Published in Dhaka Tribune on Tuesday, 28 November 2017

Middle class feels the squeeze at rising cost of living

In 2016, the national household income was at Tk15,945, a 45% increase from Tk7,203 in 2005. On the other hand, the national household expenditure was at Tk15,715 in 2016, a 39% rise from Tk6,134 in 2005.

Shahed Mehbub, 35, currently employed as a mid-ranking executive in a private IT firm, is looking to rent a small 800 square feet apartment. He plans to move from his existing 1,100 sq ft two-bed apartment in Mohammadpur before January next year, as the landlord is getting ready to increase the rent yet again.

Mehbub, who has been living in that apartment for the last eight years, initially paid a rent of Tk8,000 per month. However, the rent has nearly doubled since then, currently standing at Tk15,000.

“The landlord is planning to raise the rent again by 15%. If only the commodity prices had remained stable, I could have afforded to stay here,” said Mehbub, head of a three-member family.

He said aside from paying more and more for essential commodities, he is now sending his daughter to school.

“It is difficult for me to afford any additional costs. To continue living in Dhaka, I must move into a smaller apartment,” he added.

The situation this lower-middle income office worker is facing is nothing unusual in Dhaka. The house rent hike, along with massive increases in commodity prices, utilities and other essentials have adversely affected the lives of most city dwellers.

According to the Consumer Association of Bangladesh (CAB), the cost of living for Dhaka residents kept going up in the last 10 years, from 2006 to 2016.

Several estimates reveal that tenants are spending around 35% to 50% or more of their income to pay house rent.

In 2006, rent for a two bedroom floor in a concrete house was only Tk3,740, which stood at an average rate of Tk19,700 last year.

The slum dwellers are even more vulnerable to the rent hike, as their rent was hiked from Tk2,250 to Tk8,500 during the same period.

Aside from the house rent, charges for essential utility services like gas, electricity and water has also gone up by around 50%.

The cost of a two burner stove went up to Tk650 from Tk400 in 2006 (61% hike), per unit of electricity is now at Tk6.99 from Tk4 in 2006 (57% hike) and per unit water is now costs Tk10 from Tk5.50 of 2006 (55% rise), CAB data shows.

In a latest development, Bangladesh Energy Regulatory Commission (BERC) on Thursday raised the price of retail electricity Tk0.35 per unit, or 5.3% on a weighted average, putting more pressure to consumers.

As the average household income saw an increase in the last decade, the household expenditure also witnessed a sharp rise.

In 2016, the national household income was at Tk15,945, a 45% increase from Tk7,203 in 2005. On the other hand, the national household expenditure was at Tk15,715 in 2016, a 39% rise from Tk6,134 in 2005.

Although the cost of living and household income has increased in the last decade, but this statistic does not apply to all income groups.

Speaking to the Dhaka Tribune, a significant number of people from low and middle income groups said they are spending a major portion of their income for food, which left no room for savings in their budget.

Rubel Miah, a rickshaw puller from Rangpur earns about Tk500 a day, but it is quite hard for him to make ends meet as the prices of essential goods are sky-rocketing.

“Of course, I do earn more money than what I used to make 10 years ago, but I cannot put aside money for savings after buying essential commodities for my family,” Rubel said.

A 2015 survey report by Bangladesh Bureau of Statistics (BBS) reveals that a rickshaw puller earns around Tk446 a day, and work on an average 26 day a month. After paying rent to the rickshaw owner, their net income stands at around Tk368 per day.

The average earnings of rickshaw and van pullers are Tk500 a day and Tk12,620 a month, the survey report said.

Addressing the issue, Dhaka University’s development studies department professor Rashed Al Mahmud Titumir said: “If the actual labour wages and general inflation had risen simultaneously, it would not have been a matter a concern. However, the BBS survey found that the labour price has dropped by 8% from 2010-11 to 2014-15.”

The data clearly shows that the poor had been hit the hardest by inflation, said Titumir, who is also the chairman of multidisciplinary think tank Unnayan Onneshan.

A number of economists pointed out that the change in inflation rate has affected the intricate relationship among commodity prices, low labour wages, and changes in food habit.

Higher food prices and lower income eventually leads to malnutrition, starvation and physical complications, which in turn are severely affecting the working class families.

Prof Rashed also added that the production cost has risen exponentially, as the government did not act on time, nor did it take timely steps such as reducing the tariff and launching OMS sales to tackle the food shortage.

“This directly contributed to the exorbitant price hike of essential commodities.”

Ahmed Ullah Bhuiyan, a retired government service holder who lives in Dhaka’s Mohakhali area, said it is becoming increasingly difficult to support a five-member family because of the sky-rocketing prices.

One of his sons is employed at a private firm and helps him out by paying the house rent and bills. But, the increasing cost of living has forced the family to cut their expenses.

“We had to drastically change our food habit. We rarely eat meat or fish anymore, and our family goes full vegetarian in the last ten days of the month. However, prices of eggs and vegetables are also very high,” he added.

Ahmed even had to take out money from two of his DPS prematurely in the last year to manage the educational expenses for his other two children.

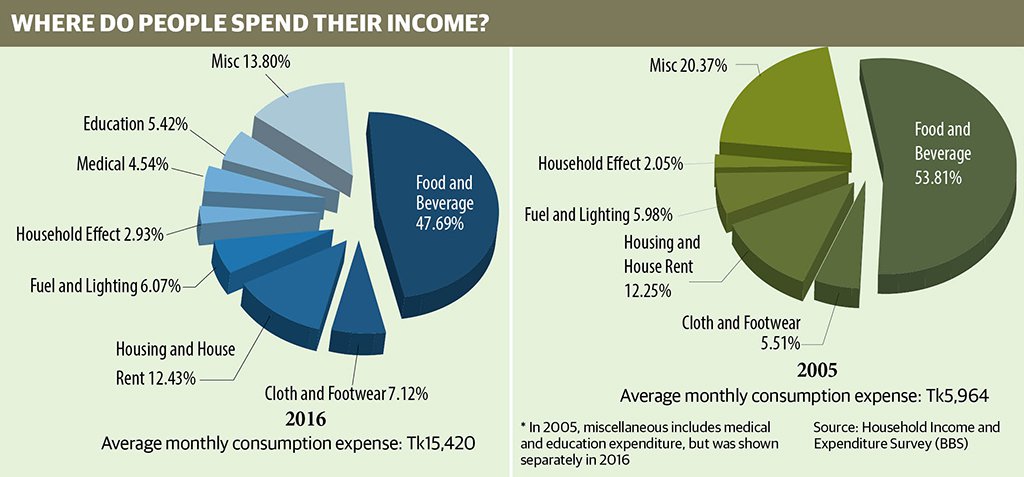

Preliminary report on Household Income and Expenditure Survey 2016, conducted by the BBS revealed that the share of food expenditure was 53.81% in 2005, but it had dropped to 47.69% in 2016, indicating that people now spend more on their non-food expenses at a national level.

The data indicates that though quality of life has improved for most, people are now spending more on non-food expenditures such as house rent, fuel and electricity, healthcare, education.

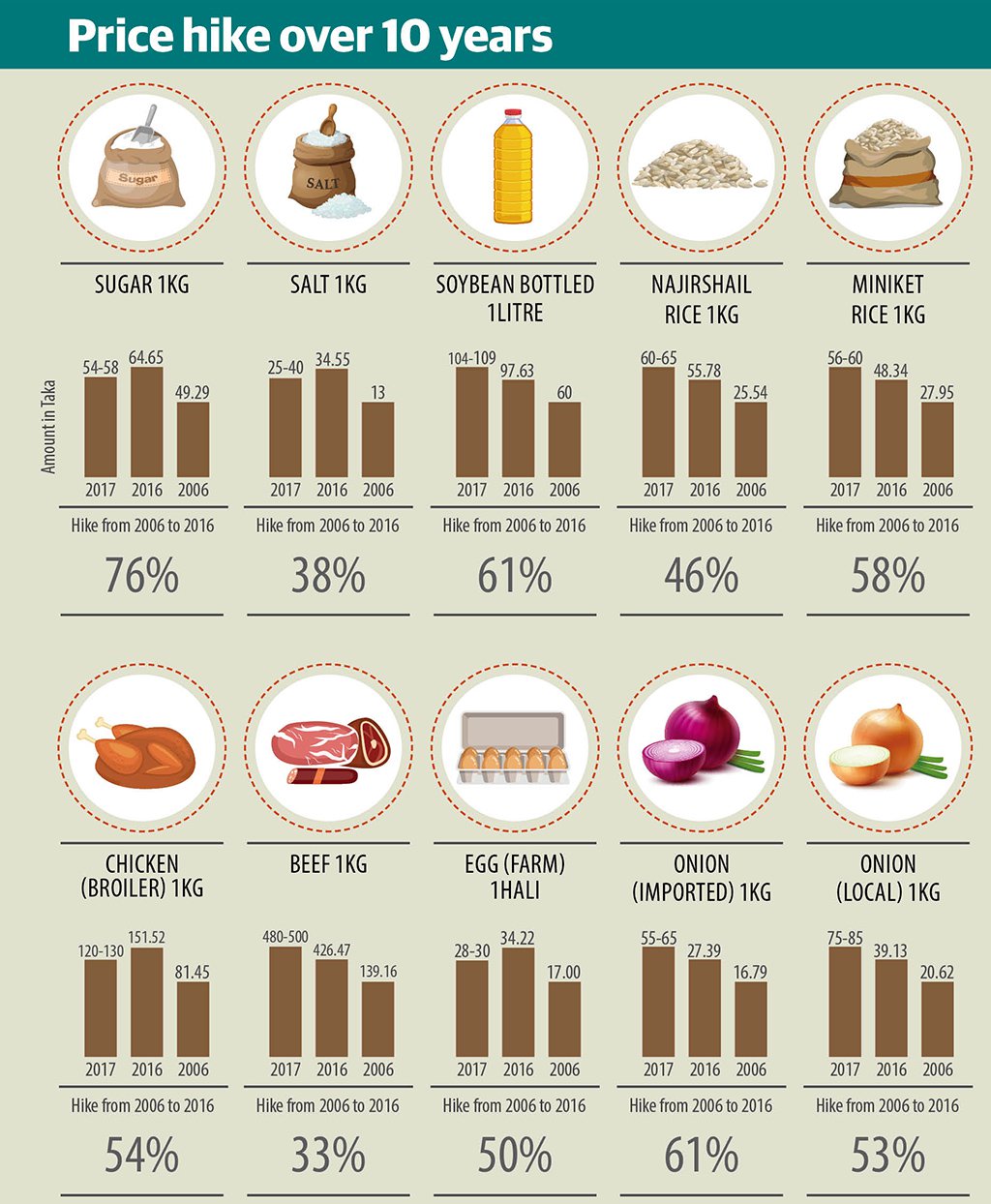

According to a CAB report, Najirshail rice was being sold at Tk26 per kg in 2006 and was at Tk56 in 2016, an increase of 46% during the period.

The price of miniket rice also saw a 58% rise as it was increased from Tk28 in 2006 to Tk48 in 2016.

Trading Corporation of Bangladesh (TCB) data says the price of Najirshail rice was sold at Tk56 to Tk60 while Miniket (fine quality) was sold at Tk60 to Tk65 in November, 2017.

The price hike has also reportedly affected the protein intake among people, as the price of eggs went up from Tk51 to Tk102 per dozen, beef from Tk139 to Tk426 per kg and chicken from Tk81 to Tk151 per kg during that period.

Mustafizur Rahman, a distinguished fellow at Centre for Policy Dialogue (CPD), said the GDP growth has increased to 6.5%, along with the household income and standard of living in the last ten years, but spending among low and fixed income people have also gone up significantly.

“The ever increasing expenditure is impacting the lives of the people. Rice prices have gone up by 10% in the last ten years. The quality of our life has not improved on par with the rising cost of living,” he added.

Mustafizur pointed out that in 2016, GDP growth was 7% and the inflation rate was 8%, which means that the standard of living of people has decreased.

“The people have also been affected by income inequality. There will be no solution to this crisis unless this inequality is properly addressed,” Mustafizur told the Dhaka Tribune.

The economist advised the government to create more sustainable and productive employment opportunities to tackle this problem.

“The government needs ideal fiscal, monitoring and security policies. It is also important to ensure good governance and tax security,” opined the CPD distinguished fellow.

Discussing the issue, CAB president Ghulam Rahman suggested that the government should diligently implement the house rent laws, reduce the use of imported fuel, and establish low cost power plants to help curb the rising cost of living.

“The lack of timely decisions by the government may fuel further inflation in Bangladesh, as imports will be more expensive. This will have an adverse impact on overall economy, but the fixed income groups are likely to bear the brunt of the financial crisis,” Prof Rashed said.