Published in The Daily Star on Tuesday 14 January 2020

BB’s baffling move

Gives approval to new NBFI, Strategic Finance and Investments, when sector is in meltdown

The central bank has given the go-ahead to set up a new non-bank financial institution (NBFI) in its last board meeting — a move that has stumped experts and industry insiders given the poorly state of sector.

In its meeting on Sunday evening, the board of directors of the Bangladesh Bank gave the letter of intent to Strategic Finance and Investments.

In its meeting on Sunday evening, the board of directors of the Bangladesh Bank gave the letter of intent to Strategic Finance and Investments.

Its chairperson is Anjuman Ara Shahid, wife of Padma Bank Chairman Chowdhury Nafeez Sarafat.

She is also a sponsor-shareholder of Padma Bank, which was rechristened from Farmers Bank earlier in January last year as part of its effort to sweep the gross irregularities and loan scams under the carpet and get an image makeover.

“This is quite the illogical move on the part of the central bank,” said Ahsan H Mansur, a former economist of the International Monetary Fund.

The financial health of NBFIs is worse than banks, said Fahmida Khatun, executive director of the Centre for Policy Dialogue, a preeminent think-tank.

At present, there are 33 NBFIs and the majority of them are struggling to survive amid rising default loans and inability to repay depositors’ money.

Another unusual aspect of the move to award the licence to Strategic Finance and Investments was the time it took the central bank to do its due diligence.

Strategic Finance and Investments had applied for licence on October 16 last year and the central bank completed all processes in less than three months, when it usually requires at least 5 to 6 months.

The move surprised even a number of the central bank officials.

“This was done within the shortest possible time,” said a high official of the BB requesting anonymity due to sensitivity of the topic.

The central bank has given the letter of intent to Strategic Finance and Investments as it had given commitment to bring the majority portion of its equity and fund from foreign sources, said Md Serajul Islam, spokesperson and an executive director of the BB.

“The new NBFI will not face any liquidity crunch as it will mobilise funds from abroad.”

Islam, however, sidestepped a query on whether the financial sector needs another NBFI.

Sarafat told The Daily Star yesterday that the new NBFI will kick off its operation on February 2 and it would take a different financial model than the existing ones.

“The majority of the NBFI’s equity and funds will come from foreign sources. So, it will inject fresh liquidity into the financial sector,” he said, adding that foreign institutions will hold a good number of shares of Strategic Finance and Investments.

Khatun of CPD remains unimpressed.

“Our experience is bad. In the past many spoke of such new models but they rarely followed through with their commitment,” she said.

Had a well-reputed foreign company intended to set up an NBFI, the reception would have been different, said Mansur, executive director of the Policy Research Institute.

“But there is no scope of welcoming this decision,” he said, adding that the NBFI sector is too crowded.

Zahid Hussain, former lead economist of the World Bank’s Dhaka office, echoed the same.

“I do not find any logic on the central bank’s decision to allow another NBFI as the existing numbers are too much larger than the requirement. And majority of them are facing different types of problem, including liquidity crunch and a lack corporate governance,” he added.

At least three managing directors of NBFIs on condition of anonymity said that a good number of them have stopped fresh lending due to acute cash crunch.

Subsequently, Mansur, also the chairman of Brac Bank, urged the central bank to liquidate the weak NBFIs for the interest of the economy or merge them with stronger ones.

In July last year, the BB was forced to start the process of liquidating People’s Leasing and Financial Services as the NBFI failed to repay depositors’ money despite maturity of funds.

Furthermore, on September 30 Rupali Bank alleged that 10 NBFIs have failed to pay back its funds amounting to Tk 933 crore, according to BB documents. The bank has repeatedly asked them to repay the money, but they were unable to. Subsequently, the state-run bank sought the central bank’s intervention.

But the BB is yet to take any effective measures to help Rupali recover the funds.

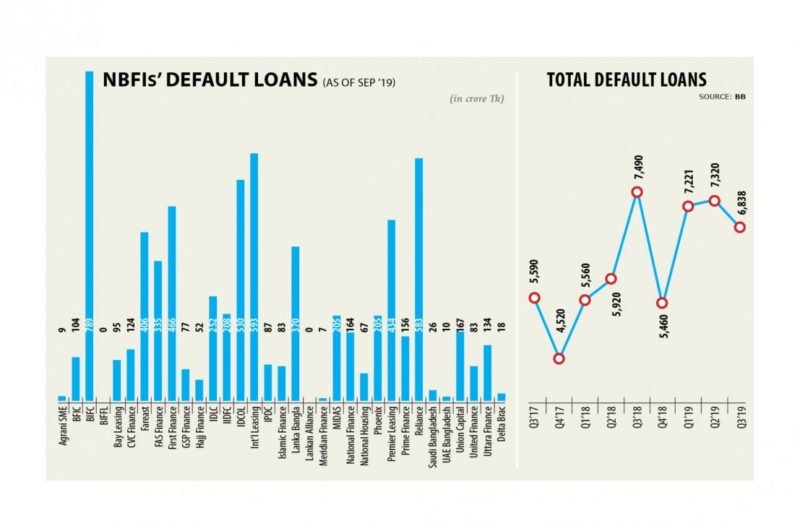

At the end of September, the total default loans in NBFIs amounted to Tk 6,838 crore, up 25.23 percent from six months earlier, according to data from the central bank.

The amount would have been much larger had the default loans of People leasing were added to the list.

Default loans of People’s Leasing is about Tk 600 crore to Tk 700 crore.

Khatun went on to urge the central bank to strengthen monitoring on the NBFI sector, rather than allowing new one.

The central bank has not taken the decision based on the current haphazard state of the sector, said Salehuddin Ahmed, a former governor of the central bank.

“Rather, it has been forced to do this because of pressure from an influential group,” he said, while advising the BB to give all-out effort to bring down default loans and restore corporate governance in NBFIs.

AB Mirza Azizul Islam, a former adviser to a caretaker government, echoed the same.