Download Presentation | Press Reports

The proposed budget for FY2019-20 does not adequately address the commitments made in the election manifesto of the current government. CPD presented an analysis of the proposed budget keeping in view the targets set in the Seventh Five Year Plan (7FYP), election pledges, current macroeconomic scenario and the Sustainable Development Goals (SDGs).

Appreciating some of the tax measures, CPD welcomed initiatives like raising VAT exemption threshold which will protect small and medium traders, tax measures for selected import items, VAT exemption on non-mechanical carriage for disabled persons (wheel chair) and hearing aids and VAT exemption on pacemaker, heart valve, Haemodialyser (Artificial Kidney), cancer medicines, etc., among others.

The budget has proposed the existing provisions about undisclosed money to continue. CPD strongly feels that investing undisclosed money in various sectors will not change the investment scenario much nor it will change the behaviour of the tax evaders rather it will continue to discourage regular taxpayers. Personal income tax measures and increase in net wealth exemption limit proposed in the budget, suggest that the budget is likely to benefit the higher-income group while the situation remains unchanged for the lower and middle-income group.

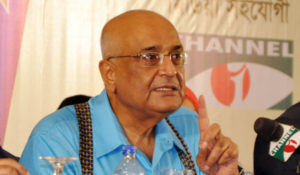

These views, among others, were shared at the CPD media briefing on analysis of the proposed National Budget FY2019-20 on Friday, 14 June 2019 at La Vita Hall, Lakeshore Hotel, Dhaka. Following the presentation of the proposed budget by the Hon’ble Finance Minister at the National Parliament on the day before, the analysis was prepared overnight by the CPD team. Following the welcome remarks from Dr Khondaker Golam Moazzem, Executive Director (a.i.), CPD, Dr Debapriya Bhattacharya, Distinguished Fellow, CPD, made the presentation titled, “National Budget for FY2019-20: An Analytical Perspective”. Ms Anisatul Fatema Yousuf, Director, Dialogue and Communication and CPD’s Senior Research Fellow, Mr Towfiqul Islam Khan, among others, were present at the event. Like every year, the media briefing was broadcasted live by Channel i to reach the mass people.

CPD analysis stated that, although aspiration for tax and non-tax revenue (as % of GDP) of FY20 is lower than that of FY19, the budgetary proposals may not be sufficient to overcome the challenges to adequately mobilise revenue. The budget proposes to increase the number of income taxpayers to more than 1 crore by next few years. However, specific guidelines such as strategies, timeline and action plan in this regard are missing. CPD has proposed lowering the income tax rate for the first slab to 7.5% from the existing 10% without changing the taxable income level.

Under the Annual Development Plan (ADP), five sectors will receive 70.1% of the total allocation of Tk. 2, 02,721 crore and the remaining 12 sectors will receive 28.2% only. Among the top five sectors, transport has the lion share. CPD appreciated that very few new projects were taken under the ADP while many earlier projects are yet to be completed.

The allocation for social sectors like education and health still remain far off from the 7FYP targets. The education and health sectors both received less as a total share of the budget. Although, beneficiaries under the social protection are expected to increase but other marginalised groups like the Dalits and Adivasi still remained left out.

The presentation at the media briefing was followed by a Q/A sessions.