Published in Dhaka Tribune on Sunday, 5 November 2017

Can Bangladesh tap into China’s declining share in RMG export?

Ibrahim Hossain Ovi

Although China’s relative share in global Readymade Garment (RMG) exports is dropping, Bangladesh must cross a number of hurdles before it can bring those orders here

As China’s relative share of global Readymade Garment (RMG) exports start to drop thanks to rising standards of living there, a number of nations are queuing up to grab the opportunity.

As the second largest RMG exporter in the world, Bangladesh is naturally a front runner in this race. However, the country faces stiff competition from South Asian and South East Asian neighbours.

Add to that, Bangladesh is yet to systematically address its weaknesses in creating a congenial business and investment atmosphere.

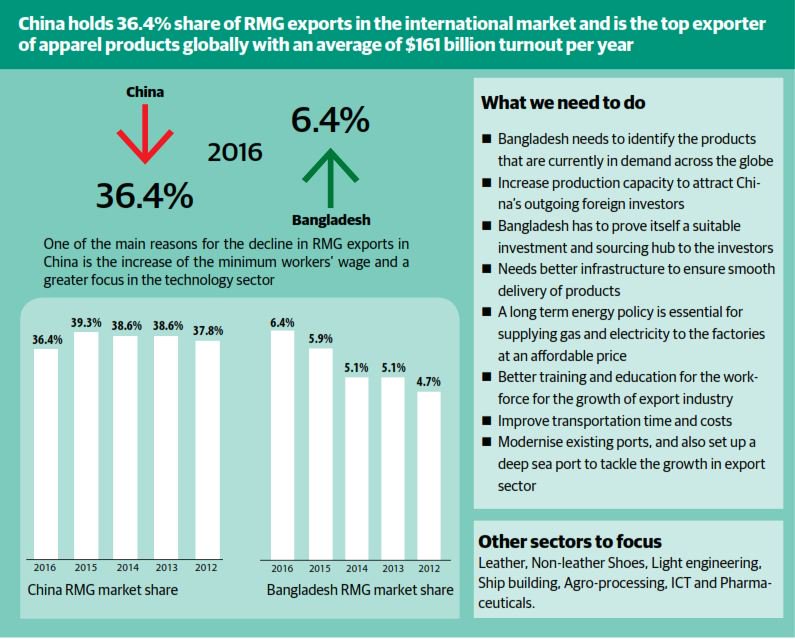

According to the World Trade Statistical Review 2017 of the World Trade Organisation (WTO), Bangladesh’s share in global RMG market went up from 5.9% in 2015, to 6.4% in 2016.

On the other hand, China’s market has dipped from 39.3% to 36.4% in 2015.

According to a World Bank study titled Stitches to Riches? : Apparel Employment, Trade, and Economic Development in South Asia, a 1% apparel price increase in China would create 1.36% additional demand for Bangladeshi products on its largest export market, the USA.

Meanwhile, a 1% rise in expected wages over there would raise the probability of women entering the labour force by 30.6% in Bangladesh. The report also said 10% price increase in China on the US market would also create 4.22% more employment in Bangladesh.

However, according to the Ease of Doing Business rankings published by World Bank, Bangladesh slipped one place to 177th after being ranked 176th last year.

To capture a stake in China’s RMG market, Bangladesh needs to identify products that are currently in demand across the globe, and also the buyers for these products, said industry insiders.

“There is a possibility that Bangladesh will receive more low-end work orders, due to a rise in workers’ wages across the globe. However, countries such as Vietnam, Cambodia, Myanmar, India and Pakistan also have the same advantage,” said Centre for Policy Dialogue (CPD) Research Director Khondaker Golam Moazzem.

“Bangladesh lacks a business friendly environment, which is essential to attract buyers, as well as foreign investors. We are also weak in creating a network with potential buyers.”

The inefficiency of the Chittagong port, which contributes to lengthy transportation time, is also a major drawback.

We should have a strategy to establish relations with investors who are leaving China, he said.

“Bangladesh is ready with a pool of safe and compliant factories certified by the global buyers. What this sector really needs is better infrastructure to ensure smooth delivery of products,” said BGMEA senior vice president Faruque Hassan.

He added that a long term energy policy is essential for supplying gas and electricity to the factories at an affordable price.

“Bangladesh’s competitive advantage is its young workforce and comparatively low wages. However, production costs have gone up recently due to compliance issues,” Hassan told the Dhaka Tribune.

The BGMEA official said better policy support, along with better training and education for the workforce, are essential for the growth of export industry.

“Workers’ productivity and efficiency – key tools in reducing production cost, are also a big challenge for the RMG sector in Bangladesh,” said Exporters Association of Bangladesh (EAB) President Abdus Salam Murshedy.

“The majority of the factory owners have upgraded the production process by introducing the latest technology. But, due to the inefficiency at mid-level management, workers fail to reach targeted productivity,” added Salam, who is also the managing director of Envoy Textiles

An official of a Swedish multinational clothing-retail company, seeking anonymity, said “Despite having comparatively low wages, Bangladesh has a big disadvantage – longer lead times. Due to longer lead times, buyers choose China and other exporting countries to source products from.”

Meanwhile, workers’ rights groups and trade union leaders called for properly establishing workers’ rights to increase work orders.

“If, Bangladesh wants to be a hotspot for the RMG industry, factory owners will have to treat workers with dignity,’ said Nazma Akter, president of Sammilito Garment Sramik Federation.

Meanwhile, Bangladesh stands to benefit from the corrective measures taken up by the industry as a result of inspections carried out by Accord and Alliance following the Rana Plaza disaster.

“Completion of Accord and Alliance inspections will help Bangladesh boost exports in the future as a number of other countries do not have certification from buyers,” said Moazzem.

Moazzem pointed out that Bangladesh government must take measures to modernise existing ports, and also set up a deep sea port to improve growth in the export sector and overcome timing problems.

Opportunities beyond RMG, beyond China

Along with the apparel sector, Bangladesh has the opportunity to expand several other export sectors such as leather, non-leather shoes, light engineering, ship building, agro-processing, ICT and pharmaceuticals.

“Bangladesh has a unique opportunity and the workforce required to dominate the global market, when China gradually winds down manufacture of low-cost products. We can sell these types of products to global suppliers, as China’s labour costs are on the rise,” Engineer M Abu Taher, chairman of Fortuna Group told the Dhaka Tribune.

“Workers’ wage in Bangladesh is low compared to China, but so is the productivity of workers. We must focus on boosting productivity of our workers, before trying to take China’s stake in the global market,” Taher said.

Bangladesh can gain a distinct advantage in the international market not only from wage hikes in China, but also from Cambodia and Vietnam.

These two countries have decided to increase minimum wages, which will come into effect from January, 2018.

Cambodian government agreed to raise workers’ wages from $140 to $153 in the country’s textiles and footwear industry.

Meanwhile, Vietnam’s National Wage Council has announced that the regional minimum wage may rise by 6.5% in 2018. The current wage is at around $175 a month.

Bangladesh also stands to attract more foreign investment, as investors are hunting for a low-cost production hub in South Asia.

Foreign investors, especially from Japan, are planning to relocate businesses from China, as the cost of doing business there is rising.

According to the Japan External Trade Organisation (JETRO), the number of Japanese businesses in Bangladesh has more than tripled since 2008, and reached 253 as of May, 2017.

“Japanese investors will choose Bangladesh as an investment destination as labour costs are comparatively lower here, than in Japan and other East Asian countries,” ABM Mirza Azizul Islam, former adviser to a caretaker government told the Dhaka Tribune.

He urged the government to offer an attractive package for the foreign investors at special economic zones for boosting foreign investment at a faster rate.