Originally posted in The Business Standard on 10 March 2025

Private sector credit growth hits decade-low

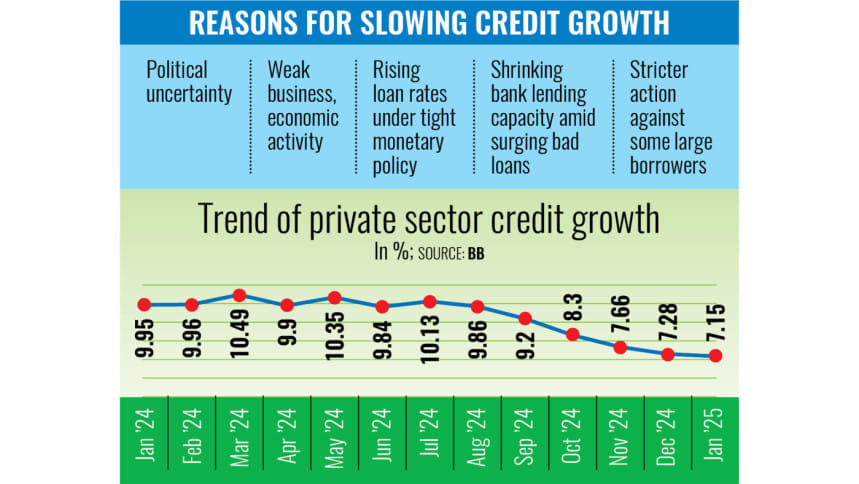

Credit appetite of the local private firms continues to fizzle out as the ongoing battle against inflation makes bank borrowing more expensive amid a volatile political climate after the August political changeover.

In January this year, credit flow to private firms grew by only 7.15 percent, the lowest since at least 2015, according to data from the Bangladesh Bank.

January’s growth was 2.65 percentage points lower than the target of 9.80 percent that the central bank has set for the second half of fiscal year 2024-25.

In December last year, loans to private firms grew only by 7.28 percent, according to central bank data.

Economists and bankers said this was a consequence of the central bank’s tight monetary stance.

For over two years, the central bank has been hiking the policy rate to combat skyrocketing inflation, which has contributed to the rise in lending rates at banks.

The banking regulator kept the policy rate unchanged at 10 percent for the January-June period of FY25.

However, experts opined that uncertainty in investment climate, banks’ go-slow strategy after the political changeover, and lackluster loan recovery also weighed on credit growth alongside the tight-fisted monetary stance.

“The policy rate has to remain high due to the contractionary monetary policy, which impacts the lending rates. This is why the demand for credit has reduced,” said Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD).

“We are now seeing a wait-and-watch approach regarding private sector investment due to ongoing uncertainty and the impending general elections,” the economist added.

He added that the trends of letter of credit (LC) opening for capital machinery imports reflect this investment reluctance.

During July to January of the current fiscal year, LC opening for capital machinery fell by 33.68 percent to $1 billion, while LC settlements for capital machinery declined by 27.33 percent to $1.24 billion, according to the central bank data.

Rahman also noted that disruptions at the borrower level contributed to the slowdown as some large borrowers have defaulted and are unable to secure new loans, impacting the overall private sector credit.

“On the other hand, new entrepreneurs have adopted a go-slow strategy in taking loans,” he said.

He believes private sector credit demand will remain subdued until the elections.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, told The Daily Star that he had never seen such slow credit growth during his over three-decade career.

The senior banker attributed the slowdown to heightened lending rates and a worsening law and order situation following the recent political changeover.

“Panic has gripped investors in recent months due to the weak law and order situation,” he said, adding that some garment companies have shut down recently.

Rahman, also a former chairman of the Association of Bankers, Bangladesh, said that around 10 banks have seen their lending capacity erode due to massive irregularities and scams, further impacting private sector credit growth.

Echoing those sentiments, a senior official of a private bank said that investors are unwilling to invest with an interim government in power due to political uncertainty.

“New investment in the private sector as well as industry expansion remain stagnant and everyone is now waiting for the national election,” he pointed out.

As of January this year, outstanding credit to the private sector stood at Tk 1,680,110 crore, according to central bank data.