Published in The Business Standard on Tuesday 9 June 2020

Tax-free income limit to be raised for first time in five years

The government looks to relieve people from financial burdens prompted by the coronavirus pandemic

The tax-free income limit may be raised while the tax rate is also likely to be reduced in the next fiscal year, as the government looks to relieve people from financial burdens in the coronavirus pandemic.

The government kept the tax-free income threshold unchanged since 2015 though businessmen and economists had been advocating raising the ceiling.

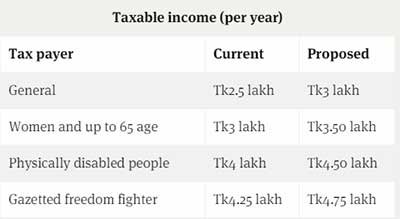

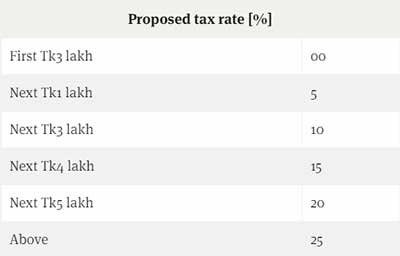

Finance ministry sources said, the tax-free income limit is being raised to Tk3 lakh, up from Tk2.5 lakh fixed back in the 2015-16 fiscal year. Besides, taxpayers belonging to a lower income group are likely to get a 5 percent tax slab, down from 10 percent.

On top of this, the slab for the highest income group is likely to be 25 percent from 30 percent.

Finance ministry officials said the facilities are designed to gave relief to low-income people, encourage more people to pay tax, and minimise the tendency of big taxpayers to evade tax.

Finance Minister AHM Mustafa Kamal will make the announcement in the upcoming national budget, slated for June 11.

On condition of anonymity, a finance ministry official said, the decision to raise the tax-free income ceiling was taken based on inflation and fall in income due to the pandemic.

However, other sources at the same ministry said the prime minister gave the decision to back the taxpayer during the crisis.

The sources noted, “The tax-free income limit has been doubled in neighboring India to 5 lakh rupees. The National Board of Revenue was not interested in increasing the tax-free income ceiling primarily.”

The NBR argued that a big chunk of taxpayers will go out of the tax net if the tax-free income limit is raised — resulting in a fall in revenue collection.

Apart from the tax-free income ceiling for general people, the limits for women, senior citizens, differently-abled and freedom fighters are also being raised.

According to the new plan, people with Tk4 lakh annual income will pay 5 percent income tax – which currently is 10 percent — on their earnings.

In the new proposal, tax rate will reduce 5 percent on all slabs, and people with annual income up to Tk3 lakh will pay 10 percent tax.

The tax rate goes up progressively to 15 percent on Tk4 lakh, 20 percent on Tk5 lakh and 25 percent on higher than Tk30 lakh annual income.

Economists said change in tax-free income limit and tax rate was necessary as living cost has gone up enormously.

They said India has doubled the tax-free income limit to boost its economy by enhancing the purchasing capacity of people. Bangladesh could have followed the lead earlier.

Distinguished Fellow of the Centre for Policy Dialogue (CPD) Professor Mustafizur Rahman said the pandemic-hit people will be relieved if the tax-free income limited is increased and tax rate is reduced.

He also believes that taxpayers will be encouraged if the new tax proposal is approved.

NBR sources said, tax deducted at source amounts to 57 to 60 percent of the total tax collection, while advance tax and corporate tax fill up the rest. In comparison, collection from individual taxpayers is too little. Therefore, focus should be shifted to big businesses for more collection.