Published in The Business Standard on 3 January 2021

Millionaires galore

Not everyone made the bucks illegally, but it is necessary to look into the income sources

It seems Covid-19 could not stop the race to become multimillionaire, though the pandemic devastated the economy, plummeting the income of common people.

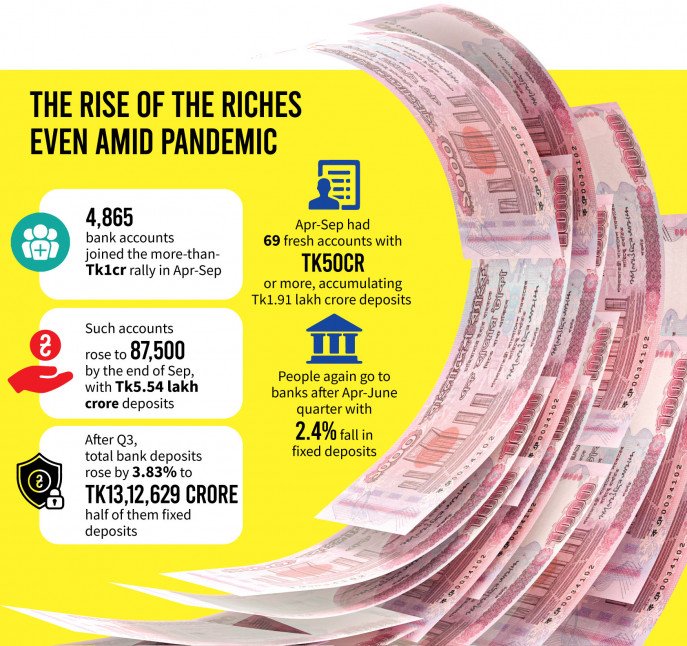

The number of people with deposits more than Tk1 crore increased in the first six months of the pandemic. From April to September in the recently concluded year, 4,865 accounts joined the rally with deposits of Tk1 crore and more.

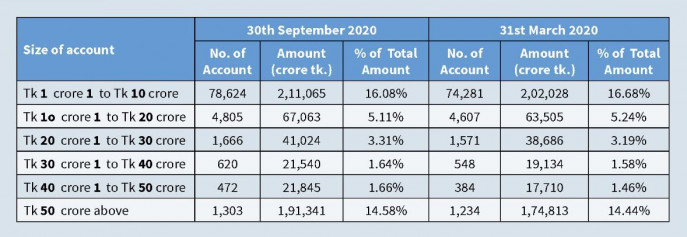

And by the end of September, the number of such accounts stood at 87,500, with deposits of Tk5.54 lakh crore. The figure is around 42% of the total Tk13 lakh crore bank deposits by the end of that month.

The information emerged from analysis of the Quarterly Scheduled Banks Statistics (July-September, 2020) report released by the central bank on Sunday.

In that six months, depositors’ number with Tk50 crore and more increased by 69. By the end of September, such accounts stood at 1,303 with more than Tk1.91 lakh crore – which is 14.58% of the total deposits.

While contacted, Iftekharuzzaman, executive director of the Transparency International Bangladesh, told The Business Standard that the increase in the number of multimillionaires amid the pandemic is indicative of the growing inequality in society.

He said not everyone made the bucks illegally. However, it is necessary to look into the income sources.

For the first time in the country’s history, the current budget allows making any size of fixed deposits without any questioning. Iftekharuzzaman noted that the provision might have caused the rising deposits, and suggested revisiting the budget provision.

Dr Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), told TBS that the central bank statistics once again proves that Bangladesh is one of the fastest growing rich populations.

She, however, does not think the pandemic has anything to do with the rising number of the multimillionaires.

The CPD executive director said the number of rich people is now on the rise riding on the country’s progress in economy, trade and commerce.

She also linked it to the budget provision on depositing any amounts without question.

In addition, the economist said those who have whitened undisclosed money by paying tax might have contributed to the burgeoning bank deposits.

Meanwhile, people did not shy away from the banks even during the pandemic. Deposit growth continued at the end of the third quarter (July-September) as in the second quarter of last year.

At the end of the third quarter, the total deposits increased by 3.83% to Tk1,312,629 crore. About half of the total deposits are fixed deposits and the amount of fixed deposits increased by 6.67% to Tk603,408 crore at the end of the third quarter.

At the end of the second quarter (April-June), the amount of fixed deposits decreased by 2.4% as compared to the first quarter (January-March).

Md Arfan Ali, managing director of Bank Asia, explains why fixed deposits are on the rise again.

He said people needed more cash during the April-June quarter since the infection rate was higher and there was a shutdown in place then. Moreover, many people broke the fixed deposits and took the money to make ends meet since their income fell.

“Now those who are depositing money in banks are keeping those not for investment but for security,” he claimed.

“Considering inflation and interest rates on deposits, the actual interest is now negative. So no one will keep money in the banks for profit,” Arfan Ali argued.

Along with deposits, loan disbursement has also increased. During the July-September quarter, loan disbursement increased by 1.33% compared to the previous quarter and exceeded Tk10.62 lakh crore.

Most of the loans went to industries and commerce. Credit to the industrial sector is more than 41% and about 34% in the trade and commerce sector. About 9% of total loans were disbursed in construction sector, 4% in agriculture and 7% in consumer loans.