Originally posted inThe Business Standard on 15 May 2025

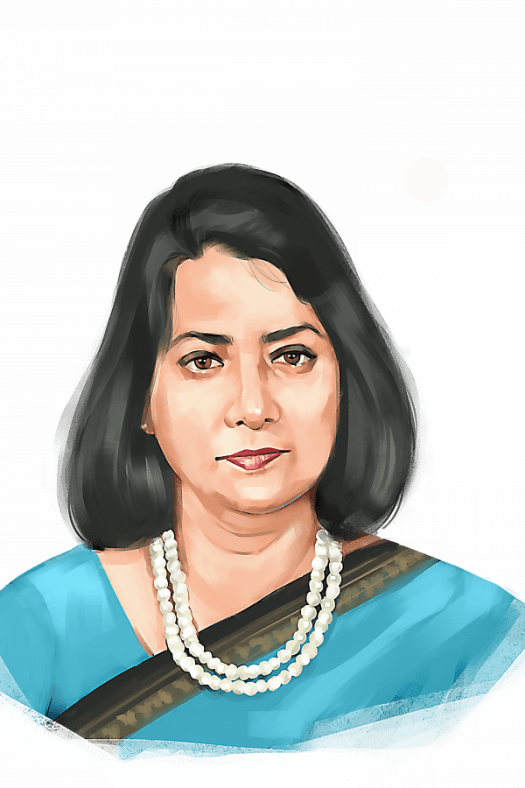

Now is an appropriate time for Bangladesh to adopt a market-based exchange rate system, regardless of the conditions set by the International Monetary Fund (IMF), Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD) said today (15 May).

Speaking to The Business Standard, Fahmida argued that a flexible exchange rate would help prevent opportunistic behaviour and reduce the chances of manipulation.

She pointed out that while peer economies such as India, Pakistan, Vietnam, China, and Indonesia have devalued their currencies recently, the Bangladeshi taka remained artificially appreciated.

$3.5b loan unlocked with shift to market-based exchange rate

“This was done to provide undue benefits to certain groups,” she said.

Although the country’s foreign reserves have not significantly increased, she noted they have remained stable recently. With remittance and export earnings showing positive trends, she believes the situation is conducive to a market-based rate.

The gap between receivables and payables has also narrowed considerably, she added.

According to her, moving to a market-based exchange rate would boost both domestic and foreign investor confidence, enhance export and import competitiveness, and help businesses make more informed decisions.

“Most importantly, it would reduce volatility in the foreign exchange market, as rates would no longer be subject to arbitrary interventions,” she said.