Originally posted in The Daily Star on 7 June 2024

BANGLADESH NATIONAL BUDGET FY2024-25

On Thursday, the new finance minister presented the proposal for the national budget for FY2024-25 at a time when Bangladesh’s economy is under tremendous pressure. The finance ministry deserves credit for undertaking the humongous task of preparing a budget during an economically challenging time. However, the proposed budget falls short of fully assessing the depth of the problem and making realistic targets, and thus suggesting practical measures to solve some of the problems.

How prudent is the fiscal framework?

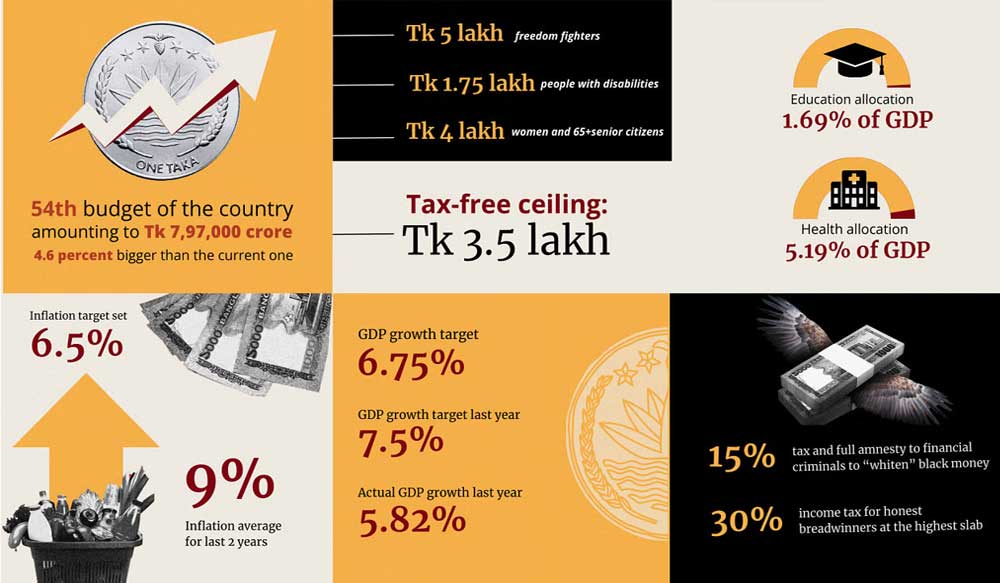

With a size of Tk 7,97,000 crore, the FY2024-25 budget is equivalent to 14.2 percent of the GDP, which is the same as the revised budget of the outgoing fiscal year.

The gap between expenditure and revenue is large, which is common in Bangladesh. Since the revenue target is set at Tk 5,41,000 crore, or 9.7 percent of GDP, the government has to rely on both domestic and foreign sources. However, given the high inflationary pressure over the last two years and the resource constraints the country faces, it would have been prudent to keep the budget deficit low, somewhere between three or four percent of GDP, even though traditionally it has been set around five percent in the annual budget. In FY2023-24, the budget deficit was set at 5.2 percent of GDP, which has now been revised to 4.7 percent. In the upcoming fiscal year, it has been set at 4.6 percent. Of this deficit, 2.9 percent will be financed from domestic sources, and 1.7 percent from foreign sources.

A large amount of domestic funding will come from bank loans by the government, which is set to be Tk 1,37,500 crore—2.5 percent of the GDP. In the revised budget of FY2023-24, the amount of bank loans has been increased to Tk 1,55,935 crore. In the outgoing fiscal year, there was low demand for bank loans by the private sector. But the government’s consistent dependence on the banking sector will create the crowding out effect for the private sector at some point. Besides, the government’s interest payment against the bank loans continues to increase.

So, the proposed budget falls short of taking a pragmatic fiscal consolidation through restrained spending and meeting the expenses through higher domestic revenue collection. Of course, the target for revenue generation has been increased slightly, from 9.5 percent of GDP in the revised budget in the outgoing fiscal year to 9.7 percent for in the upcoming fiscal year.

How realistic are the key targets?

According to the finance ministry, the total revenue collection recorded a 13.3 percent growth during the July-January period of FY2023-24. This is a considerable improvement from the corresponding figure of FY2022-23. Despite this improvement, the revenue growth still has to be as high as 63.2 percent during the remainder of FY2023-24 to meet the annual target, which seems unplausible. Therefore, a practical and achievable target is essential for planning expenditures. There is an attempt by the government to enhance revenue collection through various tax measures.

The projections on some key economic indicators are also far from reality. For example, the proposed budget has set GDP growth at 6.75 percent for FY2024-25. Amid the current economic pressure, this projection is high. In FY2023-24, the GDP growth was estimated to be 7.5 percent. However, provisional estimates by Bangladesh Bureau of Statistics (BBS) revealed that in FY2023-24, the GDP growth rate could be 5.82 percent.

Similarly, gross investment as a share of GDP has been projected to be 33.41 percent in FY2024-25. This is in contrast to the fact that gross investment as a share of GDP has been declining over the past few years. Between FY2019-20 and FY2023-24, the decline in the gross investment-GDP ratio has been 0.33 percentage points. Most importantly, the private investment-GDP ratio also declined from 24.18 percent in FY2022-23 to 23.51 percent in FY2023-24. So, how the projection of higher private investment at 27.34 percent of GDP will be achieved in FY2024-25 remains a mystery.

What is there to curb inflation?

Amid the existing economic pressure, the government will have to settle for a low-level equilibrium, i.e. low inflation and low growth. Spending cuts are needed in unnecessary operational costs, unproductive projects, and special support to certain privileged groups. Higher allocations should be made for the poor, low- and middle-income groups through social protection.

Another way to provide some respite to ordinary citizens is through employment. In the absence of private investment, job creation has become limited. Despite a reasonable GDP growth, the capacity of the economy to generate employment is reducing. The employment elasticity is a measure to see how employment is changed due to economic growth. The quarterly GDP estimates and the Labour Force Survey (LFS) data from the BBS reveal that the employment elasticity of GDP is on a downward trend. More worryingly, the opportunity for decent employment is limited. The LFS 2022 data indicate that 90.5 percent of the industrial employment and 67.8 percent of the service sector employment are in the informal category.

For the poor, an important source of support is the government’s social safety net (SSN) programmes. The overall SSN budget as a percentage of the total budget increased marginally—from 17.0 percent in the revised budget for FY2023-24 to 17.1 percent in FY2024-25. The SSN budget as a percentage of GDP saw an increase—from 2.40 percent in the revised budget to 2.43 percent in the proposed budget.

However, as before, pension for the retired government employees and their families, interests from savings certificates, agriculture subsidy, and programmes for freedom fighters are included in the SSN, inflating the allocation for the sector. If these allocations, which don’t directly help the poor, are taken out, the actual allocation for SSN is much smaller. For example, if we exclude pension for the retired government employees and their families, interests from savings certificates, and agricultural subsidy, the SSN allocation drops to 9.2 percent of the total budget and only 1.32 percent of GDP.

There hasn’t been any support in terms of tax measures for the low-income groups. In the budget for the outgoing fiscal year, the government increased the threshold level of tax-free annual income from Tk 3 lakh to Tk 3.5 lakh. However, the inflation continued to be close to 10 percent through the fiscal year. Food inflation is even higher. Indeed, food expenditure in Bangladesh is much higher than many countries with more per capita income (CPD 2024).

In such circumstances, the threshold of tax-free income should have been increased to Tk 5 lakh as expenditure for essential items eat up most of the earnings of low-income households. This rebate will not cost the government much. Instead, it should collect taxes from the tax evaders and new sources. The hard-earned money of the taxpayers should be used prudently. This will increase public confidence in the tax system. This will create fiscal space for the government to spend on priority areas, including support to the poor and low-income families. The announcement by the government to reduce taxes on many commodities is a positive step.

However, the authorities have to make sure that the reduced tax is reflected through reduced prices in the market. This initiative should be continued till the prices are down at a tolerable level. Allocation for programmes such as open market sales (OMS) should have been higher because the supply is inadequate compared to the demand. This is not a requirement for the low-income families only—the middle class also has a demand for such support.

Finally, the government has set the target for inflation at 6.5 percent in FY2024-25. Unfortunately, this is an unrealistic target. The policymakers have to take several pragmatic, bold and unpopular measures to reach the target within the next 12 months.

Dr Fahmida Khatun is executive director at the Centre for Policy Dialogue (CPD) and a non-resident senior fellow at the Atlantic Council.