Dr Khondaker Golam Moazzem on BCIM-EC and Bangladesh’s export to China, published in The Daily Star on Monday, 27 April 2015.

Bangladesh-China Trade & Investment Corridor: Importance, Potential & Outlook

The One Belt One Road initiative of China will not only connect the Asian economic giant with Europe but will also bring new opportunities for South Asian countries like Bangladesh. A roundtable organised by Standard Chartered Bank and The Daily Star sheds light on how Bangladesh with close links to the two of the most populous countries in the world — China and India — will gain economically from the initiative.

Mahfuz Anam

Editor & Publisher, The Daily Star

The growing trade relationship between Bangladesh and China is phenomenal — this is one of the major developments to have taken place in the last decade. I, as a media person, would frankly admit that we have not covered it enough. But it is high time that we focus on this positive development for Bangladesh. As a newspaper, I would like to tell Chinese investors that we do not have that much interaction with you, so please inform us of the problems you are facing here. We have vibrant business reporters who will report on these issues, so that you can create a win-win situation for China and Bangladesh. It is an open invitation — you get your profit and we build our country.

Abrar Anwar

CEO, Standard Chartered Bangladesh & Keynote Presenter

With almost $10 trillion of GDP, today, China is the second largest economy in terms of nominal value. But in terms of purchasing power parity, it is the number one economy. It is the largest exporter in the world; and it also has the largest foreign exchange reserve, which is close to $4 trillion. In the global landscape, five Chinese corporate houses stand in the top ten.

China’s GDP is growing at more than 7 percent, so having such a big economy beside us is a great opportunity for Bangladesh. While Bangladesh itself is a growing economy, with more than 6 percent of GDP growth over the last decade, we can still learn a lot of things from China. We can gain from investing in the trade and investment corridor in a planned way.

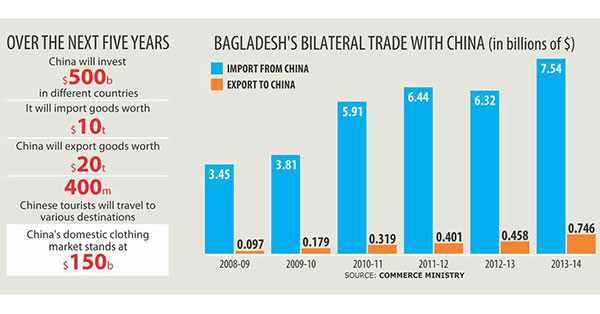

China is the largest trading partner of Bangladesh, with total bilateral trade volume coming to $8.287 billion in fiscal 2013-14. However, it is expected to grow to more than $10 billion in this current fiscal year. In fiscal 2013-14, Bangladesh imported $7.5 billion worth of goods from China and exported $746.20 million worth of goods to China. So there is also a trade imbalance.

Trade between Bangladesh and China is 12.63 percent of Bangladesh’s total trade. Bangladesh enjoys duty benefits for over 4,700 products. Our key export items are garments, leather, raw jute and frozen food, of which 32.44 percent is leather and 32.35 percent garments. Garments, which account for 80 percent of our total exports, have the substantial potential to flourish in the Chinese market. Our key imports are electrical equipment, mechanical machinery, cotton and cotton fabrics, knitted fabrics, fertilisers and so on.

Over the next five years, there will be some major developments in China: $500 billion is expected to be invested by the government and Chinese corporate houses in different countries; China is expected to import $10 trillion worth of products and export products worth $20 trillion; and 400 million Chinese tourists will travel to various destinations. We need to see how we can tap into this potential.

The greater China (Mainland China, Hong Kong and Taiwan) is the largest source of net foreign direct investment (FDI) in Bangladesh. In 2014, $197.87 million flew in from that region. Given China’s huge capital stock, there is a major upside there that Bangladesh can tap into. In general, the FDI contribution from Taiwan and Hong Kong has been higher than that from Mainland China. So there is huge potential to tap into the capital market in Mainland China.

Commerce, agriculture, infrastructure, industry and energy are the main sectors in which the Chinese FDI can come. The projects which have scope for Chinese investment or technical assistance are: the second crude oil refinery unit of Eastern Refinery Ltd in Chittagong, rail bridge over the Jamuna river and a high-speed “chord” train line between Dhaka and Comilla, multi-lane tunnel under the Karnaphuli river, deep-sea port near Sonadia island, establishment of barrage in the Ganges system in Rajbari, the garment village at Bausia in Munshiganj and so on.

In Bangladesh, Standard Chartered has been present for 110 years and in China for more than 160 years. So we are already connected on both the parts — and we see the potential at both ends. As a bank we can facilitate investment from China through commercial loans, syndicated finance, bonds and other investments. Recently, Standard Chartered has arranged the first-ever Sinosure-backed financing in the telecom sector. We are also the mandated lead arranger for an export credit agency-backed 225MW power project in Sirajganj, where Chinese engineering, procurement and construction (EPC) contractor and Sinosure are providing cover among the ECAs.

With the emergence of China as an economic superpower in the region, the revival of Silk Road has vast potential. The recent launch of Infrastructural Bank with huge investment from China indicates that revival of the route will get the blessings from China. In terms of revival of the Silk Road, the inter-Asia connectivity is very critical to ensuring that all the nations within this belt are able to get economic benefits from each other’s trade and investment role.

His Excellency Ma Mingqiang

Ambassador, Embassy of the People’s Republic of China in Bangladesh

We are working very hard to find new solutions to the trade imbalance issue by encouraging more FDI to Bangladesh. I have talked to the ministry of finance and the ministry of planning about how we can increase Chinese investment in Bangladesh. As we are discussing an exclusive Chinese economic zone, it will increase Chinese investment by 100-200 percent in Bangladesh.

Chinese leadership has put forward an initiative called ‘One Belt One Road’ extending from China to Europe. It will also connect the South Asian countries. Last year, when the Chinese president was visiting South Asia, he put forward some initiatives as well. He said that over the next five years, Chinese investment in South Asia will be more than $30 billion. China has allocated $20 billion in consortium loan in South Asia, and we will provide training opportunity to 5,000 youths from South Asia.

We have a lot of similarities with Bangladesh. Both the countries are densely populated, agricultural, resource-deficient and developing countries. Our requirements are enormously complementary to each other, so it provides huge potential for cooperation. China believes in developing hand in hand with its neighbours, and we are working on consolidating our relations with South Asia. We hope business circles from both the sides would seize this opportunity.

Syed Afsor H Uddin

Chief Executive Officer, Public Private Partnership Office, PMO

Last year, I attended a meeting in Beijing on how public private partnership can be applied within China to enhance the development of infrastructure and other facilities at the provincial level. In that very year, Chinese State Council released a guideline on local government’s role in using PPP and another on investment and financing through PPP model.

PPP using private sector investment has become a new modality to reduce investment gap. This investment modality is already active in both China and Bangladesh. Many Chinese companies are showing interest in PPP contracts. We have about 42 PPP projects worth $16 billion in the pipeline.

Patricia Wong

Executive Director & Head, Network Corridor, Standard Chartered, China

We have a strong presence in both China and Bangladesh. Local knowledge of China and Bangladesh coupled with a strong product capability in both the countries put our bank in a good position to help Chinese companies do business in Bangladesh. Our strong project finance and PPP capacity will be very helpful for Chinese businessmen.

Leveraging and maximising the network is the key for our bank. We have 14 Chinese relationship managers in 11 countries. In South Asia, we are deploying a second Chinese relationship manager. This shows how important this market is to us. In Bangladesh, we have 31 Chinese clients. We are looking forward to the banking mode to facilitate the Bangladesh-China trade and investment corridor.

Alamgir Morshed

MD, Financial Markets, Standard Chartered Bangladesh

Chinese policymakers have created three markets for one currency. They have segregated an onshore market for the yuan, where the offshore players have no access without certain approval. There is an offshore market, which is predominantly out of Hong Kong and accessible to foreign players.

Despite China being a global trading hub, settlements with the yuan are still low. However, in the last five years, it has progressed a lot. On any given day, turnover in world trade is around $6 trillion, with the Chinese yuan accounting for 1.5 percent of it. The Chinese policymakers want to increase that amount to 20 percent by 2020.

The IMF is reviewing its SDR Currency Basket (consisting of dollar, euro, yen and pound) at the end of 2015, and the Chinese yuan will most definitely be considered one of the currencies of the basket then. Very soon, the Chinese yuan will be considered a reserve currency — that is the future of the currency. That would be another big step in opening up the Chinese forex market to the global community.

Despite $12 billion of trade between the two countries, the transaction of the renminbi is almost zero in Bangladesh. This kind of seminar can really create awareness about the use of the renminbi. For example, the export of garments from Bangladesh to China is growing exponentially, but the common question among the exporters is: should we receive the payment in the dollar or the renminbi? What is the incentive for receiving that payment in the renminbi instead of the dollar? These exporters are also importers of machinery from China. If they receive the export payment in the renminbi and maintain that in export retention account, it can be re-used to import machinery. This will free them of the costs of currency conversions to make payment.

Standard Chartered Bangladesh has a renminbi account, which is the first-of-its-kind for any bank in Bangladesh. We have a branch in Hong Kong, and also the permission from Bangladesh Bank to transact in the renminbi. This has created a structure for exchange in the renminbi, which other banks still have to put together. The renminbi is coming — we cannot ignore the currency of a global leader in trade like China.

Shahidullah Azim

Vice President, BGMEA

China is the largest exporter of garments in the world, but their production cost is rising, which has created an opportunity for Bangladesh.

We have huge scope even in the Chinese market, as it imports around $5 billion worth of garment items a year. Of the total, our share is only $241 million.

We have already prepared a roadmap: by 2021, we will increase our exports from $25 billion to $50 billion, and China can be a big market for us.

We are also improving our factory standards. By 2016 we will have more than 100 eco-friendly factories. We would request the Chinese ambassador to give us the opportunity to tap into the Chinese apparel market.

Khondaker Golam Moazzem

Additional Director of Research, Centre for Policy Dialogue

The slow rate of growth in Bangladesh’s export to China is basically due to China’s rules of origin. As a result, we have to give 40 percent domestic input. This is a very high limit for a country like Bangladesh, because we are not yet capable of producing that amount of raw materials. For garments we have to import most of the raw materials. I will urge China to reduce the percentage of domestic input to 30 percent, as in the Canadian market.

China has recently extended its duty-free product basket to 4,700 products, but due to the very high level of rules of origin we are not getting its benefit.

If the BCIM corridor is realised, it will have a deeper impact on Bangladesh-China trade, as it will directly connect Bangladesh with the southern part of China. The Silk Road initiative is also very plausible to take this connectivity network forward, as the current route of maritime Silk Road is not directly linked at any point with Bangladesh. The closest connection point is Kolkata. Is it possible to connect it with any port of Bangladesh? Otherwise, it will not be very beneficial for us.

Syed Sadek Ahmed

Director, BGMEA

China is a big emerging market for Bangladesh, as it has a large consumer base. All the top retailers of the world are opening their branches in China.

Meanwhile, the Chinese people are leaving manufacturing behind and going towards designing. So we need to exploit this opportunity by meeting their standards and choices and sell our garments there.

I would like to raise an issue about China’s rule for duty-free access. To take advantage of that facility, we have to ship the goods by sea to China without touching any other border. In other words, if you transship the goods, it will not get the duty-free benefit. It is our request to His Excellency that since you are giving us duty-free access, please allow us transshipment facility as well.

Ron Lim

Managing Director, Eastcompeace Smart Card Bangladesh

Infrastructure should be the top priority for Bangladesh. There must be some good policy and good regulation to facilitate our business. Economic zones should come forward with tax holiday facility for people like us who want to invest more in Bangladesh. We can also export items to our neighbouring countries from our Bangladeshi factories.

We are very eager to do business in the renminbi. We need to buy a lot of raw materials from China. If we can make the payment in the renminbi, it will greatly benefit us.

Nabhash Chandra Mandal

Additional Secretary, Board of Investment

Bangladesh has a very friendly business environment for foreign investors. According to our National Industrial Policy 2010, all sectors except a few are open to foreign investment.

According to the policy, 100 percent foreign equity is allowed in Bangladesh. Bangladesh has given top priority to export-oriented industries. Joint venture is allowed but not mandatory. Foreign private investment is secured by Foreign Private Promotion and Protection Act 1990.

Competitive labour force, steady growth, minimum risk factors, satisfactory forex reserves and stable exchange rate are some of the attractive features of Bangladesh for Chinese investors. The government has decided to build a special economic zone for Chinese investors in Chittagong. We are also working hard to improve our gaps in power, infrastructure and port facility. The BoI has taken some initiatives like online registration, online visa recommendation, work permit, and one-stop-service, to make doing business in Bangladesh easier. We are well set to facilitate robust Chinese investment in Bangladesh.