Published in The Daily Star Monday, 13 June 2016

Falling interest rates on deposits erode NBR’s tax receipts

Sohel Parvez

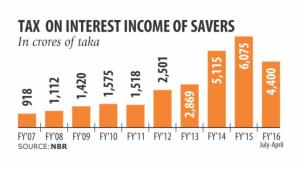

Sliding interest rates on deposits have taken a toll on the National Board of Revenue’s takings from savers — a development that taxmen say might not lead to growth in collections this fiscal year.

Sliding interest rates on deposits have taken a toll on the National Board of Revenue’s takings from savers — a development that taxmen say might not lead to growth in collections this fiscal year.

The tax authority logged in about Tk 4,400 crore as tax from interest income from bank deposits in the first ten months of the fiscal year. The amount is 72 percent of last year’s takings of Tk 6,075 crore.

“Our collection from interest earnings on savings and other deposits is still in line with the last year’s collection. But it may not be possible to register growth over the previous fiscal year,” said a senior official of Tax Zone-1, the main collector of tax from interest income of savers.

Tax deducted from interest earnings of savings and fixed deposits is the second biggest source of withholding tax collected by the NBR. The weighted average interest rates on deposits dropped to 5.92 percent in March from 7.06 percent a year earlier. In March 2014, it was 8.21 percent, according to the Bangladesh Bank.

Over the last two years, sluggish demand for loans and eagerness by a section of entrepreneurs to borrow from abroad forced banks to cut lending rates and, as a result, to lower deposit rates. The lending rate came down to 10.78 percent in March from 13.36 percent a year ago, according to central bank data.

The official said many of the fixed deposit schemes, which were opened earlier at higher interest rates, are now maturing. As a result, the impact on collections has so far been low, he said.

But the full brunt will most definitely be felt in the incoming fiscal year, as the interest rates have again declined this year, he added.

The government has been collecting tax from profits or interest incomes of depositors for more than two decades now, irrespective of whether the savers have taxable incomes or not — the justification of which is questioned by many.

As of April, there were 7.62 crore bank accounts, 76 percent of which are savings accounts.

The total deposits stood at Tk 762,669 crore, in contrast to Tk 699,673 crore at the end of June last year, according to BB. Currently, the NBR charges 10 percent tax on interest income of savers who have submitted their taxpayer identification numbers to banks.

Depositors who do not have TINs or have not submitted TINs to the banks against deposits face a 15 percent tax deduction on interest incomes from savings and fixed deposits.

From next fiscal year, the tax authority is seeking to impose a 5 percent source tax on interest earnings of provident, pension or gratuity funds’ bank deposits and savings instruments to bring all deposits under its withholding tax net and boost collections. The measure may not help accelerate tax collection from deposits in banks because of the decline in interest rates, said the official.

In addition, the NBR also collects 5 percent tax on interest income from savings instruments for investment above Tk 5 lakh a year.

The tax on savings instruments is completely unacceptable in a country that has got no universal social welfare scheme or universal pension scheme, said Anis A Khan, managing director and chief executive of Mutual Trust Bank.

In any case, the investment in government savings is limited by law and mostly retired people invest their life-long savings in these government bonds for better living standards, he said.

“So, tax on these instruments will be a burden and result in a decline in their living standards,” said Khan, adding that tax on interest earnings from bank deposits is also not acceptable.

The imposition of tax on interest earnings forces people who deposit money in others’ names to avoid tax and hide wealth to pay tax, said Towfiqul Islam Khan, research fellow of Centre for Policy Dialogue.

“From that perspective, the measure seems okay as it helps bring untaxed money under the tax net.”

However, it also needs to be recognised that many savers who do not necessarily fall under the tax bracket are penalised by such measures, he said, while suggesting the government introduce a threshold level to protect the small savers.