Originally posted in The Business Post on 4 October 2024

People under pressure as inflation outstrips wage growth

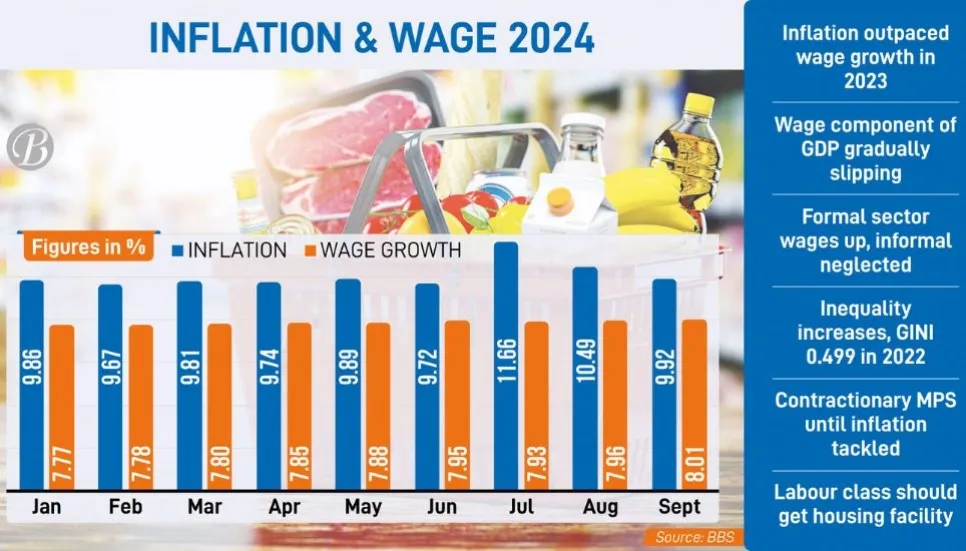

Bangladesh has been tackling persistent high inflation for the past two years, which has outpaced the rate of wage growth consistently.

A comparison of inflation and wage percentages clearly indicate that the real income of low- and middle-income segments of the population is on the decline. This in turn is curbing this segments’ purchasing power, reducing their quality of life, and giving rise to inequality.

Latest data from the Bangladesh Bureau of Statistics (BBS) show that inflation was higher than wage growth in the country throughout last year, and the situation remained unchanged until September 2024.

This indicator however changed slightly for the better in September, a month after the new government assumed power following the fall of Hasina regime.

Inflation has come down by more than one percentage point in September compared to July this year. On the other hand, the wage growth rate has crossed the 7 per cent mark to 8 per cent in the last month.

But real wage growth continues to remain in the negative, indicating that wage growth is still less than inflation. The Bangladesh Bank has taken notice of this issue.

In its latest report titled “Bangladesh Bank Quarterly,” the regulator mentioned, “Despite this upward trend in wage growth, it continues to lag behind the inflation rate, resulting in negative real wage growth that disproportionately impacts poor, low-, and middle-income households.”

Speaking to The Business Post, Centre for Policy Dialogue (CPD) Distinguished Fellow Prof Mustafizur Rahman said, “We have noticed that the wage component of our GDP is gradually decreasing. GDP can be divided into wage and non-wage components. There the wage component is decreasing.

“This situation can also be seen in other indicators – such as income inequality.”

Household Income and Expenditure Survey (HIES) 2022 by the BBS show that the income Gini coefficient (inequality measurement indicator) stood at 0.499 in 2022, compared to 0.482 in 2016 and 0.458 in 2010.

According to the BBS, this figure indicates that the concentration of income in higher income groups is gradually increasing.

Mustafizur said, “During the last two years, the real wage situation has worsened. If we look at the minimum wage, there is a basic increase of 5 per cent. But food inflation is increasing by double digits, that means purchasing power has decreased.

“If labour income were to increase by 10 per cent or 15 per cent, then real wages would increase even with 10 per cent inflation.”

Food inflation has been surging above 10 per cent since April this year. It jumped to 14.10 per cent in July, which was the highest ever in recent decades. It dropped down to 11 per cent in August and further declined to 10.40 per cent in September.

It should be noted that in Bangladesh’s context, the inflation calculation basket has more food items than non-food ones.

Mustafizur Rahman added, “In the case of formal sectors such as garments, wages may have increased by 5 per cent every year. But the informal sector is bigger in our economy. In that case, the wages of many may not have increased at all.”

What can be done?

Discussing the issue, Mustafizur said, “In many countries, the Cost-of-Living Adjustment (COLA) is applied in these cases. So that nominal wages can be adjusted with inflation. There is no such system in our country.

“Many countries have housing and food rationing for workers. When these can be done, real living standards do not fall much, even if nominal wages do not rise as much. We have to do this in our country too.”

The eminent economist continued, “It is a very good decision that the government is talking about distributing food through Trading Corporation of Bangladesh (TCB) in labour intensive areas. Besides, we have to think about how we can prevent the decline in purchasing power and quality of workers’ lives.

“We discussed this issue in the White Paper Committee. We have many issues, if it does not make it into the white paper, we will get it somewhere else.”

The Yunus-led government formed a white paper committee to study the economic situation after assuming office. The committee will report to the government within the next three months.

Central bank initiatives

The Bangladesh Bank quarterly report mentions that it continued to adopt a restrictive monetary policy, raising the policy (repo) rate gradually to curb inflation. However, the rate of inflation remained above comfortable levels.

Moreover, the disruption of supply chains resulting from the nationwide uprising led by the students’ anti-discrimination movement and the recent flooding in Bangladesh could potentially impact inflation in the upcoming months.

To this end, the current interim government has taken various measures to reduce the price of daily commodities such as onions, potatoes, and some pesticides, by decreasing the duty rate, and solving some import complications.

The government has directed all relevant ministries, offices, and departments to evaluate the existing stocks and shortages, review the future demand, and take necessary steps to resolve various problems of the transportation system, including ports and major destinations.

Additionally, one crore low-income families are being provided with low-cost products monthly, such as 5kg of rice, two litres of soybean oil, and 2kg of lentils per family through TCB. This facility will continue in the coming days.

Relevant agencies are also actively addressing issues such as hoarding, syndication, and other illegal activities in a bid to eliminate supply bottlenecks.

The Bangladesh Bank is likely to maintain its contractionary monetary policy stance until obvious signs of easing inflation are evident. These measures are intended to reduce inflation expectations and facilitate a positive impact on inflation by December 2024.