Published in The Bangladesh Post on Friday, 30 March 2018

Savings tool sales top fiscal target

Belal Muntasir

The government borrowing surpassed the requirement for the current fiscal year as the net sales of national savings tools already overshot their target by 9.85 for the year in just eight months.

The government borrowing surpassed the requirement for the current fiscal year as the net sales of national savings tools already overshot their target by 9.85 for the year in just eight months.

The net investment in savings tools was recorded at Tk 33,119.78 crore in the July-February period of fiscal 2017-18 against total target of Tk 30,150 crore for the whole year, according to the data of Directorate of National Savings (DNS).

The government borrows money from public through selling savings tools, including savings certificates and bonds, to meet the fiscal deficit.

Data shows, the amount of investment was recorded at Tk33,282 crore in July-February of the corresponding period of fiscal 2016-17.

Economists said people are investing in savings tools because of their higher interest rates.

Jaid Bakht, a research director at the Bangladesh Institute of Development Studies, told Bangladesh Post that although bank interest rate on FDR is rising, the interest rates of savings tools are highest.

Besides, people consider it safer than deposit in bank as some banks are reportedly passing through crisis period, he said.

Explaining the trend Bakht said there are some privileged investment tools like pensioner scheme, provident fund and so on, which help boost the investment.

Besides, the government did not reduce the interest rate of the tools in the interest of the people, especially in election year, despite recommendation for a cut in interest rate.

According to DNS, the first 8 months saw investments of unprecedented level.

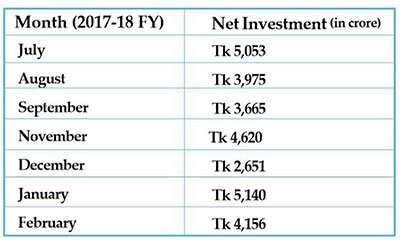

The data shows, Tk 5,140crore, the highest, was invested in January of the current fiscal while in July of the same fiscal it was Tk5,053 crore and February Tk4,157 crore.

August witnessed investments worth Tk3,975 crore, September at 3,665, Octobor Tk4,620 crore, Novemeber Tk3,857 crore and Decemeber Tk2,651 crore.

Directorate of National Savings said Tk 15,350 crore, the maximum net investment, came from family savings certificates during the period while the second highest was the ‘Three-month-profit based tools’ which fetched Tk 6,218 crore and ‘Pensioner’ Tk 2,965 crore.

The surplus of the total sales after paying the interest or capital of the previous investments is referred here as net investment.

During the period banks collected Tk16,816 crore net investment while the Bureau received Tk 7,317 crore and the Post office Tk29,652 crore.

Mustafizur Rahman, a fellow at the Centre for Policy Dialogue (CPD), believes the excess sales of savings tools actually raises the loan of government, which is not a good sign.

Every year, the government has to make substantial budgetary allocation to repay the loan that raises burden of the government, he said.

Rahman said the fixed income people used to be more attracted by the savings tools, but now the comparatively rich people are investing heavily here to enjoy the higher interest rate.