement, this is “sufficient” to attain the real GDP growth and CPI inflation projections of the FY2018-19 national budget which are 7.8% and 5.6%, respectively.

For the July to December period of FY2018-19 (H1), the central bank set the private sector credit growth ceiling at 16.8%, but the actual growth as of December 2018 stood at 13.3%.

Elaborating on the policy, the governor said: “The slowdown in private sector credit growth in H1 may largely have been due to uncertainties centering the national election. However, whether the recent rigidity in lending and deposit interest rates have also contributed—with high yield national savings certificates siphoning away much of household savings, causing a decrease of bank deposits bearing much lower interest rates—will be clearer in H2.”

Addressing these issues, and bringing down banking sector non-performing loans (NPLs) by instilling strict lending and recovery disciplines remain the key imperatives, read the policy statement.

Balancing inflation and output risks—given the near-term domestic and global inflation rates, growth outlook, and the associated risks—repo and reverse repo rates will be maintained at current levels of 6% and 4.75%, respectively, for H2, the governor added.

Speaking to the Dhaka Tribune, President of Federation of Bangladesh Chambers of Commerce & Industries (FBCCI) Shafiul Islam Mohiuddin, said that a cut in private sector credit growth rate will not cast an adverse impact in investment right now.

“I also think that this will not squeeze fund flows, but if that happens, the central bank can amend it through negotiation,” Shafiul added.

He further said there must be coordinated efforts in investment and employment generation, and therefore “the private sector needs improvements in ease of doing business, maintaining growth, and a controlled inflation rate”.

“Additionally, the private sector needs clear policies for SEZs [Special Economic Zones], which are creating new opportunities for investors,” the business leader added.

Commenting on the new monetary policy, Research Director at the Centre for Policy Dialogue (CPD) Khondaker Golam Moazzem said that the central bank has set the private sector credit growth based on the track record of achievement, “which was less than the target” in H1.

“Since there is a gap between the target and achievement, the new ceiling will not impact the credit flow negatively,” Moazzem explained, adding that there is a possibility for inflation rates to rise, especially the price of commodities.

“However, there is still hope as paddy production was very fruitful this year,” he said, adding that the government has to monitor the market to check price manipulation and creation of artificial shortages of supply.

Moazzem opined that increase of inflation depends on the government’s decision. “If the prices of oil rises in the global market and the government increases the prices of electricity and gas, there will be negative impact on the commodity market pushing the inflation up,” he added.

Moazzem claimed that despite the economy picking up pace after elections every time, this will not happen this year as there have been “no changes in the business environment and ease of doing business”.

The Association of Bankers, Bangladesh (ABB) Chairman and Dhaka Bank Managing Director Syed Mahbubur Rahman said that liquidity conditions in the banking sector will make it challenging to achieve this target.

“But we appreciate the initiatives that have been taken to reduce NPLs,” Mahbubur added.