Published in The Financial Express on Thursday, 20 April 2017

The Government of Bangladesh has been increasingly reliant on the sales of National Savings Directorate (NSD) certificates for budget deficit financing. Net sales of NSD certificates stood at Tk. 28,894.15 crore (Tk 289 billion) during July-January of FY2017 which is 74.0 per cent higher than that of the corresponding period of FY2016. It should be noted that the target for net sales of NSD is Tk. 19,610 crore (Tk 196 billion) for the entire FY2017. Accordingly, the sales up to the month of January was already an astounding 47 per cent higher than the annual target. As is known, NSD instruments entail payment of higher interest rates; consequently, higher amount of resources will be required for debt servicing. This could put under jeopardy the country’s relatively comfortable debt sustainability track record and credentials. Hence, a downward revision of NSD rates, as also maximum ceiling on purchase, may be considered recognising the fall in the deposit interest rates in commercial banks and in view of the medium to long term implications of accumulating debt servicing liabilities of the government.

WEAK BANKING SECTOR PERFORMANCE PERSISTS: Non-performing loan (NPL) in the banking sector continued its usual cyclical pattern but remained higher than previous years’ levels. Over the last few years NPL as a share of total outstanding loan tends to come down in December but then registers a rise afterwards. A possible reason could be restructuring and rescheduling of loans that takes place at the end of December every year. While state-owned commercial banks (SCB), specialised banks (SB), and private commercial banks (PCB) evinced mixed trends over the last four quarters, foreign commercial banks (FCB) exhibited upward trends with respect to the NPL. It should be mentioned that the Government of Bangladesh injected a total amount of Tk. 9,655 crore (Tk96 billion) over the last five years (between FY2012 and FY2016) in order to recapitalise the SCBs plagued with NPL. In FY2017 there was a Tk. 2,000 crore (Tk 20 billion) budgetary allocation for this. At the same time, the commercial banks have significant amount of excess liquidity in the face of lack of domestic demand and in view of the tendency of large investors to borrow from abroad.

Bangladesh is to fully implement BASEL III from January 2020. As a core requirement, between 2015 and 2019, the commercial banks need to maintain a capital adequacy ratio (CAR) to the tune of 10.625 per cent in 2016. In December 2016, neither the SCBs nor the SBs could maintain the minimum requirement. Although PCBs and FCBs maintained CAR above the minimum requirement, underperformance of SCBs and SBs brought down the total share below the minimum requirement. This state of affairs calls for adequate policy attention since the required CAR for 2017 has been set at 11.25 per cent.

Of the profitability indicators for banks, both Return on Asset (ROA) and Return on Equity (ROE) have come down from 0.77 per cent and 10.51 per cent respectively at the end of December 2015 to 0.71 per cent and 9.92 per cent during the corresponding period of 2016. The ROA for SCBs, SBs and FCBs deteriorated from (-) 0.04, (-) 1.15 and 2.92 per cent respectively in December 2015 to (-) 0.16, (-) 1.40 and 2.56 per cent respectively in December 2016. On the other hand, ROA for PCBs remained nearly unchanged at 1.03 per cent. From December 2015 to December 2016, the ROE for SCBs, SBs and FCBs deteriorated from (-) 1.47, (-) 5.79 and 14.59 per cent respectively to (-) 6.02, (-) 6.94 and 13.09 per cent respectively. The ROE for PCBs has somewhat improved from 10.75 per cent in December 2015 to 11.09 per cent in December 2016.

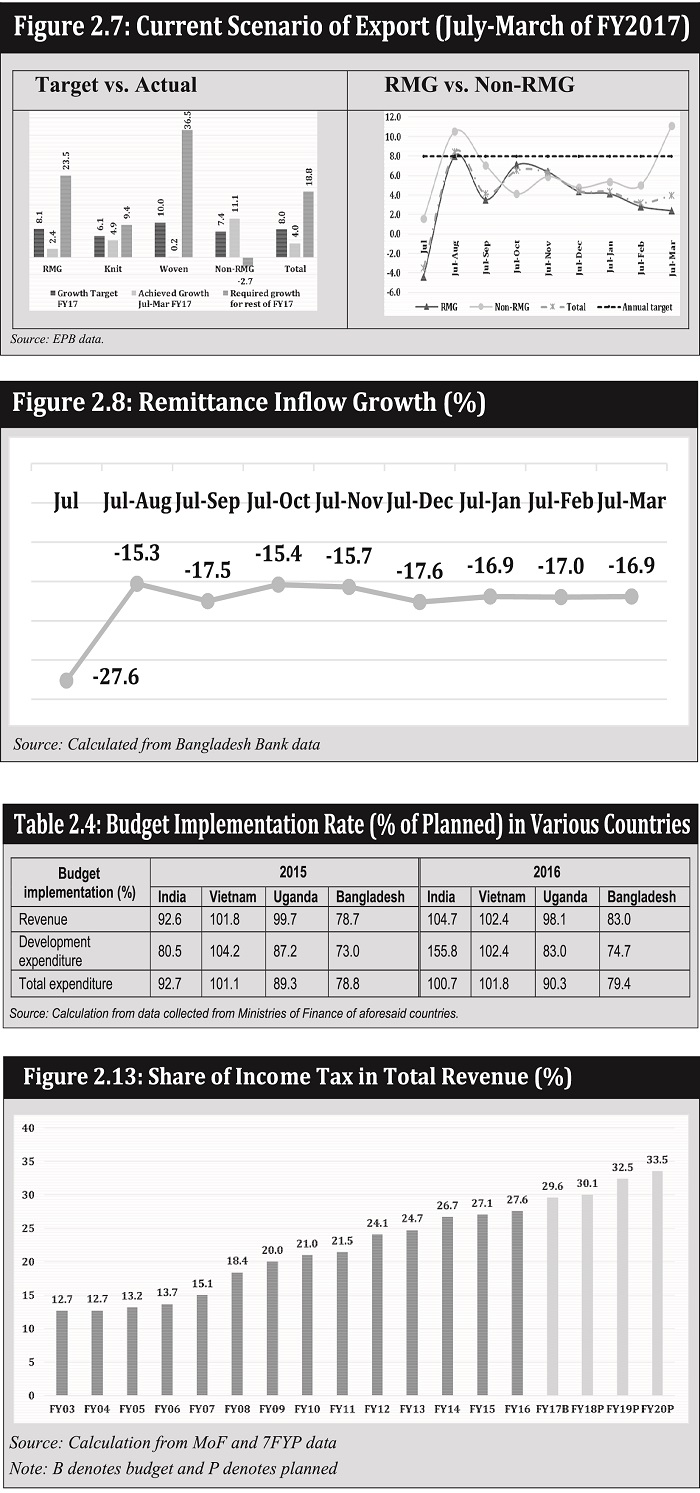

LOWER GROWTH IN EXPORT EARNINGS HAS EMERGED AS A CONCERN: During the first nine months of FY2017, export earnings have remained below the annual target [Figure 2.7]. According to Export Promotion Bureau (EPB) data, export earnings rose by 4.0 per cent during July-March period of FY2017 against the annual growth target of 8.0 per cent. Export growth of RMG products (2.4 per cent) was below the target (8.1 per cent). Knit RMG items attained 4.9 per cent growth during July-March of FY2017 against the annual target of 6.1 per cent. Over the same timeframe, woven RMG items recorded a lowly 0.2 per cent growth as opposed to the target of 10.0 per cent. On the contrary, non-RMG products registered 11.1 per cent growth against the annual target of 7.4 per cent. The better performance of non-RMG products was underpinned by leather products and footwear, jute and jute goods, and engineering equipments.

Export growth in the non-traditional markets (7.5 per cent) outstripped the export growth in the traditional markets (2.8 per cent). The boost in non-traditional markets was mostly attained via impressive performance of non-RMG products in Australia, Chile, China, India, and Russia. RMG products achieved significant growth in non-traditional markets such as Chile, China, and Russia.

Export performance in the US market was rather subdued in FY2017 although it is showing some signs of improvement in recent months. Both knit and woven RMG exports have posted low growth. Performance in the EU is has experienced a gradually declining trend. This is particularly so in case of the woven exports.

The sluggish performance of Bangladesh’s export originates from depressed global demand, relative strengthening of BDT compared to some of the competitors, and relatively high cost of doing business in Bangladesh. Exchange rate of BDT against other currencies has emerged as a concern, more so against the USD. Although the nominal exchange rate has remained fairly stable in recent times, real effective exchange rate (REER) has seen some appreciation leading to erosion of Bangladesh’s export competitiveness.

REMITTANCE INFLOW CONTINUED TO EXPERIENCE DECLINE: The case of remittance inflow to Bangladesh is rather intriguing. Thus far, for all the months in FY2017 remittance inflow has declined compared to the corresponding months of FY2016 [Figure 2.8]. This has been happening at a time when monthly outward migration flow has seen a robust rise. During the July-March period of FY2017, remittance inflow declined by (-) 16.9 per cent (Figure 2.8) while outward migration rose by 30.9 per cent. While depressed economic situation in petro-dollar earning Middle-East countries, and the consequent downward pressure on salaries and wages are a cause, greater flow through informal channels has also been cited as reasons. Higher flow through money transfer agencies of various types and higher cost of sending are also reasons. A more in-depth study of the possible reasons is called for to identify appropriate policy interventions in this regard.

RECOMMENDATIONS FOR THE BUDGET: The recent trends in major macroeconomic correlates demonstrate a number of strengths on which the national budget for FY2018 can draw upon. The prevailing macroeconomic stability attributed to restrained budget deficit, sliding inflation amid low level of global commodity prices, declining interest rate, positive balance of payment and stable exchange rate provides a unique opportunity for the government to calibrate its fiscal policy in accordance with its developmental objectives. In this backdrop, the government may like to opt for an expansionary fiscal policy in the context of the upcoming national budget to serve its development aspirations as well as to support private investment uptake and accelerate the economic growth momentum. Indeed, Bangladesh economy is well-positioned for such a policy push also thanks to the comfortable debt situation of the country (Bhattacharya and Ashraf, 2017).

Since FY2010, the government has formulated national budget in a way that raises public expenditure to gross domestic product (GDP) ratio. Planned public expenditure in FY2016 was 17.0 per cent of GDP which was 14.3 per cent in FY2010. Regrettably, actual public expenditure (i.e. realised budget) declined to 13.5 per cent in FY2016 from 14.0 per cent in FY2010. Similarly, planned revenue-GDP ratio was increased from 10.0 per cent in FY2010 to 12.0 per cent in FY2016. However, actual revenue-GDP ratio was 10.0 per cent in FY2016, a rise from the 9.5 per cent posted in FY2010. Indeed, the gap between planned and realised public expenditure has widened over the years (3.5 percentage points in FY2016) compared to that between planned and realised revenue mobilisation levels (2.0 percentage points in FY2016). This implies that either the institutional capacity of the government could not keep pace with the plan laid out in the consecutive national budgets, or the design of national budget allocations was faulty.

Indeed, a number of planned reform agendas remained unimplemented and this has severely constrained the capacity of the government to raise the budget implementation rate. Successive delays in implementing the VAT and SD Act, 2012 had also held back several other revenue mobilisation reform agendas (including new Acts on Direct Tax and Customs) which constrained the revenue mobilisation efforts. As is known, the government had planned a number of reforms geared to raise the ADP implementation capacity. These included policy on the Project Preparatory Fund (PPF), appointing project directors through direct interviews by the line ministries and divisions, assigning a dedicated official in each government agency for monitoring and evaluating respective projects, and delisting the longstanding ‘non-operational’ projects from the ADP (CPD, 2016a). Regrettably, these have not been adequately followed up. Implementation Monitoring and Evaluation Division (IMED) also comes up with recommendations in the annual progress report based on the challenges faced during the project cycle on a regular basis. Again, these are often not adequately followed up with concrete measures. In this backdrop, it is also observed that large amount of allocations made against the ‘mega projects’ have remained underutilised in successive years. In addition to the above, while the prevailing low level of global commodity prices has indeed contributed to macroeconomic stability, this may have, at the same time, constrained realisation of revenue mobilisation targets.

One may also argue that public spending is affected by government’s willingness to pursue a policy of ‘fiscal discipline’ in the backdrop of weak revenue mobilisation capacity. In Bangladesh, over the last decade no national budget has aimed for a budget deficit that is higher than the threshold of ‘5 per cent of GDP’. Besides, actual budget deficit never surpassed the corresponding target levels. Indeed, over the last five years, budget deficit hovered around 3.5 per cent of the GDP.

As a matter of fact, budget implementation capacity has become a major concern from the perspective of macroeconomic management in Bangladesh. This issue has been highlighted in several CPD studies of recent years on budget analysis. Indeed, compared to other developing countries, budget implementation rate (in the areas of both revenue mobilisation and public expenditure, including development expenditure) in Bangladesh is quite low [Table 2.4].

It is often argued that opting for an ambitious target may also raise higher realisation rate. However, such relationships are very weak for both revenue and the ADP (Annual Development Programme). In view of this, it is critical to ensure discipline in formulating budgetary targets.

One of the positive developments in the area of national budget implementation is that, over the last three years (FY2014-2016) at least some part of the ADP financing could be serviced by the revenue surplus (total revenue minus all other public expenditures including amortisation payment for foreign aid). Indeed, in view of the lower global petroleum prices, required public money for ‘loans and advances’ in favour of SoEs was rather low which provided the additional fiscal space.

Maintaining this trend will require significant improvements in revenue mobilisation efforts. The 7th Five Year Plan (7FYP) aims to raise revenue-GDP ratio to 16.1 per cent in FY2020 from the 10.0 per cent in FY2016. Considering the shortfall predicted for FY2017 based on CPD projection, over the next three years, annually, on an average, 31 per cent growth will be required to attain the target. It is well understood that the revenue mobilisation plan for FY2018 will largely rely on a successful implementation of the VAT and SD Act 2012. However, without making a similar effort towards augmenting earnings from the income tax, it is highly unlikely that the aforesaid medium-term target will be achieved. Indeed, 7FYP also aims to raise the share of income tax in total revenue to 33.5 per cent in FY2020 from 27.6 per cent in FY2016 [Figure 2.13]. In order to attain this, over the next three years income tax mobilisation, on an average, needs

to increase by 43 per cent annually.

In view of above, while an expansionary fiscal policy for FY2018 is called for, the government will need to address the structural weaknesses in budget implementation by undertaking the required reforms. Besides, taking the disquieting trends in the macroeconomic scenario into cognisance, it is also important to pursue a set of economic policies including, but not limited to, fiscal-budgetary measures on an urgent basis.

First, in view of depleting growth of export earnings and sliding remittance inflow, the government should continue with devaluation of the BDT over the short term. While it is understandable that the central bank needs to consider several factors to this end, including increase in import costs leading to higher cost of production and inflationary pressure for consumers. However, this is critically important for maintaining export competiveness and ensuring adequate resource flow to the rural economy in the form of remittance inflow.

Second, the government must reduce the administered prices of kerosene and diesel. The continuous windfall gains by the BPC at the expense of consumers and producers is not well-justified. It may be recalled that a CPD study found the reduction in petroleum prices to have positive impact on economic growth, private investment and employment (CPD 2015). Moreover, the forthcoming national budget should inform how the windfall gain has changed BPC’s bottom line and how this has been made use of the BPC till date i.e. how much of this profit was used to adjust accumulated losses and repay earlier debts. Transparency in this regard can help appropriate policymaking in the areas of proposed price adjustments as also allocation of relative benefits to be enjoyed by key stakeholders and sectors (e.g. farmers, transport users, producers, exporters and consumers).

Third, the government needs to adjust both the interest rates and purchasing ceiling with respect to NSD certificates. This is important from both debt servicing liability and fiscal discipline perspective. This may also help restore interest of depositors in saving with the commercial banks.

Fourth, in view of rising rice price in the domestic market, the government will need to exercise caution and vigilance. If required, the government should go for import of rice after the Boro procurement in line with its public food distribution programme for FY2018. Given the observed volatility in prices of agricultural commodities, the government is well advised to set up an Agriculture Price Commission on an urgent basis to ensure incentivised price for the producers while maintaining market stability.

Fifth, the government needs to be prudent in allocating taxpayers’ money to SCBs for recapitilisation. It may be recalled that CPD has earlier proposed setting up an Independent Financial Sector Reform Commission (IFSRC) to come up with appropriate recommendations to address the formidable fault lines in Bangladesh’s financial sector. This Commission can undertake an in-depth review and assessment of the health and performance of the financial sector of the country and come up with concrete guidelines to deal with NPL, recapitalisation of banks and rescheduling of bad debt. This has now emerged as an urgency particularly in view of the need for a smooth transition to the BASEL III regime.

This is a slightly abridged version of the first section of the CPD’s paper titled ‘State of the Bangladesh Economy in FY2016-17: Second Reading & CPD’s Budget Recommendations’ which was released in Dhaka on April 16, 2017. The main report has been prepared by CPD IRBD 2017 Team and is available on http://cpd.org.bd