“It is critically important to enhance administrative efforts towards revenue mobilisation. It is disappointing that the NBR, in recent years, has not put the required emphasis on administrative reforms which are required to accelerate tax mobilisation efforts.”

Published in The Daily Star on Tuesday, 27 October 2015.

Tax receipts rise, but miss target

Sohel Parvez

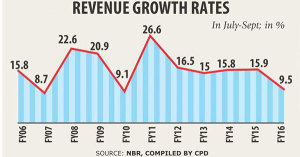

Tax collection rose 9.5 percent year-on-year to Tk 30,905 crore in July-September, according to provisional estimates of the National Board of Revenue.

The amount is Tk 5,803 crore less than the NBR’s target for the period.

NBR Chairman Md Nojibur Rahman said they would be able to meet the annual revenue collection target, which is Tk 176,370 crore.

“There is a rising trend in tax receipts. I am optimistic that we will exceed the target,” Rahman told The Daily Star.

Revenue collection is linked to factors such as the implementation of the annual development programme (ADP) and imports, he added.

“The actual trend will be seen by December,” said Rahman, adding that it would be possible to assess overall tax collection after crossing the deadline for returns submission on November 30.

The latest revenue collection growth is the lowest since fiscal 2009-10, said Towfiqul Islam Khan, research fellow of the Centre for Policy Dialogue.

NBR data shows that revenue collection from overseas trade (exports and imports) rose 8.16 percent year-on-year to Tk 9,855 crore in the July-September period.

Collection of VAT from the domestic services and manufacturing sectors rose 10 percent to Tk 11,499 crore.

Income tax receipts grew 10 percent to Tk 9,551 crore in July-September from the same period a year ago, according to the NBR.

Officials blamed the less-than-expected collection figure on falling imports and low prices of various imported items, including petroleum and commodities, low rate of ADP implementation, extension of the deadline on tax return submission as well as sluggish export growth.

In the first quarter, development spending stood at Tk 6,502 crore, down 7.43 percent year-on-year. Development spending enables the tax authority to log withholding taxes from contractors, which provides nearly 30 percent of NBR’s tax collection at source.

Imports fell 3 percent in July-August of fiscal 2015-16. Export receipts edged up nearly 1 percent in July-September year-on-year.

Khan, the CPD’s research fellow, said lower commodity prices in the international market and failure to accelerate private investment and hence, economic activities, have taken a toll on revenue collection.

There is no doubt that the revenue collection target for the current fiscal year was ambitious, Khan added.

“It is critically important to enhance administrative efforts towards revenue mobilisation. It is disappointing that the NBR, in recent years, has not put the required emphasis on administrative reforms which are required to accelerate tax mobilisation efforts.”

The revenue shortfall needs to be checked in order to maintain fiscal balance, particularly in view of the recent pay scale revision for public servants, he said.

“Lower tax revenue collected by the government may also hinder investment for basic public services and infrastructure development,” he said.

“If such a trend cannot be reverted, the government will need to consider an early revision of the national budget for the ongoing fiscal year in view of recent developments,” said Khan.

Rahman of the NBR said three members from the income tax, VAT and customs wings are monitoring revenue mobilisation. The NBR also activates monthly report cards for all to ensure good performance, he added.

“Tax and VAT deduction at source is becoming institutional. We have identified some of the areas for revenue,” he said, adding that the NBR also takes steps to realise outstanding taxes, particularly from government bodies.

For the NBR, he said, this quarter was for mobilisation of inputs and for strategically placing manpower to achieve the revenue target for the fiscal year. The results of these steps will be seen in the coming quarters, he added.