Published in The Daily Star on Wednesday, 7 May 2014.

Amnesty for black money: a no-go

Rejaul Karim Byron and Faaria Tasin

The government is once again looking inclined towards giving amnesty to black money in the upcoming fiscal year, a concession which did not yield desired results in the past.

At a pre-budget meeting with the Economic Reporters Forum last week, Ghulam Hussain, chairman of the National Board of Revenue, spoke favourably of the provision to legalise undisclosed or black money, as it might arrest the rampant capital flight from the country to Malaysia, Dubai and Canada.

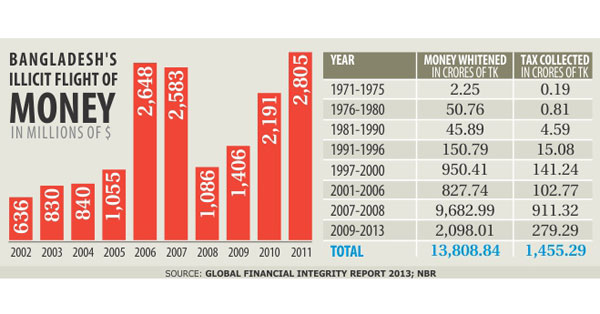

Between 2002 and 2011, $16 billion of illicit capital left the country, according to a December 2013 study by Global Financial Integrity, a US-based non-profit organisation focused on curtailing cross-border flow of illegal money.

“It appears that the amount of illicit financial outflow from Bangladesh is quite large, relative to the size of GDP,” said Zahid Hussain, lead economist of World Bank’s Dhaka office.

Barring a few exceptions, the scope to legalise black money was present, in one form or the other, in every year’s budget.

Between fiscal 1971-72 and fiscal 2012-13, some Tk 13,808 crore was whitened, with the NBR receiving taxes of Tk 1,455 crore during the period, which is just around 1 percent of this year’s collection target.

In other words, the idea of extending amnesty to black money sounds promising in theory but underwhelms to no end in practice.

“I oppose it from all perspectives, in terms of social justice, economic justification and political culture,” Debapriya Bhattacharya, distinguished fellow of the Centre for Policy Dialogue, said at a pre-budget meeting.

He said those who advocate for the provision to bring illegal wealth into the mainstream economy have no data to back them up.

“The reality is there is no evidence that big such liberal provisions brought big amount of investment.”

Rather, it creates a culture of tax evasion, which, in turn, is an unjust punishment to honest tax payers, Bhattacharya added.

“Bangladesh’s experience with black money whitening facility provides no confidence that it will help in stemming, let alone alle-viating, the illicit financial outflows,” Hussain said.

He went on to cite the average amount of black money legalised and the illicit outflows in the last four years to further his point: on average, about $70 million was whitened, whereas the illicit capital flight averaged about $1.5 billion.

While a rather generous black money whitening facility was in place in 2010, the size of illicit financial outflows peaked at $2.19 billion the same year, the WB economist said.

“This is not surprising since the facility has nearly become a permanent fixture of the fiscal incentive regime in Bangladesh.”

The incentive to whiten black money is strongest when such opportunities are offered for a very limited period along with a credible threat of very large penalties if black money is detected after the facility expires, according to Hussain.

“Such has not been the case in Bangladesh.”