Published in The Daily Star on Thursday, 5 June 2014.

Economic triumphs dim in haze of risks

Analysts say raising confidence will be the main challenge next fiscal year

Sajjadur Rahman

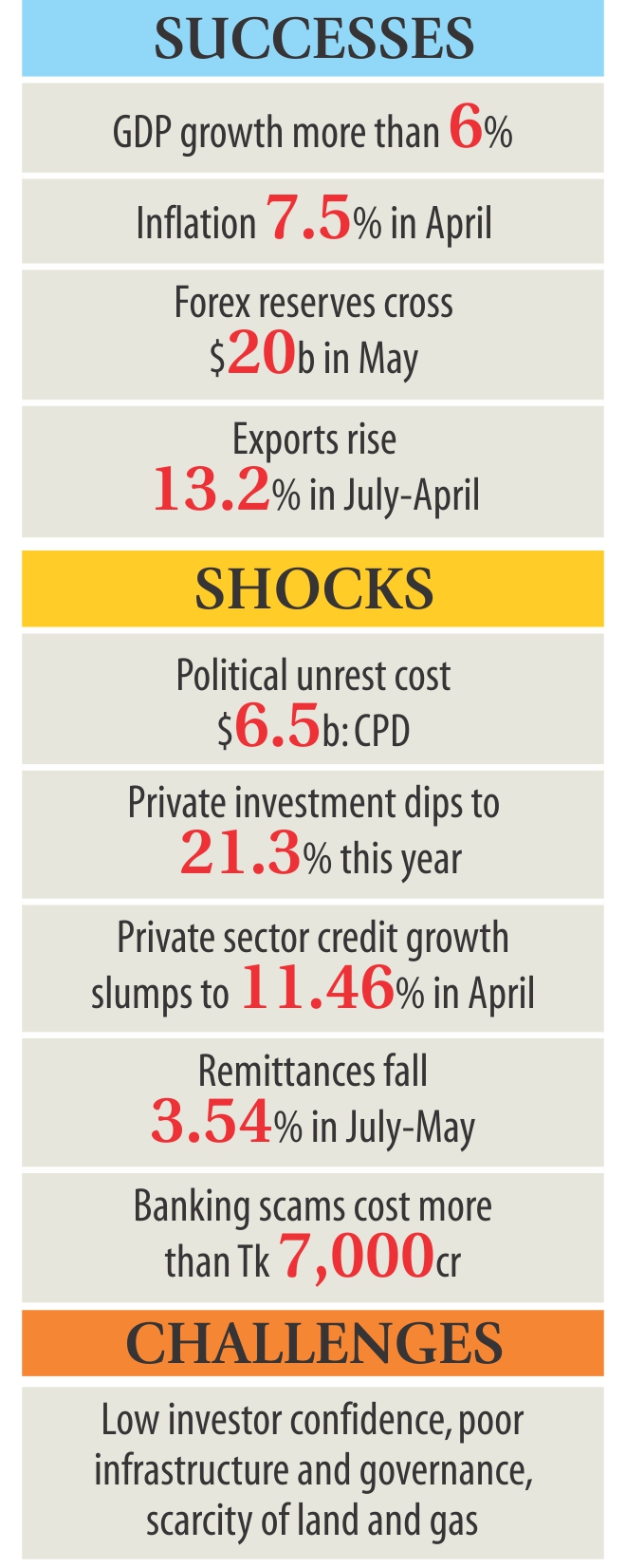

Bangladesh has probably weathered the longest spell of political violence and sluggish investments and achieved healthy economic growth of 6 percent for the outgoing fiscal year.

Average inflation stood at 7.5 percent at the end of April. The exchange rate remains stable and balance of payments very strong. Foreign exchange reserves crossed the $20-billion mark in May. Year-on-year, exports and imports grew by 13.2 percent and 11.1 percent respectively in the first 10 months of the current fiscal year.

The finance minister and the central bank governor can cheer up due to successes in macroeconomic management despite facing a very tumultuous time, especially in the first half of the outgoing fiscal year ending June 30.

“The performance is quite satisfactory in terms of macroeconomic management,” said Ahsan H Mansur, executive director of Policy Research Institute.

But these healthy macroeconomic fundamentals could not regain investor confidence, which nosedived last year due to massive political violence ahead of the January 5 national election. Some 848 acts of political violence killed a total of 507 people in 2013, according to Ain of Salish Kendra, a human rights group.

Of the 72 days of strikes and blockades in 2013, around 60 days were during July-December, the first half of the current fiscal year. According to an estimate by Centre for Policy Dialogue, political unrest caused Bangladesh a loss of nearly Tk 50,000 crore ($6.5 billion), which was $1.4 billion in a World Bank assessment.

“Insecurity in the mind of people has endangered the investment climate. Political violence dented confidence and impacted individual’s lifestyle,” said Mansur, also a former official of the International Monetary Fund.

Consequences of the violence were manifold. Private investment went down to 21.3 percent this year from 21.7 percent a year ago. Private sector credit growth slumped to 11.46 percent in April this year, significantly lower than the target of 16.5 percent set in the ongoing monetary policy.

Inward remittances declined 3.54 percent in the first 11 months of the fiscal year on the back of a shrinking outflow of migrant workers. Between July last year and May this year, Bangladesh received nearly $12.93 billion in remittances compared to $13.41 billion for the same period of last fiscal year.

A number of financial scams including those involving Hall-Mark and BASIC Bank also created unnecessary hurdles for good borrowers and entrepreneurs and piled up bad loans, which ultimately contributed to a higher interest rate.

“Economic growth, employment and poverty reduction initiatives all were hampered due to political violence last year. We cannot see the shocks on all indicators at a time,” said Mustafa K Mujeri, director general of Bangladesh Institute of Development Studies (BIDS), a government-sponsored research organisation.

In this backdrop, analysts, economists and businesses said regaining investor confidence would be the biggest challenge for the government and the finance minister in particular, who will announce the budget for fiscal 2014-15 today.

“The government needs to go for drastic and visible actions to achieve the targeted accelerated growth set in the Sixth Five Year Plan,” Mujeri said. According to the plan, which will expire next year, Bangladesh should register 8 percent economic growth.

The CPD thinks the evolving situation could be addressed by institutional strengthening, reforms and good governance at all levels and by putting in place an inclusive and participatory political culture.

The independent think tank also identified three traditional non-economic factors—weak implementation capacity, weak oversight capacity and weak capacity for reforms—which it believes need to be addressed for achieving higher economic growth.

On the fiscal front, Mustafizur Rahman, CPD’s executive director, said soundness of fiscal framework was undermined because of relatively slow pace of revenue mobilisation and development expenditure.

“Financing public expenditure will be a challenge for the government if the current trends of revenue collection and foreign aid continue in future,” Rahman said.Pr

Government documents show, dependence on domestic resources as a source of financing has increased significantly to 91.6 percent during July-March of the current fiscal year, up from 72 percent in the previous year’s budget. Concerns arise as revenue earning is lagging behind (by around Tk 10,000 crore) so far this fiscal year.

“Bangladesh should look for low-cost foreign funds to plug its budget deficit,” Mujeri of BIDS said. But the economist is in favour of increasing public expenditure, which he said facilitates private investments, both domestic and foreign.

Analysts advised the government to create a favourable environment for investors, at any cost. They suggested the government address some issues immediately to regain confidence of the investors.

FAST-TRACKING BIG PROJECTS

Bangladesh’s trade economy (export-import) now stands at around $65 billion. Of the amount, at least $50 billion worth of goods are carried through the Dhaka-Chittagong highway. The road is very narrow compared to the needs. Often, a truck loaded with export or import goods takes 12-15 hours to reach Chittagong port from Dhaka or vice versa, pushing business costs up.

The Dhaka-Chittagong four-lane highway project was approved in 2006 with an estimated cost of Tk 2,382 crore (revised at Tk 3,190 crore). The implementation of the project started in 2010 and was supposed to be completed by 2012. But the deadline for completing the project has already been extended four times raising questions about the government’s seriousness. Analysts said the construction of the road should be given the highest priority as the country’s resource mobilisation depends largely on trade through the road.

Another important highway is Dhaka-Mymensingh, beside which one-third of the country’s industrial units are located. Due to traffic gridlock, it takes 2/3 hours to travel a distance of 30/40 kilometres. Many businesses said they are ready to pay toll if the government builds a highway or expressway. Yet, there is no visible initiative.

LAND AND GAS FOR INVESTORS

The China factor is more or less known to people of Bangladesh. It means the rise in production cost in China has forced many of its garment makers to shift their factories to cost effective countries, and Bangladesh is a topmost choice on the list. But scarcity of land and gas is a major barrier to cashing in on the chance.

Zahid Hussain, lead economist at the World Bank’s Dhaka office, said recently that if Bangladesh can provide 40,000 acres of land to Chinese investors, around 15 lakh new employments will be created. Though the government plans to develop special economic zones, it is going very slow to implement those.

Another obstacle is the scarcity of gas in industrial units. Many industries are sitting idle after investing crores of taka for want of gas connections. Government data shows, the gap between demand and supply of gas is 750 million cubic feet per day.

“The government should tell us that it cannot give us gas connection, and that we should not set up new plants,” said a managing director of a group of industries that exported more than $300 million worth of garments last year.

REMITTANCES AND RURAL ECONOMY

Inward remittances play a big role in turning a country’s rural economy into a vibrant one. But the recent decline in the inflow of remittances and manpower export indicates a weak prospect for Bangladesh to become a middle income country.

Remittances fell 3.54 percent in the first 11 months of the fiscal year due to a shrinking outflow of migrant workers. During the first 10 months of the outgoing fiscal year, outflow of migrant workers declined 10.5 percent, meaning the domestic economy has to absorb more than 20,000 workers every month. Recruitment of Bangladeshi workers in Saudi Arabia and the UAE is yet to resume, which according to analysts, is a matter of grave concern.

REINING IN GRAFT

The World Economic Forum Global Competitiveness Report 2012-2013, which surveyed business executives, found that the level of public trust in politicians is very low in Bangladesh. According to Transparency International’s Global Corruption Barometer 2013, the Bangladeshi political parties are widely perceived by the surveyed households to be corrupt.

Large scale corruption in state-owned BASIC and Sonali banks in 2012 and 2013 involving more than Tk 7,000 crore has also eroded investor and financial sector’s overall confidence.

Analysts said this endemic corruption must be reduced to give investors, both domestic and foreign, an idea that they do not need to bear additional costs.