Published in Dhaka Tribune on Sunday, 25 May 2014.

Tax cut for listed companies unlikely

Syed Samiul Basher Anik

Hope for non-listed ones yet to evaporate

The rate of corporate income tax is likely to remain unchanged in the upcoming fiscal year as the National Board of Revenue (NBR) forwarded a fresh recommendation to Prime Minister’s Office.

The case for non-listed companies has not been, however, cancelled as the prospective candidate for the tax exemption.

The revenue authorities put forward the recommendation on Thursday, following the PM’s instruction to see the extent of revenue loss due to previously proposed rate cuts.

“The previous proposal, if implemented, would cause a revenue loss of at least Tk600 crore annually,” said a senior official as the NBR worked on the PM’s instruction.

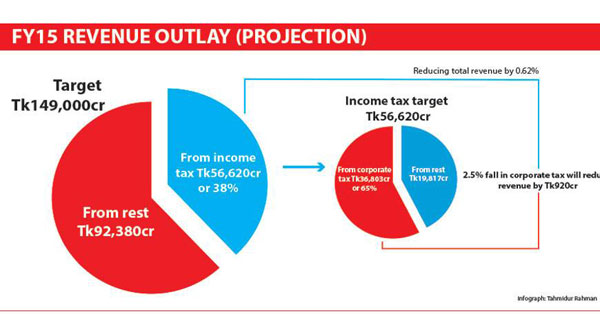

He said the NBR considered the tax cut proposal made earlier would make it difficult to achieve around Tk149,000 crore of revenue target likely to be set for the for the fiscal 2014-15.

The corporate tax contributes around 65% of the revenue comes from the income tax. The NBR is planning to mobilise highest revenue from income tax – 38% of the total revenue targeted for fiscal 2014-15.

In its fresh proposal, the official said, the NBR recommended reduction of tax rate only for the non-listed companies.

Earlier at few pre-budget meetings, the finance minister as well as the NBR chairman indicated that the new budget would accommodate some exemption from the corporate tax.

Different trade bodies have long been urging the government to reduce the corporate tax for both publicly listed and non-listed companies.

The tax-cut indication emerged after the businessmen proposing for the exemption to recover from the setback they suffered due to political turmoil before the January 5 national election.

The tax authorities last week held a meeting with Prime Minister Sheikh Hasina when they recommended a corporate tax-cut plan, but the PM instructed making an estimate of revenue loss to be incurred if the plan is implemented, another senior official said.

“We have changed our previous position as NBR will surely fail to achieve the revenue target,” he added.

In the revised proposal, he said the NBR recommended reduction of tax rate for the non-listed companies from the existing 37.5% to 35% and keep the rates for other companies unchanged.

Currently, banks and financial institutions are paying 42.5% corporate tax while it is 27.5% for publicly traded companies, 37.5% for non-publicly traded companies, and 37.5% for merchant banks. For the publicly traded mobile companies, the tax rate is 40% while it is 45% for the non-publicly traded operators.

NBR officials said they would finalise the tax rates after getting consent from the Prime Minister. The NBR would hold another meeting with the PM before the budget scheduled to be placed in parliament on June 5.

Centre for Policy Dialogue Executive Director Prof Mustafizur Rahman emphasised on bringing the non-listed companies under the listed companies’ list first, rather than lowering the tax rate, to support increasing the revenue collection.

“There is a huge possibility that lowering the corporate tax rate will have negative impact on the revenue collection as the revenue target set for the FY2014-15 is already challenging to achieve,” he said.

According to a KPMG conducted “Corporate and Indirect Tax Rate Survey 2014,” the corporate tax rate in some South Asian countries are 20% in Afghanistan, 27.5% in Bangladesh, 28% in Sri Lanka, 33.99% in India and 34% in Pakistan.

Former NBR Chairman Muhammad Abdul Mazid said the government should opt for alternative methods, may be expanding the tax net, to cover up the revenue losses.

“Before lowering the tax rate for corporate companies, NBR has to ensure the revenue losses to be incurred, as a result, would be compensated through taking effective measures like plugging of loopholes in the tax system, and expansion of the income tax base,” he said.