The 51st national budget of Bangladesh has been presented at a time when the economy is facing considerable challenges and the macroeconomic stability has been significantly weakened amid negative developments both on domestic and external fronts. The budget for FY2022–23 needed to be innovative in terms of approach, flexible in terms of allocative priorities, and target-specific in terms of budgetary measures in order to better address current challenges. The budget does have some welcoming measures such as better identification of contexts and challenges, expression of accountability by delineating the progress of past promises, continuation of fiscal measures to protect domestic industries, harmonisation of tax structure in case of export-oriented industries, and relatively less election-focused. However, it falls short in addressing inflationary issues, assuring citizens regarding keeping the administered prices at the same level, and expanding social safety net allocations in view of rising demand. Moreover, this proposed budget is worse in terms of welcoming illicit/illegal income and capital flight and providing more support to higher income group while keeping the low and middle income groups at bay.

These observations were emerged at the Budget Dialogue 2022 organised by the Centre for Policy Dialogue (CPD) under its flagship programme “Independent Review of Bangladesh’s Development (IRBD)”. The dialogue was held on Friday, 16 June 2022. Dr Fahmida Khatun, Executive Director of CPD, chaired the session. Dr Khondaker Golam Moazzem, Research Director of CPD, delivered the keynote presentation.

On behalf of the IRBD team, Dr Moazzem showed in his presentation that the gross domestic product (GDP) growth target has been set at 7.5 per cent for FY2022–23, which is almost the same as the previous year’s target (7.7 per cent). The government’s growth projection is higher than the forecasts by World Bank, International Monetary Fund (IMF), and Asian Development Bank (ADB), which is deemed contradictory to the current global growth rate. Besides, the growth of credit to private sector has been set at 15 per cent in FY2022–23. However, Inflation is assumed to be stable at 5.6 per cent in FY2022–23, but it has not been clear how that target would be achieved given the high commodity prices and global inflationary pressure which may lead to mounting ‘stagflation’. Also, Bangladesh’s external sector is undergoing a challenging time. Growth target for export earnings has been set at 20 per cent in FY2022–23 which seems a realistic target. Nevertheless, growth target for import payments has been set at 12 per cent in FY2022–23 which does not seem feasible. In addition, exchange rate is expected to appreciate and reach BDT 86.2/USD on an average in FY2022–23 which does not reflect the realities on the ground.

Dr Moazzem further presented that public debt as share of GDP is still at a reasonable state for Bangladesh which is a positive sign, but it may increase to some extent in FY2022–23 driven by higher domestic and external borrowing in view of the ongoing COVID-19 pandemic. In terms of broad fiscal framework, budget deficit has been projected at 5.5 per cent of GDP in the national budget, although it is questionable how that plan would be implemented. It is a matter of concern that development expenditure (17 per cent) is programmed to grow faster than operating expenditure (12.2 per cent). For subsidy, there is no doubt that the administered prices are set to rise in FY2022–23. CPD feels that utilisation of foreign aid will hinge on ability to implement the planned Annual Development Programme (ADP) projects since 96 per cent of foreign loans are tied with ADP.

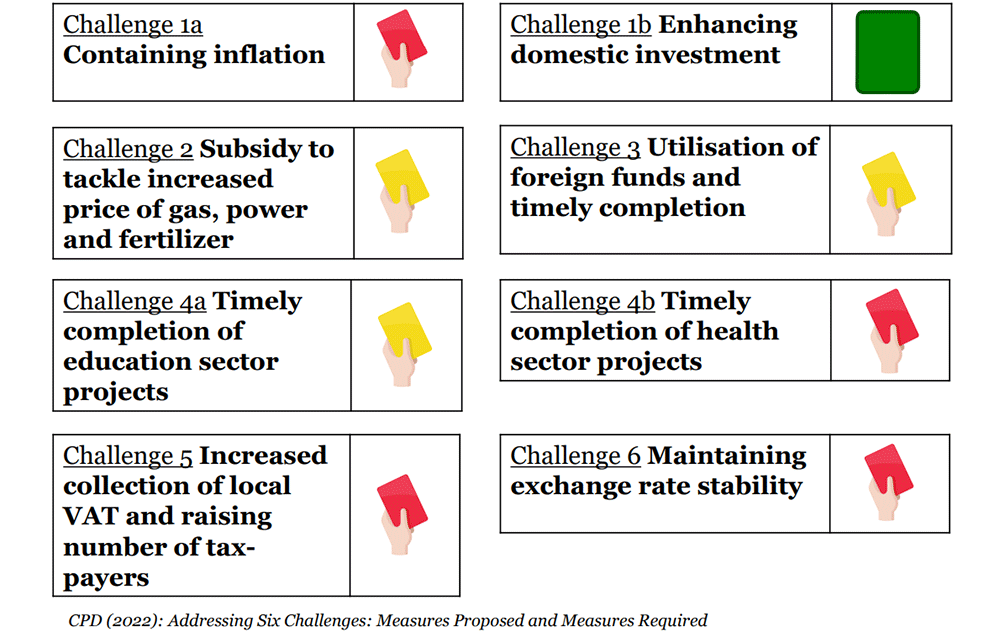

Dr Moazzem presented that six challenges have been rightly acknowledged in the proposed budget. These are: (i) containing inflation and enhancing domestic investment, (ii) financing additional subsidy for the increased price of gas, power and fertiliser in international markets, (iii) utilising funds available through foreign assistance and ensuring timely completion of high priority projects, (iv) ensuring timely completion of projects in education and health sectors, (v) increasing collection of local value added tax (VAT) and raising the number of individual tax-payers, and (vi) maintaining stability in the exchange rate of taka and keeping foreign exchange reserves at a comfortable level.

Based on the analyses of the proposed measures involving the above-mentioned challenges, CPD strongly urged that the budget need to address the following issues in a better and careful manner: containing inflation; increasing the collection of local VAT and raising number of tax-payers; completing health sector projects on time; and maintaining exchange rate stability.

As for containing inflation, the budget did not offer any significant respite through fiscal measures from the inflationary pressure originating from high import prices and recent significant depreciation of Bangladeshi taka, particularly as far as the low-income people were concerned. As regards changes in case of personal income tax (PIT) particularly in view of the skyrocketing prices of essentials, CPD already proposed to either increase this threshold to BDT 350,000 in order to provide some respite to the general citizens, or to raise the range of the next tier (at 5 per cent tax) from BDT 1 lac to Tk. 3 lac. CPD also proposed to reinstate the highest PIT rate, applicable for top earners, from 25 per cent to 30 per cent in FY2022–23 (was reduced in FY2020–21); raising this rate would be an additional source of revenue for government to mobilise additional resources for thrust sectors. As CPD proposed earlier, existing high duties on daily necessary items should be lowered immediately.

In terms of healthcare projects, the budget falls short in addressing this key concern, primarily owing to lack of data transparency and budget allocation. Budget allocation on health in FY2022–23 is only BDT 2,158 per person per year. Besides, the budget documents of FY2022–23 have failed to publish data on how much funds were disbursed through the fiscal support measures launched in response to the COVID-19 pandemic. Detailed financing information as regards administering vaccines should also be published to ensure transparency and accountability.

As for the issue of exchange rate stability, CPD strongly urges for removal of the provision regarding Special Tax Treatment in respect of undisclosed offshore assets. According to the proposed provision, no authority, including the income tax authority, shall raise any question as to the source of any asset located abroad if a taxpayer pays tax on such asset. Such an initiative is ethically unacceptable, will discourage honest taxpayers, and unlikely to generate the intended revenue. In the face of falling forex reserves, CPD recommends that the government should resort to alternative sources maintain the reserve stability.

Dr Fahmida Khatun chaired the dialogue. She echoed that the budget lacks guidance and initiatives to address the challenges. She said that the fiscal measures that have been taken to protect the low-income people and the middle-class are inadequate. She mentioned that cutting off allocation for Open Market Sales (OMS) is a harmful step. There was an opportunity to lessen the burden of higher prices through the cut in duties of imported items and lowering of taxes domestically, but that did not reflect in the budget. She opined that the government should have raised the tax-free income limited from the current level. She also called for a cut in luxury and unnecessary expenditures and emphasised quick implementation of the projects which will create avenues for employment.

Mr M A Mannan, MP, Hon’ble Minister for Planning, Government of Bangladesh, virtually joined the dialogue as the Chief Guest. In his speech, Mr Mannan thanked CPD for arranging this dialogue. He further stated that the government has prepared the budget covering all issues aiming for the country’s development. “The government is committed towards taking cognisance of the people who have been left out and towards working for an inclusive development. The government is trying the best to this end.” Under the social safety net programme, he said, the government is providing all sorts of support to the poor and low-income people so that they can lead a standard life. The government is providing standard houses to the homeless people. He, too, agreed that initiatives regarding rations for the poor need to be taken into consideration. He said, “We have a problem with subsidy allocation in this budget. But we are trying to make it more people-friendly.” He added, “We work with big baskets. We do not have the opportunity to work in a small range like various research institutes.”

Mr Kazi Nabil Ahmed, MP, Member, Parliamentary Standing Committee on Ministry of Finance, was present as one of the Special Guests. He acknowledged that keeping forex reserves and import market stable will be a great challenge for Bangladesh in the coming year. He said, COVID-19 and the current inflation along with the Russia-Ukraine war have caused us some problems. As a result, prices are rising in the international market. “However, I believe that under the leadership of Prime Minister Sheikh Hasina, we will overcome this problem quickly,” he reaffirmed. He also expressed hope that the Padma Bridge project will create a major impact on the positive growth in case of employment generation and investment opportunities. He also promised to raise many of the concerns at the parliament that were discussed in the dialogue.

Barrister Anisul Islam Mahmud, MP, Chairman, Parliamentary Standing Committee on Ministry of Expatriates Welfare and Overseas Employment was also present as a Special Guest. He said that food prices and declining forex reserves are the biggest challenges currently. He emphasised that all stakeholders need to be consulted during the budgeting process, including public representatives. He felt that this budget lacks any initiatives related to employment generation.

Mr Amir Khosru Mahmud Chowdhury, Former Minister for Commerce was present as a Special Guest at the event. He opined that the budget was presented with questionable data. He said, World Bank report also says that Bangladesh lags behind in statistical capacity. He commented that the portrayal of development by the government is a false idea. He said that there is a lack of transparency in the budget that has been prepared.

Socialist Workers Front President Mr Razekuzzaman Ratan was present at the dialogue as a discussant. He said that the government should have discussed with the workers in labour force before formulating the budget, since the labour force contains more than 6.82 crore workers and these workers are important stakeholders.

Ms Shusmita Anis, Vice-President, Bangladesh Employers’ Federation (BEF), said that the inflation along with the skyrocketing price of daily essentials has added to the sufferings already induced by the pandemic and the Russia-Ukraine war. She opined that VAT for retailers should be reduced to the wholesaler level. “We must raise our tax-free income threshold to at least Tk 5 lac,” she said.

Mr Rizwan Rahman, President, Dhaka Chamber of Commerce & Industry (DCCI), said that private sector credit flow will be the biggest challenge this year. Considering the challenges facing small and medium enterprises, he considers that the integrated tax administration system should be prioritised. Without tax automation, tax revenue will not increase.

The event was followed by an intriguing open-floor discussion. High-level policymakers, diplomats, foreign delegates, researchers, development practitioners, academicians, business leaders, civil society representatives, development partners, and journalists participated in the dialogue.