Originally posted in The Daily Star on 18 September 2025

Women’s participation in banking declines

Sluggish economy and rural branch expansion cited as key factors

Women’s participation in the banking sector fell in the first half of this year compared with the last six months of 2024, amid unemployment among female graduates showing an uptick.

Top bankers said recruitment slowed during the current economic turbulence, with new hires favouring men. Some women also left troubled banks facing uncertainty or internal restructuring.

New branches have recently opened, mainly in semi-urban and rural areas. Family responsibilities and childcare may have discouraged women from taking these posts, since most of their families live in cities.

Meanwhile, the central bank says it has instructed banks to ensure that half of all agent banking staff are women. The Bangladesh Bank (BB) believes this will help increase women’s participation in the banking sector, especially in rural areas.

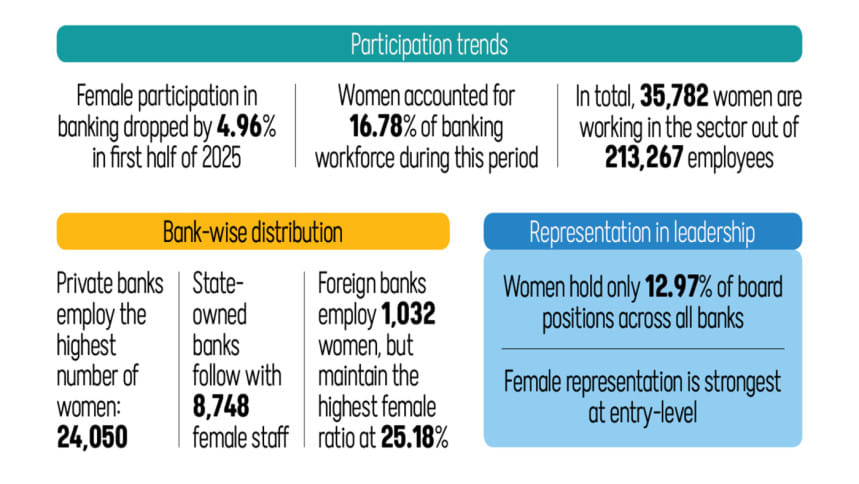

According to the central bank, female participation in banking dropped by 4.96 percent, or 1,867 individuals, in the first half of this year compared with the second half of last year.

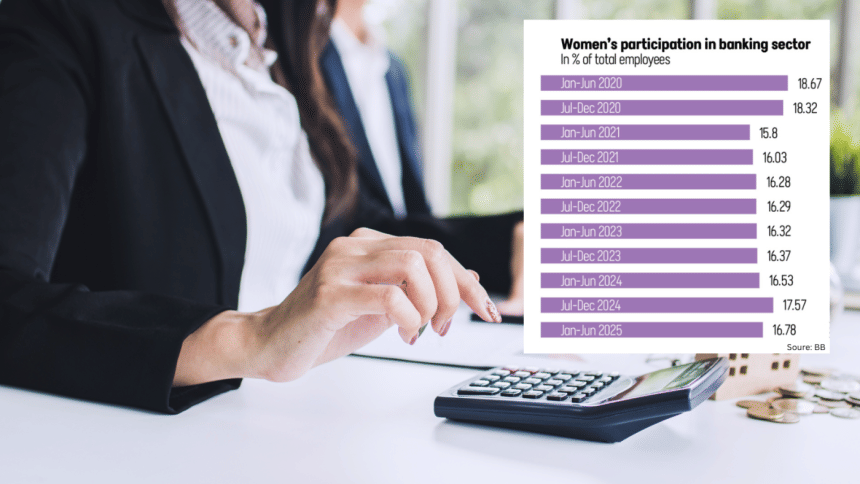

Women accounted for 16.53 percent of the sector workforce in the first half of 2024, rising to 17.57 percent in the second half. By mid-2025 this had slipped to 16.78 percent.

There were 35,782 women among the sector’s 213,267 staff at the end of June, according to the BB’s latest Gender Equality Report of Banks and Financial Institutions.

Mohammad Ali, managing director of Pubali Bank PLC, said the sector is expanding mainly in rural areas but most female officials prefer to stay in urban centres, especially Dhaka, for family and personal reasons.

“Many female employees have spouses who are also employed in Dhaka, making relocation difficult,” he said.

“While banks are opening new branches outside Dhaka, no new branches are being approved within the city. As a result, the demand for human resources is shifting to rural areas, but women are often reluctant to take up these roles. In fact, about 80 percent of the total female workforce in banking is now concentrated in Dhaka.”

“Unless our social values evolve to support women working outside major cities and unless women themselves feel empowered to seize those opportunities, female representation in the sector will remain stagnant,” said Ali.

Hasina Sheykh, professor of banking and insurance at Dhaka University, said traditional cultural expectations in Bangladesh still strongly influence women’s careers.

“When we think of a woman, we often immediately think: mother, sister, daughter or daughter-in-law. These roles carry expectations that directly affect women’s careers,” she said.

Drawing on her own experience, she said her mother worked in an educational institution but never aimed for a top position, believing that climbing too high professionally would come at the cost of her family.

“I have seen this mindset up close, where women’s professional lives are supported only if they do not disrupt family responsibilities such as cooking, childcare or household chores,” she added.

She said that in her own classrooms, she now sees a 50-50 gender ratio, or even more women. “But the question is, where do they go after graduating?”

Most begin careers in banking with enthusiasm, but many leave after marriage or childbirth, she said.

She added that when a qualified woman leaves the workforce, the loss is not just personal but societal.

“If this trend continues, and more women join the workforce without adequate family support, we will face a societal shift that requires full-time daycare models like those in the West. But even that will not solve everything,” she commented.

Mahia Juned, additional managing director of City Bank PLC, said the recent fall in female participation appears to be driven mainly by trends in private commercial banks.

The share of women in the workforce of private commercial banks dropped from 17.9 percent to 16.62 percent in the first half of this year, a shift not seen in foreign, specialised or state-owned banks, she said.

“Recruitment across the banking sector remains low due to the ongoing economic situation. Where hiring does take place, we are seeing a higher proportion of male recruits. Also, in some troubled banks, employees may have left due to uncertainty or internal restructuring,” she added.

M Rezaur Rahman, head of human resources division at Dhaka Bank, said that the female employee ratio at their bank is not declining but is gradually increasing.

He acknowledged that women in Bangladesh still face significant challenges in entering and sustaining banking careers.

According to him, Dhaka-based recruitment processes, social expectations, and safety concerns often deter female applicants, especially for branch roles outside major cities.

He added that long hours, frequent transfers, and a lack of flexible work options make it difficult for women to balance work and family life.

Many also exit mid-career due to marriage, maternity, or relocation abroad, he said.

IN NUMBERS

Among the four types of commercial banks, 43 private banks employ the most women, at 24,050 or 16.62 percent of their total workforce.

Six state-owned banks employ 8,748 women, representing 16.68 percent of their staff. Three specialised banks employ 1,952 women, or 16.28 percent of their workforce.

Nine foreign commercial banks have the smallest number of female staff, at 1,032, but the highest proportion of women at 25.18 percent.

Out of 61 scheduled banks, private commercial banks account for 67.21 percent of all female staff, followed by state-owned banks at 24.45 percent. Overall, women make up 16.78 percent of all officers and employees, the BB report says.

According to the report, women hold just 12.97 percent of board seats across the sector. Foreign banks have the highest share of female board members at 17.24 percent, while state-owned banks have the lowest at 3.85 percent.

Female participation is highest at the entry level, but drops at mid-level and senior roles. Among scheduled banks, the proportion of female officers under 30 years old is nearly double that of those over 50 years old. Turnover among female staff is highest in foreign banks, according to BB.

BB’S 50% FEMALE QUOTA IN AGENT BANKING

Arief Hossain Khan, executive director and spokesperson of the central bank, said it has instructed banks to ensure that half the workforce in agent banking is female.

“This policy could be a powerful lever to increase women’s participation, especially in rural areas,” he said, adding that hiring in banking remains sluggish due to lingering effects of the Covid-19 pandemic.

“We believe that once recruitment returns to normal levels and banks prioritise gender equity in their hiring, this target can be more meaningfully achieved,” he said. “We are engaging with private banks and closely monitoring implementation procedures to ensure these instructions are followed.”

“We recognise that real progress will require not just rules, but also structural changes in hiring practices, outreach to under-represented communities, and support for women who face barriers in moving outside urban areas,” added Khan.

Fahmida Khatun, executive director at local think tank Centre for Policy Dialogue (CPD), said the declining trend in female representation in banking is not encouraging.

According to the economist, women’s participation depends on various factors, including the workplace environment. Many choose banking because it is more organised and structured than other industries.

Fahmida urged banks to be more proactive in creating clear pathways for qualified women to move into senior leadership and boardroom positions.