Published in The Financial Express on Friday, 12 September 2014.

RMG and manpower export: Risk of depending on two markets

Naimul Gani Saif

Without any doubt, the two major forces that are driving the economy of Bangladesh forward for the last couple of decades are export earnings and inward flow of remittance. However, remittance inflow has not shown much promising sign for the near future as during the last fiscal year, it recorded a negative growth (-1.6 per cent) for the first time since fiscal year 2001-02. In addition, according to the Bureau of Manpower, Employment and Training (BMET) data, in 2013 only 4,09,253 persons were employed overseas which is almost 33 per cent lower than the number of 2012. This sharp decrease in overseas employment is supposed to be reflected in the remittance earning in upcoming years. Even the overseas employment during the first seven months of 2014 does not make us optimistic about the situation as only 2,39,808 workers migrated during this period. At this rate, total number of migrants might be slightly above 4,00,000 at the end of 2014. So it is safe to infer that wage earners’ remittance is not going to increase sharply in coming days.

Now, why has the ever-growing remittance inflow started to reduce suddenly? We will get the answer if we analyse the country composition of our overseas employment over the last few years. In 2008, 8,75,055 persons, highest ever in a single year, went abroad for employment out of which more than 63 per cent went to the United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA). In 2007, more than 51 per cent of total migrants went to these two countries. We need to keep in mind that 2007 and 2008 were the only two years when the number of migrant workers crossed the benchmark of 8,00,000. Unfortunately this trend was not observed during these two years only. Rather it has been the historical trend of our labour force migration.

Since the very beginning, the UAE and the KSA have been the most desired destinations of our foreign workers. Available BMET data shows that in 1976, 36 per cent of total migrant workers went to the UAE and the KSA. In 1980, the ratio was 46 per cent, in 1990 it was 45 per cent and in 2000, it reached an unbelievable height of 80 per cent. And till 2012, on average more than 50 per cent of our yearly migrant workers were going to these two countries alone. These figures are enough to show how ridiculously the flow of Bangladeshi migrant workers was concentrated in these two markets.

Bangladesh first suffered the consequences of this tremendously high market concentration in 2008 when suddenly the KSA imposed restriction on issuing Iqama (residence/work permit) transfer facility to Bangladeshi nationals. The action was based on the claims that they were involved in various criminal activities, illegal business and they were overstaying their visa period. Furthermore, though there was no official declaration, the KSA reduced recruiting Bangladeshi workers drastically in 2009. Since there was no official statement from the Saudi government, it is not possible to identify the main reason behind this radical fall in recruitment. From 2008 to 2009 within one year, the number of workers going to the KSA fell from 1,32,124 to 14,666, accounting for a negative growth of 89 per cent. This fall, however, was not reflected in the remittance inflow, as, according to the sector insiders, a lot of workers had to come back from the KSA since the Iqama transfer facility was withdrawn and the returning workers might have brought all their savings with them which may have kept the remittance earnings from falling.

In the meantime, Oman gradually emerged as a new destination for our migrant workers. As in 2011, 1,70,328 workers went there which was 217 per cent higher than previous year. The next major blow hit our remittance inflow when the UAE suspended issuance of visa for Bangladeshi workers in August, 2012. In the next year, manpower export to the UAE fell by 93 per cent from 2,15,452 to only 14,241. This huge fall was ultimately reflected in the remittance inflow as it dropped by 1.6 per cent in FY 2014 for the first time since FY 2002. It seems Bangladesh will have to pay the price dearly for making its manpower export heavily concentrated on two countries only until and unless new markets for our manpower export are identified or the traditional markets are revived through diplomatic negotiations.

EXPORT BASKET: Let’s have a look at the country and the product composition of our export basket. Traditionally, our export has been highly concentrated on a few goods. Till the late nineties, major portion of our export earnings came from jute and jute goods which was above 50 per cent on average. Since then, our export earnings started to be more dependent on garments industry and in the last fiscal (FY 2014), almost 80 per cent of our total export earnings came from readymade garments (RMG). Definitely it is a good sign that Bangladesh has developed so much expertise in this sector that several setbacks in recent time could not affect the growth of RMG export. But still it is never good for a country to be dependent on a single industry so intensely.

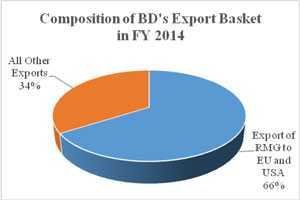

Another alarming feature of our export basket is that it is even more concentrated on a few markets. Since all the 28 countries of the European Union (EU) follow the same rules and regulations, we can consider them as a single market for our export and in FY 2014, Bangladesh earned around US$ 22 billion or 81 per cent of its total export revenue from the EU and the USA markets. And RMG constitutes almost 91 per cent of Bangladesh’s total export to the EU and the USA. The extent of market and product concentration of Bangladesh’s export basket becomes clear with the fact that around 66 per cent of our total export earnings is generated by exporting RMG products to the EU and the USA in FY 2014.

Bangladesh has been exporting RMG to the USA without any concessionary benefits. In the EU, Bangladesh enjoys generalised system of preferences (GSP), namely the Everything But Arms (EBA) arrangement, under which facility Bangladesh gets duty-free quota-free access for all products except arms and ammunitions for being one of the 48 LDCs in the world. Since Bangladesh has been exporting garment items to the USA based on its competitive strength, the suspension of GSP by the USA in June 2013 did not have any visible negative impact on our export. The step taken by the USA was also a symbolic response since our major export items (i.e. RMG) were not covered by the scheme in view of the two deadly incidents that took place in our RMG industry: Rana Plaza collapse and Tazreen Fire incident.

RMG and manpower export: Risk of depending on two markets

However, it is the EU GSP that actually matters for Bangladesh since Bangladesh gets duty-free access for RMG whereas its competitors like China, Vietnam, Cambodia and others do not. Though the GSP facility is still in place for Bangladesh in the EU market, they expressed their concerns in a strong voice regarding the working environment in the garments industry of Bangladesh. It is not guaranteed that another major accident in our RMG sector will not result into suspension of the GSP facility in the EU market too. The EU also wants Bangladesh to improve the safety of the RMG industry significantly as soon as possible and failing to do so may result in GSP suspension too.

In addition, the EU has reformed its GSP policy that has come into effect from January 01, 2014. Under this reformed policy, that is under the GSP Plus facility, developing countries may be granted duty and quota-free market access if they are identified as vulnerable nations. Till now, there are 13 beneficiaries of the GSP Plus scheme most of which do not pose any substantial threat for Bangladesh. However, inclusion of Pakistan in the GSP Plus scheme is an alarming news for us since Pakistan possesses a bit of expertise in the RMG sector as is proven by the fact that it exported US$ 4 billion RMG in 2013, according to the Trade Map data.

Furthermore, Pakistan has a sustainable backward linkage industry for RMG as it is one of the biggest cotton-producing countries of the world. Bangladesh will definitely suffer from Preference Erosion in the EU market as Pakistan will have more market share.

LIFE LINE OF OUR ECONOMY: So, it is obvious that just like our remittance sector, our export sector is heavily dependent on two markets only. And it is not confirmed that our export sector will not face hurdles in the EU and the USA just as our manpower export did in the UAE and the KSA. If the EU cancels GSP facility of Bangladesh or if it grants GSP Plus facility to new developing countries which are competitors of Bangladesh in global RMG trading then, our export earnings will face a huge blow right where it hurts because almost half of our total export earnings comes from RMG export to the EU. We have already observed the consequences of over concentration on a few markets in our remittance inflow and we should not take the same risk with our export sector ever.

The economic growth of our country is largely dependent on export earnings and all the stakeholders of this sector should work together to ensure sustainability of this life line of our economy.

There is no alternative of exploring new markets and promoting non-traditional potential export items. The government has already taken several steps to diversify our export but those steps have not resulted in any significant reduction of market and product concentration. Export diversification requires much more attention than it is getting now. Otherwise, time may come when export earnings will experience negative growth too.

The writer is Research Associate, Centre for Policy Dialogue (CPD). naimul.saif@gmail.com