Published in The Daily Star on Wednesday 8 January 2020

Trade deficit tapering off

Development a source of concern

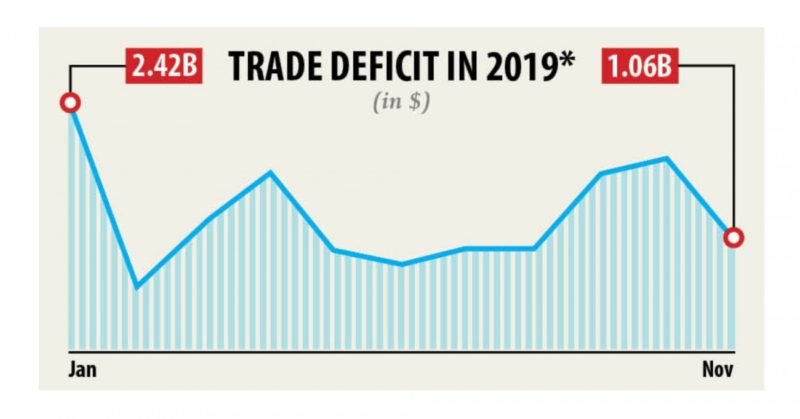

Trade deficit narrowed 79.51 percent in November to $1.06 billion from the previous month on the back of sliding imports — a worrying development as it suggests of sluggishness of the economy.

November’s figures were down 19.70 percent from a year earlier, according to data from the Bangladesh Bank.

The decreasing trend of trade deficit is good for a strong economy but such a phenomenon is not a positive indicator at all for the growing economy like Bangladesh, experts said.

During the period, imports declined 17 percent from a month earlier to $4.06 billion and exports nearly 1 percent to $3 billion.

“Both falling exports and imports is a sign of an economic slowdown,” said Fahmida Khatun, executive director of the Centre for Policy Dialogue, adding that businesses are facing a lack of confidence in activating their investment plans for want of a conducive climate.

Bangladesh’s ranking in the World Bank’s ease of doing business index is far from ideal and that has hit the confidence of businesses.

Inadequate infrastructure, corrup-tion and bureaucratic complexities discourage businesses from going for expansion by taking bank loans, Khatun said.

Besides, banks are also feeling discomfort in giving out loans to businesses due to high volume of default loans, which has squeezed their capacity for disbursement.

On top of that, the government has recently taken a decision to fix the interest rate for lending at 9 percent from April 1 — a move not welcomed by banks.

“Banks think that loan disbursement at that rate will not be viable for them in many cases.”

The import of both capital machinery and raw materials, the two major ingredients for expansion of industries, have been nosediving in recent months, sounding an alarm on the manufacturing sector as whole.

“This had an adverse impact on exports as well,” Khatun added.

The lower import growth has also brought a negative impact on private sector credit growth, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

In November last year, private sector credit growth dropped to 9.87 percent, which is the lowest since 2008 at least. Bangladesh Bank’s data goes as far back as 2008. “We should give our all-out effort to bring back the confidence of businesspeople for the greater interest of the economy.”

Both exports and imports will turn around from the existing frustrating condition if businesses get back their confidence, he added.

The overall trade deficit in the first five months of fiscal 2019-20, however, were higher by $28 million from a year earlier at $6.68 billion.

“But the upward trend will not be sustainable if imports maintain the declining stance,” Khatun said.

The deficit in current account balance, however, decreased more than half to $1.09 billion in the first five months of the fiscal year due to a remarkable growth in remittance.

Between July and November this fiscal year, remittance inflows stood at $7.71 billion, up 22.71 percent from a year earlier. This has brought relief for the government in management of the external sector of the economy, said a central bank official.