Published in Dhaka Tribune on Thursday, 9 November 2017

Betting on indirect tax

Shariful Islam

Revenue collection in Bangladesh is still heavily reliant on indirect taxes

Over the last few years, the National Board of Revenue (NBR) of Bangladesh has taken a series of initiatives with the target of increasing the share of income tax in the overall revenue collection.

Revenue collection in Bangladesh is still heavily reliant on indirect taxes.

There are three major sources of revenue in our economy: value-added tax (VAT), customs duty and income tax. Of them, only income tax is direct tax.

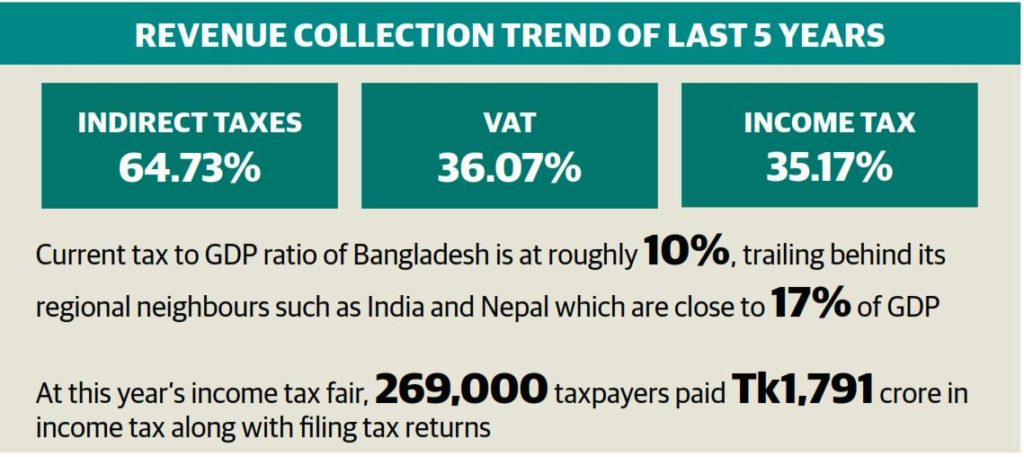

In the last five years, revenue from indirect taxes has covered 64.73% of the total revenue, while income tax has only covered 35.17%, falling persistently short of VAT (36.07%).

Since the inception of VAT in 1991, income tax has never exceeded it.

Currently, 3.1 million people hold tax identification numbers (TIN) and of them, 1.6-1.7 million submit tax returns. However, according to the economic think tank Centre for Policy Dialogue, there are eight million taxable people in the country.

One expert says 60% of income tax comes in as tax at source, and very few individuals pay self-assessed income tax.

A recent Finance Ministry survey says 45-65% of the income in our economy remains untaxed.

In this fiscal year, tax revenue was estimated to cover 62% of the national budget.

Economists, business leaders and other experts who spoke to the Dhaka Tribune blamed the ongoing tax collection and expenditure system, the revenue board’s lack of institutional capacity and failure of coordination among all stakeholders for this.

“Only honest people, especially from the middle-income group, are paying income tax. Most rich people are out of the tax net. The rich feel no need to report their actual wealth and this is the result of the existing tax system,” former Bangladesh Bank governor Salehuddin Ahmed said.

He said in the existing system revenue officials create pressure on the people who are paying tax, while the untaxed are being free from pressure.

“Unless the system is changed, income tax collection cannot be extended,” said Ahmed, adding: “The income tax submission process should be easy, and the internal transparency of the income tax department has to be ensured.”

Dr Shantanu Majumder, an associate professor of political science at Dhaka University, told the Dhaka Tribune: “Income tax is direct tax. By paying income tax, a citizen can be directly invested in the country’s development. People have to become more aware about this. It is a matter of political economy.”

But economist AB Mirza Azizul Islam, former financial adviser to the caretaker government, thinks taxpayers would be more motivated to pay direct tax from their earnings if the government achieves more transparency and accountability with its expenditure.

“If taxpayer money is spent in ensuring good governance and visible development work, that will encourage the taxpayers,” he said.

Although income tax collection is on an upward trend, the country’s tax to gross domestic product (GDP) ratio is embarrassingly low.

A recent study by the Policy Research Institute of Bangladesh (PRI) showed that the current tax to GDP ratio in Bangladesh is at roughly 10%, while the average tax to GDP ratio for Organisation for Economic Cooperation and Development (OECD) countries is 34%.

In some countries of Western Europe citizens pay over 40% of their income in taxes.

The study also found that Bangladesh trails behind its regional neighbours such as India and Nepal which are close to 17% of GDP.

AB Mirza Azizul Islam said: “The tax to GDP ratio is very low in Bangladesh. Although the country’s overall revenue collection is increasing, it should be driven by income tax; which has not taken the lead yet. There is scope for increasing the amount of income tax.

“For this, the tax net needs to be expanded. The country’s economy is expanding and the growth has reached the rural areas. Many rural businesses are now taxable and they need to be brought into the tax net.”

The National Board of Revenue has taken a series of initiatives including organising tax fairs, tax camps and observing tax weeks and tax days. It has taken the income tax return submission process online and has honoured regular and top taxpayers with awards.

Last week NBR organised seven-day tax fairs at eight divisional cities, four-day fairs at 56 districts, two-day fairs at 34 upazilas and one-day mobile fairs at 71 upazilas between November 1 and 7.

At the fair, 269,000 taxpayers paid Tk1,791 crore in income tax and filed tax returns, while 944,000 people received various other services.

Former NBR chairman Muhammad Abdul Mazid told the Dhaka Tribune: “The success of NBR’s income tax fair shows the sorry state of the income tax offices. If the taxpayers are interested to do this at the fair, why are they not going to the income tax office instead?”

He suggested that the atmosphere of the tax offices need to be improved and that the NBR should organise fairs or tax camps at rural areas only to incorporate the untaxed people into the tax net.

The former NBR chief said the revenue authorities have to collect income tax in a systematic way, enabling taxable people to automatically pay their income taxes.

Mustafizur Rahman, a distinguished fellow the Centre for Policy Dialogue (CPD), told the Dhaka Tribune: “To increase the number of income taxpayers as well as the amount, the government has to address both tax evasion and tax avoidance.

“For this, the institutional capacity of NBR has to be increased, use of technology in transfer pricing and other works and more coordination among NBR, Bangladesh Bank and export-import agencies are also needed,” he said.

President of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) Md Shafiul Islam Mohiuddin told the Dhaka Tribune: “The rebate process of taxation should be addressed immediately. As businesses pay advance income tax; our rebate on business losses should be ensured in a transparent and accountable way.”

While he thought the NBR’s recent initiatives were laudable, he said the work should be done more efficiently.

NBR Chairman Md Nojibur Rahman said: “The revenue board has been working full swing to realise the revenue targets against all odds. About 50% of the total revenue will come from income tax by 2021.”

PRI Executive Director Ahsan H Mansur said: “Bangladesh will not be able to eradicate extreme poverty by 2030, and simultaneously become an upper middle-income country, if it cannot expand its tax base.”

“Amid the ongoing economic growth momentum, if the country fails to make a strong push for tax reforms now, it will be a lost opportunity of monumental proportions for Bangladesh,” he added.