Published in The Daily Star on Wednesday 29 January 2020

Private sector’s appetite for credit craters

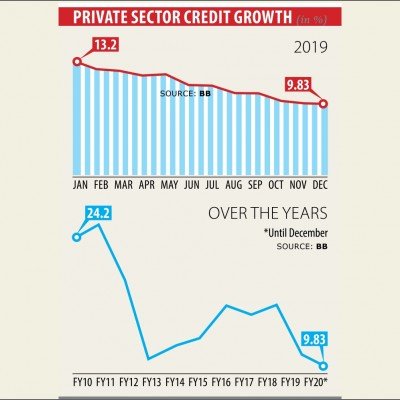

Private sector credit growth dropped to the lowest since 2008 in December last year, in continuation of its downward trend of the previous 21 months.

Private sector credit growth dropped to the lowest since 2008 in December last year, in continuation of its downward trend of the previous 21 months.

In December last year, the year-on-year credit growth stood at 9.83 percent, down from 9.87 percent from one month earlier, according to Bangladesh Bank data, which goes as far back as 2008.

“Private sector credit growth will decline significantly within the next three to four months if the government continues to borrow from banks heavily,” said Ahsan H Mansur, executive director of the Policy Research Institute.

As of January 15, the government borrowed Tk 50,842 crore from the banking sector, exceeding its annual limit of Tk 47,364 crore for fiscal 2019-20.

The large revenue shortfall has compelled the government to borrow so heavily from banks, Mansur said.

As per the National Board of Revenue’s provisional data, it logged in Tk 105,161 crore in collections for the first half of the fiscal year, up 7.3 per cent year-on-year. The sum missed the periodic target by Tk 31,507 crore.

The central has recently been forced to revise its key monetary and credit programmes, setting a fresh government sector credit growth of 37.7 per cent for fiscal 2019-20. In July last year, it had set the target of 24.3 per cent.

Besides, the government’s recent decision to fix 6 per cent interest rate for deposits and 9 per cent for lending will create an extra pressure on private sector credit growth, said Mansur, also the chairman of Brac Bank.

Some banks have already started slashing the interest rate on deposit as per the government decision, which have forced depositors to withdraw their money.

“This will erode the banks’ liquidity base further and shrink their capacity to disburse loans,” he said.

Banks will also take a cautious stance in disbursing loans to private sector given the 9 per cent interest rate for lending as they will think the rate will not fetch them good profits, said Fahmida Khatun, executive director of the Centre for Policy Dialogue.

Businesspeople will not show interest in expanding their business as the country’s business climate is far from ideal and that has hit the credit growth.

“Although Bangladesh advanced 8 notches in the World Bank’s ease of doing business ranking to 168 out of 190 countries, this is not enough to give a boost to businesses.”

Inadequate infrastructure, corruption and bureaucratic complexities discourage businesses from going for expansion by taking bank loans.

“The country has been enjoying political stability for months. But businesses are still dealing with unpredictability.”

Against the backdrop, a portion of people are laundering money abroad for want of business-friendly environment, Khatun added.

All economic indicators except remittance are showing a frustrating performance, said AB Mirza Azizul Islam, a former adviser to a caretaker government.

The import of capital machineries and industrial raw materials are declining for months, in an indication of a sluggishness in the private sector.

“The businesses are not even using their existing capacity to run their enterprises.”

Rising defaulted loans is another reason behind the declining private sector credit growth, Islam said.

In the first nine month of 2019, defaulted loans increased 23.82 per cent to Tk 116,288 crore.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, echoed the same.

The global economy has been facing some sort of crisis for the last few months, which has hit the domestic economy adversely, he said.

This has decreased the export of the garment sector, which also put an adverse impact on private sector credit growth, said Rahman, the immediate past chairman of Association of Bankers, Bangladesh, a forum of banks’ managing directors.

“The heavy government borrowing from banks and the 9-6 per cent bounds will give a signal to banks to disburse loans carefully,” he added.