Published in The Financial Express on Tuesday, 18 April 2017

The Centre for Policy Dialogue (CPD) Report

The report presents Centre for Policy Dialogue’s (CPD’s) perspectives in the context of the upcoming FY2018 budget by taking the current dynamics of macroeconomic performance as the reference points. Here we place the first part of the report that presents a positive trend in respect of inflation, bank interest rates, NBR revenue, proxy indicators showing positive signs in private investment etc.

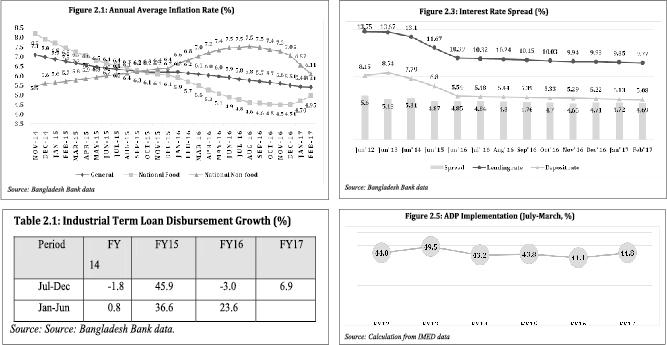

Designing of national budget for FY2018 ought to take into cognisance the context in which the exercise is being carried out. Hence, it is important to review Bangladesh’s current macroeconomic trends which will inform the fiscal-budgetary allocations, measures and incentives to be proposed in the budget. MACROECONOMIC CORRELATES IN POSITIVE TREND Headline inflation continued to decline albeit with some rise in food inflation. Consumer Price Index (CPI) inflation in Bangladesh has maintained the declining trend in FY2017, till February 2017 (Figure 2.1). Annual average inflation was 5.41 per cent in February FY2017 which was well within Bangladesh Bank’s Monetary Policy Statement (MPS) target of 5.3-5.6 per cent for FY2017. However, this declining trend is primarily driven by declining non-food inflation, although the rate was higher compared to food inflation. Within non-food inflation, inflation of medical care and transport expenses have seen some slow down. On the contrary, inflation of rent, fuel and lighting is showing upward trend in recent months. In view of this, the government’s decision to further increase gas and electricity price may exacerbate the inflation situation over the coming months. At the same time, the decision to keep administered retail prices of kerosene and diesel unchanged in the domestic market deprived the consumers and producers of Bangladesh to get some relief on account of the lower oil price in the global market. Indeed, it may be noted here that, price of kerosene, which is the primary source of energy for the poor in Bangladesh, is currently about 1.8 times higher than that of Kolkata, India.

At the same time, the rising food inflation since January 2017 needs to be closely monitored in view of its adverse effect on the poorer households. Rising rice price in recent months in the backdrop of declining public stock appears to be the major cause that is pushing food inflation upward. At present, coarse rice price is about 24 per cent higher than a year ago. Also, average rice price in Bangladesh is about 27.9 per cent higher than that of India. Observation of recent data suggests a negative correlation between rice stock and rice price. It needs to be noted with due seriousness that, FY2017 marks the lowest level of rice stock in March since FY2012. Also, Aman procurement (till the end of March 2017) to the tune of 444 thousand MT, fell somewhat short when compared against the target of 500 thousand MT. It will, thus, be advisable that the policymakers take a closer look at the stock situation and calibrate the targets for Boro season procurement accordingly.

INTEREST RATE CONTINUED TO FALL WITH STICKY SPREAD: Interest rates for both lending and deposit continued to decline throughout the FY2017, in line with the declining trends experienced in FY2016. Curiously, both of the rates have been decreasing by maintaining a similar trend with the result that the spread has been hovering around 4.7 per cent (Figure 2.3). It needs to be closely monitored to what extent the weak state of the corresponding banking sector parameters including non-performing loans (NPL) and CAMELS indicators (see below), is contributing to a situation where the spread are not coming down. Indeed, without significant improvement in corporate governance and operational efficiency in the banking sector, further reduction of the spread will be difficult. As is the case, Bangladesh Bank’s directives to the commercial banks to raise efficiency has not produced any visible success.

PROXY INDICATORS FOR PRIVATE INVESTMENT SHOW PROMISING SIGNS: FY2016 ended with an upturn in private investment-GDP ratio. During July-February of FY2017, capital machinery import, which has important investment implications, registered an impressive growth of nearly 24.0 per cent. However, this investment was concentrated in one particular area, the power sector (CPD, 2017). This uptake is reflected in the private sector credit which increased by 15.9 per cent by the end of February 2017 compared to the corresponding period of FY2016. During July-February of FY2017, net foreign direct investment (FDI) inflow also increased by 17.4 per cent.

Agriculture credit disbursement registered 21.8 per cent growth during July-February of FY17, which was 14 per cent during corresponding period of FY16. It is to be noted that, this is the highest attained growth since FY2014. Non-farm rural credit also rose by 28.6 per cent during the aforesaid period. Additionally, loan disbursement to small and medium enterprises rose by 21.7 per cent during July-December of FY2017.

On the flipside, industrial term loan disbursement recorded only 6.9 per cent growth during July-December of FY2017, which was (-) 3.0 per cent over the matched period of FY2016. As can be seen from Table 2.1, during the January-June period of both FY2015 and FY2016, growth rate of industrial term loan disbursement was significantly high. Replicating similar growth in FY2017 has proved to be difficult.

To be able to reap the benefits from the prevailing scenario, it is important to deliver infrastructure and policy support in a timely fashion. Of particular importance in this connection is ensuring the availability of gas and electricity and raising efficiency of port facilities on a priority basis.

Balance of payment situation is still at a comfortable zone. Up to February of FY2017, the overall balance of payments was positive (USD 2.5 billion) while current account balance fell into the deficit terrain [(-) USD 1.1 billion which was USD 2.9 billion during the corresponding period of FY2016]. Higher trade deficit alongside the falling remittance inflow have contributed to this. During July-February of FY2017, taka has appreciated against Euro, Chinese Yuan and GBP and depreciated against USD and Indian Rupee. Foreign exchange reserves stood at USD 32.2 billion at the end of March 2017 – indicating nearly a USD 2.2 billion increase from July 2016. The Government of Bangladesh is considering to utilise the growing forex reserve for infrastructure development through a sovereign wealth fund. CPD argued that independent institutional mechanism, moderate interest rate, feasible maturity period and appropriate monitoring and governance should be the key concerns in the aforementioned context. It is also to be noted that whilst the reserves do provide a cushion in terms of months of import that it can sustain, growing debt servicing and other obligations in terms of foreign exchange payments should inform any policy decision in this context.

NBR REVENUE COLLECTION GROWTH IMPROVED: FY2017 set an ambitious NBR (National Board of Revenue) revenue growth target of 38.9 per cent compared to the actual collection in FY2016. Against this the attained growth has been 20.6 per cent up to October of FY2017 when compared with the corresponding period of the previous fiscal year. The comparable periods for FY2015 and FY2016 registered a much lower growth of 8.0 and 10.9 per cent respectively. However, the required growth of NBR revenue for the remainder of FY2017 is 45.8 per cent which is not likely to be achieved. It is likely that a significant revision of revenue mobilisation target will be made while preparing for the budget for FY2018. It may be recalled that, CPD (2017) expressed its apprehension that the revenue mobilisation by the end of fiscal year was likely to be about Tk. 38,000 crore (Tk 380 billion) lower than the target set for FY2017. In view of this, further efforts towards domestic resource mobilisation along with exploration of new avenues ought to be one of the key priorities that should inform the forthcoming budget for FY2018.

ADP IMPLEMENTATION PACE SOMEWHAT RECOVERED: ADP implementation was 44.8 per cent during July-March of FY2017. This is an improvement over similar timeline of FY2016 (41.1 per cent) and the second highest after FY2013 (Figure 2.5). It may be said that ADP implementation has recovered from its earlier slump in July-March of FY2016 and returned to trend performance pace. However, this recovery is primary anchored on higher expenditure of local resources. Utilisation of foreign funding is lowest in last five years. Besides, pace of implementation of the fast track projects have been mostly unsatisfactory. Up to February, 2017 implementation rates in FY2017 for the Padma Multipurpose Bridge and Padma Bridge Rail Link were 30 per cent and14 per cent respectively against respective allocations for FY2017. However, for construction of Single Line Dual Gauge Track from Dohazari-Ramu-Cox’s Bazar and Ramu to Ghundum near Myanmar Border the corresponding figure was 67 per cent. Similarly, up to January, allocations for FY2017 for the Dhaka Mass Rapid Transit Development Project (Metro Rail) and Rooppur Nuclear Power Plant Projects have been used to the tune of only 4.4 per cent and 25.5 per cent respectively. Implementation of deep sea port projects at both Paira and Sonadia appears to be stalled. Slow progress of these projects is reflected in the low demand for funds. It may be recalled that, revised ADP (RADP) allocation for Padma Multipurpose Bridge was 48.5 per cent of the original allocation in FY2016. One should caution that the slow pace of progress of these mega projects will likely result in higher cost. Also this will create uncertainty among the private investors as regards timely delivery of the needed infrastructure contingent upon which investment decisions are made.