Centre for Policy Dialogue (CPD) organised a media briefing on the release of the State of the Bangladesh Economy in FY2017-18 (First Reading) on 13 January 2018 in Dhaka. Mr Towfiqul Islam Khan, Research Fellow at CPD, presented the analysis which was prepared under CPD’s flagship programme Independent Review of Bangladesh’s Development (IRBD).

The report presented an analysis on Bangladesh’s macroeconomic performance during the first half of FY2018 on the basis of latest available data on various economic indicators. It analysed the strength and weakness of the country’s macro economy and provided observations on mitigating various forthcoming challenges.

Key points of the report highlighted during the media briefing include:

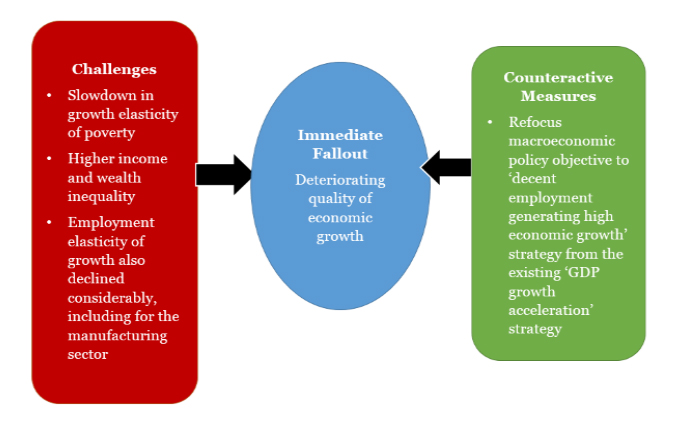

1. Rising Income and Wealth Inequality

- Poverty reduced in absolute level, but pace of poverty reduction has slowed down.

- Poverty and employment estimates pose questions in context of the benefits of the attained economic growth.

- Rich are getting richer while the poor are getting poorer. Ratio of income of top five per cent and bottom five per cent households increased to 121.3 in 2016 from 31.6 in 2010.

- Wealth inequality depicts an even direr picture. The percentage share of wealth of top five per cent and bottom five per cent households was 51.32 and 0.04 in 2010.

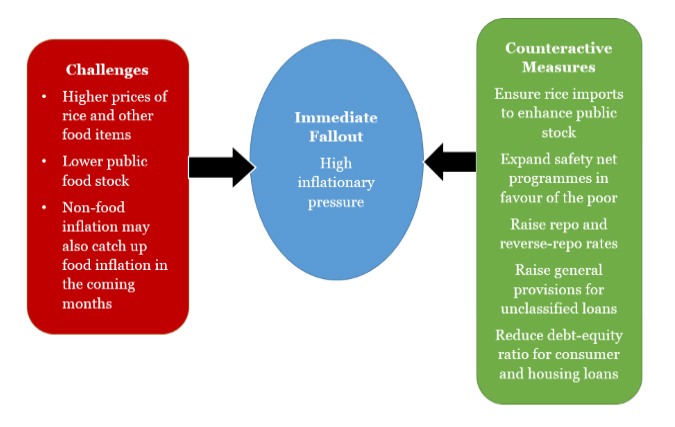

2. Inflation and Food Stock Outlook

2. Inflation and Food Stock Outlook

- Since mid-2017, Bangladesh has experienced a rise in inflation partly due to the consecutive floods. High food inflation is likely to continue in the coming months. The inflation rate rose to 7.13 per cent in December’17 vis-à-vis 5.38 per cent in December’16.

- Government’s distribution of food grains was at the lowest level when the inflationary pressure was at its peak. Inadequate stock is the major reason behind the failure to ensure required food grain supply under the public food distribution system (PFDS).

- According to a CPD study, the estimated loss of Boro production was about 15.8 lac metric tons during the flash flood in haor areas in 2017 while the estimated loss of rice production was about Tk700 crore to 2700 crore during the monsoon flood. Therefore, a possible shortfall of food grains for the PFDS during H2 FY18 could be between 2.44 to 3.47 lakh MT.

- According to CPD’s estimation, an additional food budget of Tk700 crore to Tk1, 152 crore will be required to address the situation.

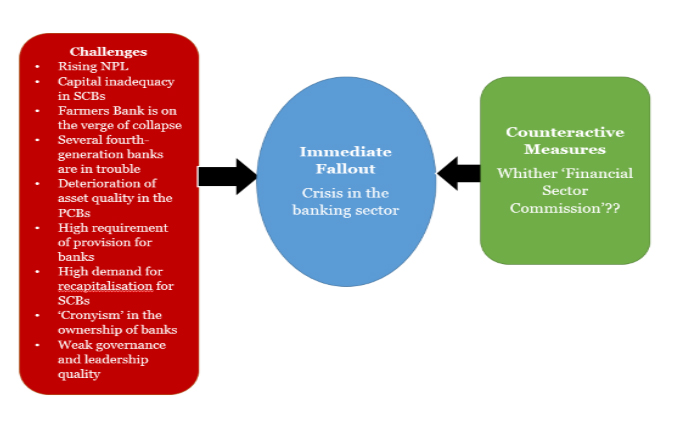

3. Growing Malignancy in the Banking Sector

3. Growing Malignancy in the Banking Sector - The banking sector of Bangladesh has been plagued by financial scams, non-performing loans, inefficiency, and slack monitoring and supervision.

- Around Tk 15,705 crore spent in recapitalising the banks during the period FY2009-FY2017 which is roughly half the cost of the construction of the Padma Bridge.

- Instead of the growing malignancy, the government amended the Banking Companies Act increasing the tenure of the board of directors of a private bank from six years to nine years, and accommodating four members of a family instead of two in the board.

- Despite a decline in the interest rate, high rates of lending continued to prevail in key sectors, discouraging investors.

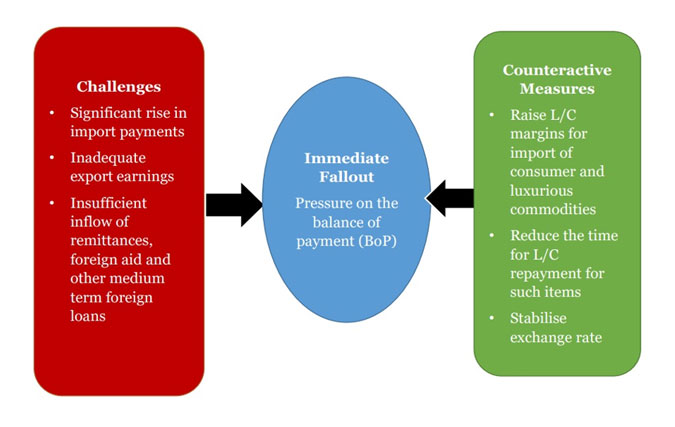

4. External Sector

4. External Sector

- Export sector of Bangladesh evinced positive signals during the 1st half of FY18. A period-on-period growth of 9.2 per cent will be required in the remaining half (January-June) of FY18 to reach the export target of USD 37.5 billion.

- Bangladesh may face additional burden of import payments in the 2nd half of FY18 as price of crude oil evinced signs of rise.

- US imports of RMG products from Bangladesh is decreasing (-5.1 per cent in July – October period of 2017).

- Suspicious import growth (75 per cent) of raw cotton despite stability in global price, unmatched RMG export growth and no strong indication of sudden spurt in investment in spinning. Besides, high import growth for sugar (50 percent) and edible oil (39 percent) is likely to continue.

- Taka started to experience some depreciation since second quarter of FY17 continuing to the early months of FY18. Monthly average nominal exchange rate (NER) in the first half of FY2018 was USD/BDT 82.6.

- Exchange rate depreciation and upturn of oil price helped the slow recovery of remittance growth. The growth for (Jul-Dec) FY18 was 12.5 per cent. On the other hand, migration growth for (Jul-Dec) FY18 was 26.8 per cent. However, but it rate will drop to -20 per cent, if excludes KSA.

- Foreign exchange reserve has declined to USD 32.0 billion as of January 2018. Current account balance is USD (-) 3,311 million, and the overall balance of payments is USD (-) 225 million for Jul-Oct FY2018.

CPD’s Observations and Recommendations

Based on the analysis, CPD observes that the macroeconomic stability of Bangladesh has come under considerable pressure. Slowdown in growth elasticity of poverty, high income and wealth inequality, food inflation, financing the budget deficit based on NSD certificates sale, rising non-performing loans (NPL), weak governance amid crisis in the banking sector, and lower remittance inflow are the major concerning areas of this fiscal year. However, the government did not undertake any major reform measures, especially for the banking sector, to improve the situation.

Considering these issues, the government should focus more on the qualitative aspects of growth rather than concentrating only on its quantity for a sustainable economy. Besides, it is a common practice in the country that the government loses its appetite to take any radical reform measures before election. Therefore, the government should maintain conservative economic management in its last year in office before national polls to maintain the economic growth.