Published in The Financial Express on Tuesday, 27 January 2015.

Export-oriented plastic industry of Bangladesh: Opportunities and Challenges

Khondaker G Moazzem and Farzana Sehrin

The quest for new export products with a view to diversify the export base is not so easy for an emerging economy like Bangladesh. Plastic products are among the few products outside textiles, apparels, leather and jute goods which have contributed towards export diversification though at a limited scale. Although this industry was started as a backward linkage industry of the export-oriented RMG sector, manufacturing of plastic and plastic based products is contributing profoundly to the economy and has become an important fragment of the manufacturing industry as well. The development of local plastic industry (particularly the SME sector) has been facilitated mainly by huge domestic low-end plastic products. According to the Bangladesh Plastic Goods Manufacturers and Exporters Association (BPGMEA), its contribution to GDP has increased over time from 0.36 per cent in 2004 to 1.2 per cent in 2008. However, per capita consumption of plastics and plastic based products is still low in Bangladesh compared to global average consumption. Likewise, the huge potentials in the global market remain unexplored due to various kinds of constraints. Present paper highlights on opportunities and challenges of the export-oriented plastic industry of Bangladesh

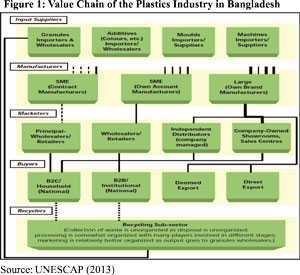

2. Plastic Sector Value Chain in Bangladesh

The value chain for plastic products is almost similar to that in other industries (Figure 1). It is observable that first stage of the value chain that is input suppliers such as raw materials, machines are all imported which reflects weak backward linkage of plastic industry in Bangladesh. In case of manufacturing of plastic industry, significant diversity of enterprises is seen ranging from large players to very small manufacturing units. Manufacturing units in the plastic industry follows two business models: own account manufacturing (OAM) or contract manufacturing (CM). In Bangladesh, micro and small industries mostly rely on CM business model whereas medium and large manufacturers mainly rely on the OAM business model. In this regard, large manufacturers market their goods under their own brand name. In the case of buying products which is the end stage of the value chain, large manufactures sale their products to the domestic market and global market as well. In the domestic market, both household and offices are the main customers. SMEs who follow CA business model sell their products to the national level particularly to the household and those who follow OAM model sell their products to the institution.

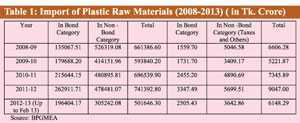

Import of Raw Materials: Bangladesh’s import of plastic products have significantly increased mainly due to rise in import of raw materials and intermediate products (Table 1). In 2013, total import of plastic products was US$1.2 billion compared to US$240 million in 2001. In the total import, US$1.16 billion was raw materials / intermediated products (96 per cent of total import in 2013) compared to US$225 million in 2001 (93.8 of total import in 2001). Major raw materials imported from abroad include polymers of ethylene, polymers of propylene or of other; olefins, polyacetal, and other polyether and epoxide resins, polymers of vinyl, chloride or of other halogenated olefins, polymers of styrene, amino-resins, phenolic resins and polyurethanes, acrylic polymers, polymers of vinyl acetate or of other vinyl esters, cellulose and its chemical derivatives, polyamides. It is to be noted that, about 20 per cent of the raw materials of plastic industries in Bangladesh are from recycled material. Major sources of importing raw materials for plastic industry are: U.A.E., Kuwait, Thailand, Sri Lanka, Japan, Malaysia, China, India, USA, Singapore, and Germany. As Plastic market demonstrate a steady positive growth rate, backward linkage of these market should be developed in the country. Import of raw materials and intermediate products takes place both under bond and non-bond categories in which import under non-bond category accounts for major share (60-70 per cent); over the years, import under bond category has also been increasing.

Manufacturing Units: According to the survey of Manufacturing Industries (SMI 2012) over 900 manufacturing units are currently operating and most of these are small-scale (about 70 per cent) and domestic market-oriented. According to the BPGMEA, nearly about 250-300 units are currently involved in the export market. About 65 per cent units are located in Dhaka and nearby areas, 20 per cent in Chittagong, 10 per cent in Narayangonj and the rest 5 per cent are in Khulna, Comilla, Bogra and Rajshahi Districts. Considering the environmental pollution created by the plastic industries particularly those of small scale non-compliant ones, relocation of these factories to environmentally complaint areas is needed.

Plastic Products: Major manufactured products of local plastic industry include PVC pipe, shopping bag, and injection molding products, garment bag, woven bags, PET/PE bottle, laminated packages, rigid sheet, garment accessories, other household products, cosmetics and medicine packs. As part of backward linkage RMG industry, Bangladesh exports mainly intermediate products such as film plastic, garment accessories made of plastic, household plastic items.

Employment: According to the SMI 2012, the sector employs about 37689 workers of which 27,437 (72 per cent) are male and 10,252 (28 per cent) are female workers. Majority of these workers are production related workers (80 per cent) and the rest are temporary workers.

- Export-Oriented Plastic Sector in Bangladesh

Global Market for Plastic and Plastic Products: Global market for plastic and related products is as big as like that of textiles and apparels products. In 2013, total global import of plastic products was US$590 billion while that of textiles and apparels was US$772 billion (where import of apparels is accounted for US$403 billion). Global plastic market ranges from raw materials, intermediate products and finished products and their import has registered a consistent rise over the last decade (e.g. 2001-2013) (Table 2).

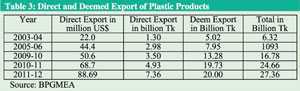

Bangladesh’s Export: Plastic products produced in Bangladesh are being exported in two forms- direct export of plastic products and deemed export of plastic products as accessories of apparel products (Table 3). According to the BPGMEA, export of plastic products is accounted for US$340 million in 2013 of which 75 per cent is deemed export and the rest 25 per cent is direct export. However, the export data reported by the Export Promotion Bureau (EPB) does not provide information of deemed export of plastic products separately. As a result, its actual contribution to the export basket is not fully come out from the published data. At present the rank of the plastic products in the export basket is 12th; but if adjusted with the deemed export, its position will move up to 8th which is be above the ranking of raw hides and skins, headgear and parts, mineral fuels, oils, edible fruit, nuts, tobacco, leather products etc.

At present, a total of 23 countries in North America, Europe, Asia and the pacific and the Middle East are the major export destination of plastic products. China is the top most export destination (22 per cent of total export in 2007) followed by Poland (7 per cent), India (5 per cent), and Sri Lanka (2 per cent). In the Europe, major export destinations are Germany (6 per cent), Belgium (4 per cent), France (2 per cent) and UK (1 per cent). If the deemed export is taken into account, major destinations are in EU because of use of plastic goods as accessories in apparels and leather and other products. Export to USA was accounted for 1.2 per cent of total export of plastic products in 2007. Seven eastern states in India are also important markets for Bangladeshi plastic products. Because of supply side constraints, Bangladesh has not yet able to take the advantage of preferential market access in full in major developed and developing countries.

Bangladesh’s main competitors in top 5 export products include both developed and developing countries (Table 4). Since Bangladesh targets low-end segment of the global market, it could compete with competitors of developed and developing countries taking advantage of low operational cost as well as of preferential market access.

- Analysis of Competitiveness of the Plastic Industry

The plastic industry lags behind other similar kinds of industries in terms of efficiency and productivity related indicators. The industry has the smallest value addition for all firm sizes among the selected sectors (Table 5). Gross value added as a share of gross output is the lowest for all categories of plastic firms. Use of imported raw materials as well as relatively high capital intensity in production process perhaps lower the share of value added in production. Within the sector, firms are varied widely in terms of value added, material cost of production, employment per firm, productivity and capital-labour ratio etc (Table 6). Hence, all categories of firms need to improve their operational efficiency in order to make them globally competitive.

- Policy Issues related to the Plastic Industry

Plastic industry enjoy similar facilities as enjoyed by other export-oriented industries. Plastic industry has been identified as a thrust sector under the Export Policy 2012-15. As part of it, the industry enjoys facilities such as five to seven years’ tax exemptions, no import duty on import of raw materials and capital machineries, duty-free import facility for limited quantities of samples for manufacturing exportable products and facility of bank loans up to 90 per cent if the value against irrevocable and confirmed letters of credit/sales agreement are available etc. Investors also enjoy facilities such as tax exemptions on royalties, tax exemption on the interest on foreign loans under certain conditions etc.

Export-oriented plastic sector does not enjoy similar kinds of facilities as enjoyed by other major export-oriented products. Plastic exporters do not receive any additional incentives/benefits as like garment exporters. For example, garment exporters enjoy 0.30 per cent tax as final settlement; 3% cash incentives for export to non-traditional markets; and 3% case incentives for backward linkage textile sector. Duty drawback facility is difficult to get by the manufacturers of plastic goods. In sake of export- oriented plastic sector, specific policy support particularly for small scale exporters is needed. Also deemed’ export need to be properly acknowledged in national statistics.

- Challenges for Development of the Export-Oriented Plastic Sector

Major challenge for the plastic industry is to improve its export competitiveness and build its capacity. The sector needs to address the following issues.

6.1 Lack of machinery use and mold manufacturing

Absence of equipment and machinery in manufacturing facilities, partly mold-making units puts Bangladesh at a disadvantage situation. Government policies and regulations are not strong enough to make entrepreneurs fervent to invest in such costly technology. Without investing on high tech machines, Bangladesh would not be able to take advantage of low cost production compared to that of China and India.

6.2 Lack of testing laboratory

One of the major challenges so far Bangladesh has been facing is the lack of testing laboratory. Bangladesh does not have any testing laboratory to test quality and strength of plastic goods. A plastic testing laboratory & testing centre is urgently needed.

6.3 Lack of skilled labour and technological efficiency

Skilled workers for operating machines is required for manufacturing well finished products. These include mold-makers, operators and computer-based designers etc. At present, the industry suffers due to shortage of skilled workers especially in the small and medium sized enterprises. Most of the enterprises hire untrained workers. In this connection, training of unskilled workers need to be ensured. Because of incurring additional costs, SMEs show less interest for in-house training for their workers.

Lack of proper knowledge on polymer science is hindrance for developing skilled professionals in the plastic industry. Local educational institutes have limited capacity to teach and train potential professionals about polymer science and technology.

6.4 Environmental concern

Plastic industry cannot ignore the environmental concerns in the process of production of plastic goods. Hence it should develop the waste management in the production process with a view to reduce environmental pollution. Managing post-use plastic waste is increasingly becoming a major concern for Bangladesh.

6.5 Other challenges

The industry suffers due to shortages of electricity and gas supply and lack of access to capital. Because of bulky nature of products, shipment of plastic products requires lots of spaces and incur high shipment costs. Moreover, shipment from Bangladesh is relatively high as due to high freight cost. Such transportation costs put the local products in pressure in the global market vis-à-vis those of other countries.

6.6 Withdrawal of GSP in the US Market

The plastic sector is partly affected due to withdrawal of the GSP in the US market owing to non-compliance of the garments and shrimp sectors. Although export of plastic products to USA as deemed exports have increased after US’s decision with the rise in export of apparels. However, direct export of plastic products did not pick up after the incidence. Export to USA has increased but its growth was slow due to lack of preferential market access facility. Under the changing circumstance, Bangladeshi products including plastic products is facing MFN duty (3-15 per cent depending on the category of products). Overall, withdrawal of GSP has partly put pressure to the export competitiveness of the plastic products in the US market.

- Recommendations for Development of Export-Oriented Plastic Sector

7.1 Need Proper Endorsement of Plastic Sector in National Policies/Accounts

Proper manifestation of the Export-oriented plastic sector in national data is urgently needed. In this regards, deemed export needs to be reported separately in export related data in order to provide better understanding about the exact contribution plastic products in export. However, authorities should be cautiousness about avoiding the ‘double counting’ of export value of plastic from apparels. It is seen that national policies need to be more balanced in order to create space for development; therefore, potential sectors need to be acknowledged properly in major national policies. Government may consider formulating sector-specific policies in order to ensure balanced growth of this growing sector.

7.2 Need Support for Technological Up-gradation

Local plastic industry needs to achieve proper mold preparation and maintenance capacities. A feasibility study needs to be undertaken to assess the demand for high-quality mold making facility at the local level. Besides, introduction of better technology in recycling industry is needed for long-term sustainability of the plastic industry. In this regard, setting up an Institute of Plastic Engineering and Technology is needed.

7.3 Need More Local and Foreign Investment

For further development, both local and foreign investment is essential in this sector. Such investment is needed to address the potentials for different goods such as toys, plastic products used in electrical items and plastic products used in automobiles. Investment for manufacturing basic raw materials is also needed such as polypropylene and PVC.

7.4 Need More Skilled Workers

Given the scarcity of skilled workers and professionals, extended level of training for workers is required. Different kinds of training particularly on use of CAD/CAM and design of software need to be arranged for improvement of product design. Bangladesh Standard Testing Institute (BSTI) should be equipped with modern amenities and trained professionals in order to facilitate industry for standardization and quality improvement issues. Government should ensure uninterrupted supply of power and gas supply for at least eight to twelve hours a day in order to minimize labour cost and wastages of raw materials.

7.5 Need to Address the Environmental Concern

As most of the plastic industries are located in the city of Dhaka and nearby areas, environment pollution is increasingly becoming a major concern for the plastic industry. Thus relocation of plastic recycling factories from old Dhaka should be undertaken as early as possible. In this connection, establishment of industrial park for plastic products is urgently needed.

Dr Khondaker G Moazzem and Farzana Sehrin are addl. research director and research associate respectively at the Center for Policy Dialogue (CPD). Dr. Moazzem can be reached at: moazzemcpd@gmail.com