Published in The Daily Star on Wednesday 12 February 2020

Revenue shortfall can’t stop stretching

Revenue shortfall against the target, which is a common occurrence nowadays, is getting wider as the fiscal year nears its end, much to the concern for the government that has already ramped up its borrowing from the banking sector.

Revenue shortfall against the target, which is a common occurrence nowadays, is getting wider as the fiscal year nears its end, much to the concern for the government that has already ramped up its borrowing from the banking sector.

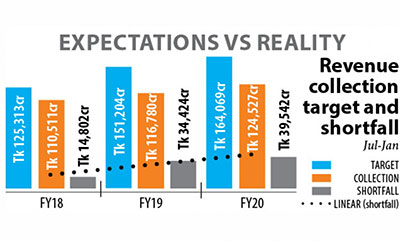

Provisional data showed the National Board of Revenue (NBR) could log in Tk 124,500 crore in the first seven months of the fiscal year, missing the target by Tk 39,500 crore for the period.

This suggests the government will have to either increase its borrowing from the banking sector or cut back on its expenditure plans for the fiscal year.

In the first half of fiscal 2019-20, the government borrowed Tk 49,000 crore, which is 63 per cent of the year’s target. Of the sum, Tk 43,600 crore from banks, which is eight times more than a year earlier.

The NBR, the main collector, fell short of Tk 31,500 crore from its revenue goal in the first half of fiscal 2019-20.

And the target is likely to be missed by more than Tk 80,000 crore, according to Ahsan H Mansur, executive director of Policy Research Institute (PRI) of Bangladesh.

The amount of shortfall remained low in past years, but the gap from target increased to more than Tk 50,000 crore last fiscal year.

“The current pace of revenue generation is hurting budget implementation this fiscal year,” said Towfiqul Islam Khan, senior research fellow of Centre for Policy Dialogue (CPD). Bangladesh’s fiscal discipline is now at risk.

“There is a need to make an honest assessment regarding the reasons behind this small growth. Surely, there is a scope for improving administrative capacity,” Khan added.

During the July-January period of the fiscal year, the NBR recorded 7 per cent year-on-year growth, according to its provisional data.

The indirect tax, value-added tax (VAT) paid by consumers, is the biggest source of revenue and the NBR collected 5 per cent higher VAT during the period than a year earlier: Tk 48,400 crore.

“Receipts from VAT might increase in the final count,” said a senior official of the NBR asking not to be named as he is not authorised to speak with the media.

Implementation of the new VAT and SD Act definitely did not translate into higher revenue mobilisation, Khan said.

“Awarding tax exemption on an ad hoc basis in the name of growth stimulation is now hurting. At the same time, we need to take a closer look at the performance of the overall economy,” he added.

Other than VAT, the collection of income tax, the second biggest revenue source, increased 15 per cent year-on-year to Tk 38,960 crore in the seven months to January.

Customs officials could post only 1 per cent higher collection of Tk 37,000 crore thanks to declining machinery, petroleum and motorcycle imports.

“There is definitely more challenging times ahead in terms of revenue mobilisation,” Khan said.

Uncertainty in the global economy in view of coronavirus does not indicate any quick recovery.

“The government will need to be proactive. There is a need for early revision of the national budget,” Khan added.

Revenue collection growth will continue to remain sluggish if the NBR goes business-as-usual, said Mansur, also a former economist at the International Monetary Fund.

“It will not be possible to improve from the current situation without a significant reform in the NBR’s system.”

He blamed corruption and under- and over-invoicing of imported goods as some of the major reasons behind the sluggish revenue flow.

Besides, the revenue collection target set by the government is unrealistic.

The government has set a target of Tk 325,600 crore for the NBR this year, up 45 per cent from fiscal 2018-19’s actual collections.

“Even after that, revenue collection could grow 25-30 per cent year-on-year if the government truly brings in reforms in the NBR. In that case, the tax-to-GDP ratio would have increased,” he added.

Bangladesh’s tax-to-GDP ratio, which is about 10 per cent, is amongst the lowest in the world.