A large number of people work in the informal sector and there have been inadequate policy efforts to bring them under the formal tax system. One way to bring more people under the system is to link e-TIN and tax return submission document with other public service facilities, financial transactions and asset ownerships

Published in The Daily Star on Thursday, 12 November 2015.

Tax returns still underwhelming

Sohel Parvez

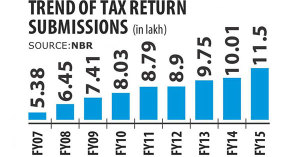

The number of tax return submissions is gradually increasing but the tally continues to remain very low considering the size and growth of the economy, analysts said.

The National Board of Revenue recorded about 11.5 lakh returns in fiscal 2014-15, up 14 percent year-on-year — the highest growth since fiscal 2008-09.

Still, the total number of tax filers continues to remain less than 1 percent of the total population of 16 crore — a figure that creates doubts about the efficacy of the tax authority’s continuous awareness and motivation campaigns.

Analysts blamed inadequate monitoring and enforcement, absence of regular taxpayer survey by independent agencies and slow pace of automation of tax systems.

The total number of returns is not adequate at all, said Ahsan H Mansur, executive director of Policy Research Institute, adding that Bangladesh should have 40-50 lakh regular tax return filers given the level of per capita income.

Currently, 17 lakh people have electronically generated taxpayer identification numbers (e-TINs).

The NBR aims to raise the number of registered taxpayers to 30 lakh by fiscal 2018-19 as part of its effort to collect more than half of its total revenue from income tax by fiscal 2021-22. However, Mansur said the current trend of growth is not adequate. “You have to go faster.”

He said the NBR should carry out independent surveys through a third party on a regular basis to find new taxpayers throughout the country. “It does not take place here,” he said. Mansur, a former economist of the International Monetary Fund, said the formal sector is quite big in Bangladesh now and withholding tax is applicable in many areas.

Those who face withholding tax deduction should submit their returns but it appears not all of them do so, he said.

For instance, banks deduct tax on deposit holders’ interest earnings but there is no follow-up from the NBR to check whether all of them have filed their returns as well.

Mansur said the taxmen should focus on non-filers; instead, they are busy with filers. Ultimately, it will discourage the existing filers, he added.

Syed Md Aminul Karim, former member of income tax policy of NBR, said the tax return submission number is frustrating.

“It is surprising to me that the rate of tax return submission is not growing fast. The number should have increased, given the efforts we put in to encourage compliance.”

“The enthusiasm of participation that we see at tax fairs is not reflected in the returns submission. It means that many old taxpayers are not filing returns.”

Citing the enrolment of fresh taxpayers after introduction of e-TIN, he said the number of returns should have been increased to 14 lakh in fiscal 2014-15.

“It means all e-TIN holders did not submit tax returns. We are not being able to ensure compliance in the absence of proper monitoring,” Karim said, while suggesting the tax authority issue notices to those who remain non-compliant

Legal action is also required, he said, adding that enforcement has to go side by side with the awareness campaigns.

Karim, however, acknowledged that the field offices do not have the adequate manpower for this.

Towfiqul Islam Khan, research fellow of the Centre for Policy Dialogue, said the number of income tax return submissions is low by any standard.

Even though the number is on the rise, about one-third of the e-TIN holders do not submit their tax returns.

He said a large number of people work in the informal sector and there have been inadequate policy efforts to bring them under the formal tax system.

One way to bring more people under the system is to link e-TIN and tax return submission document with other public service facilities, financial transactions and asset ownerships, Khan added.

Muhammad Abdul Mazid, a former NBR chairman, stressed the need for monitoring and enforcement to increase compliance.