Originally posted in Dhaka Tribune on 1 September 2024

State of the economy

Bangladesh’s reserves stabilize, but challenges loom

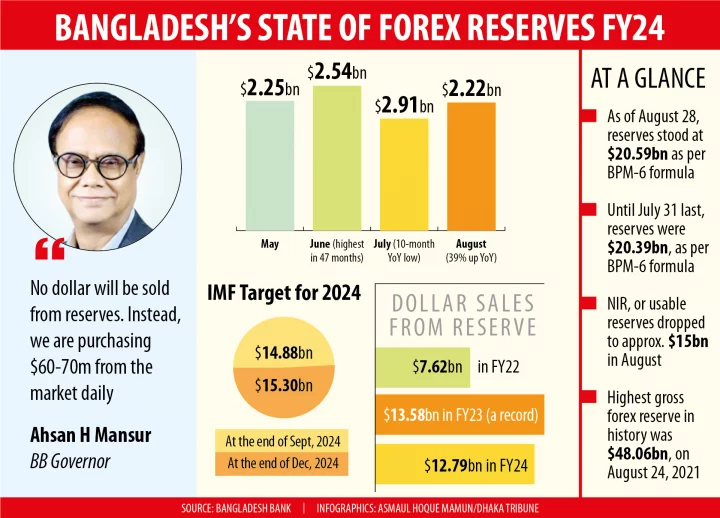

The country received $2.22 billion in remittances in August, marking a 39.6% year-on-year increase

In August, Bangladesh’s foreign exchange (Forex) reserves showed signs of stability, thanks to rising remittance flows and the new governor’s decision to pause selling dollars from reserves. This comes after July saw a record drop in reserves.

Since FY22, Bangladesh Bank injected $34 billion into banks to help them manage a severe US dollar shortage. This heavy intervention significantly impacted the country’s Forex reserves and exchange rate.

The situation appeared to stabilize last month, following the end of the previous government’s regime on August 5. However, economists warn that maintaining this stability will be a tough challenge for Bangladesh’s new interim administration.

Under the conditions of a $4.7 billion loan from the IMF, Bangladesh must have $14.89 billion in Forex reserves by the end of September.

The country received $2.22 billion in remittances in August, marking a 39.6% year-on-year increase. This is particularly encouraging as it follows a challenging period in July 2024, when remittances hit a 10-month low of $1.91 billion during the student protests.

It’s important to note that banks were closed from July 19-23 due to the unrest, along with public and general holidays. Additionally, the country faced a five-day broadband internet shutdown and a ten-day mobile internet blackout, severely disrupting foreign transactions with local banks.

Remittance flow

In August, expatriates sent $1.76 billion to Bangladesh through private commercial banks, according to Bangladesh Bank data.

Islami Bank Bangladesh Ltd received the largest share, with $405.23 million in remittances.

Six state-owned commercial banks—Agrani, Janata, Rupali, Sonali, Basic, and BDBL—together received $383.46 million. Bangladesh Krishi Bank, a state-owned specialized bank, received $78.12 million.

Among the state-owned banks, Agrani Bank received $96.89 million, Janata Bank received $155.88 million, Rupali Bank received $100.65 million, Sonali Bank received $29.96 million and Basic Bank received $0.07 million.

New reserve management

Since FY22, the central bank has continued to pump dollars into banks from the forex reserves, which caused the reserves to come down to risky levels.

The central bank pumped $7.62 billion into banks in FY22, a record $13.58 billion in FY23 and $12.79 billion in FY24, central bank data showed.

In exchange, the banking regulator mopped up the equivalent amount of local currency against the US dollar, which is a major reason for the liquidity crisis in terms of the local currency in banks, economists said.

But the new governor decided not to sell dollars from the reserve.

Regarding the reserve management challenge Bangladesh Bank Governor Ahsan H Mansur recently stated: “No dollar will be sold from reserves; instead, we are purchasing $60-70 million from the market daily.”

He detailed recent expenditures, including $300 million to pay electricity bills and $35 and $20-30 million for agricultural needs.

Forex increased slightly

The increase in remittance flow has positively impacted Bangladesh’s Foreign Exchange (Forex) reserves. According to the central bank, using the IMF’s BPM-6 method, the reserves stood at $20.59 billion as of August 28, slightly up from $20.39 billion on July 31. The Gross Forex Reserves were $25.82 billion, showing a modest increase.

However, there’s another measure called Net International Reserves (NIR), which is reported only to the IMF and not made public. According to central bank sources, the net usable reserves have fallen to $15 billion.

For context, the highest reserves in Bangladesh’s history were recorded on August 24, 2021, at $48.06 billion.

IMF reserve maintenance challenge

As part of the IMF’s $4.7 billion loan agreement, Bangladesh was given a target to maintain $14.89 billion in reserves by the end of September this year. The IMF document sets even higher targets: $15.3 billion by December 2024, $16.601 billion by March 2025, and $19.4 billion by June 2025.

However, meeting these targets has come at a cost. To achieve the June target, Bangladesh had to cut down on imports, which slowed economic growth and led to rising inflation due to higher fuel costs.

What experts are saying

“Reserves are now lower than they should be. Restoring and maintaining them will be a challenge for this government,” said Dr Mustafizur Rahman, Distinguished Fellow at the Centre for Policy Dialogue (CPD), in an interview with Dhaka Tribune.

To address this challenge, Dr Rahman suggests several measures:

Firstly, maintain remittance flow by ensuring that the recent increase in remittances continues. Then monitor trade invoicing by strictly overseeing export under-invoicing and import over-invoicing.

Thirdly, speeding up foreign loan disbursement. Then reducing loan repayment burden.

He also suggested continuing to limit imports for a while.

And lastly, limit dollar sales from reserves, he added saying that the central bank should be cautious in selling dollars from reserves.

A senior official from Bangladesh Bank also mentioned that the bank has implemented various measures to boost remittance inflows, which have positively impacted the country’s foreign exchange reserves.