Originally posted in The Daily Star on 18 July 2023

How much will Bangladesh benefit?

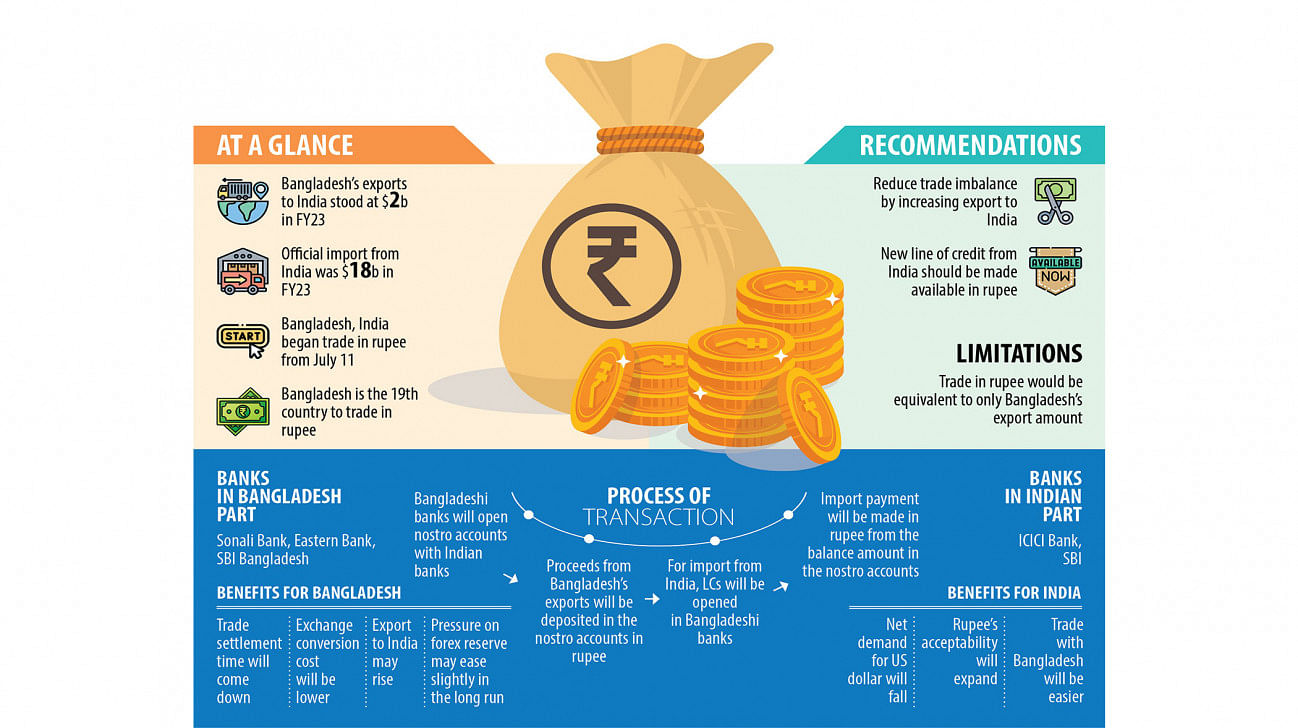

Bangladesh and India began settling cross-border trades in the Indian rupee (INR) last week, a development that has been hailed as a landmark for the growing bilateral commerce in general and for Bangladesh in particular.

Initially, the scope of making import payments would be limited to the equivalent of Bangladesh’s export earnings of around $2 billion from India.

For all latest news, follow The Daily Star’s Google News channel.

This means it might not immediately give a boost to Bangladesh’s foreign currency reserve, whose level fell by about 30 per cent in the past one year owing to higher import bills against lower-than-expected export and remittance earnings.

As per new arrangements, Bangladeshi exporters will receive their proceeds in the rupee in the nostro accounts opened with ICICI Bank and State Bank of India (SBI). The proceeds will be used to facilitate Bangladesh’s import transactions with India.

Trade analysts describe the move as a welcome step, saying it would deepen trade ties between the two neighbours, reduce dependency on the US dollar, and cut the cost of business.

“Bangladesh has found a new currency to settle international trades and this will bring benefit in the future,” said Ahsan H Mansur, a noted economist.

Before the addition of the rupee to the list of currencies used to carry out cross-border trades, Bangladesh settled trades in the US dollar, the pound sterling, and the euro, with the American greenback dominating.

Mansur said the addition of the rupee will bring no major benefits immediately, especially when it comes to alleviating the pressure on the reserve.

“This is because Bangladesh will receive rupees instead of US dollars against export proceeds since India will make payments in their currency to settle imports as well.”

The trading arrangement will be beneficial for the businesses that import from India and export to the country. Besides, trade costs will be lower for them, said Mansur.

Mansur, also the executive director of the Policy Research Institute of Bangladesh, a private think-tank, however, says local businesses may attract more customers which will raise Bangladesh’s exports to India.

Bangladesh’s scope to open letters of credit has been squeezed to some extent owing to the fall in the forex reserve.

The settlement of LCs in the rupee may solve the problem to some extent, Mansur said.

The growing trade in the rupee will help India make its currency a reserve currency, he added.

The US dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling are the reserve currencies.

Prof Mustafizur Rahman, a trade analyst, also said that trading in the INR would not bring much impact on the reserve level as a certain volume of US dollars will neither be added to the reserve nor leave it.

He said some global brands that have a presence in India may continue to purchase goods from Bangladesh in the USD.

Rahman, also a distinguished fellow at the Centre for Policy Dialogue, said the risk facing the taka will still be there since the INR may fluctuate.

He suggested attracting more lines of credit and more foreign direct investments in the rupee from the neighbouring country.

“Then it will benefit our economy.”

Atiur Rahman, a former governor of the Bangladesh Bank, said the beginning of trade in the rupee is a very first but very important step for bilateral trade.

“If Bangladesh can increase its exports to India, the benefits of the mechanism will expand. So, Bangladesh needs to find out new avenues to export more to the neighbouring country.”

If India offers a new line of credit in the rupee and the loan is used in settling LCs regarding fuels, it can lessen the pressure on the forex reserves to some extent, he said.

The former governor suggested using UPAS (Usance Payable at Sight) LC to import products from India. “This will reduce costs and popularise the system.”

The BB rolled out UPAS LC, an import system carried out on the basis of buyers’ credit, in 2012.

“We are not going to replace the US dollar. Instead, we are supplementing it,” said Amit Kumar, country head of SBI.

He said the benefits of trade in the INR are the reduction of net demand for the US dollar, the lowering of costs stemming from currency conversions, and cutting the processing time needed to carry out trades.

Kumar said a market-based exchange rate is beneficial for Bangladesh.

“The taka has depreciated steeply against the US dollar in the last one year. The rupee has not witnessed such a fall. So, settling of trades is good for Bangladesh.”

The taka has depreciated by around 10 per cent against the INR in the past one year while it weakened by around 25 per cent against the USD.

According to the SBI official, trading in the INR would be cost-efficient since hedging will not be involved. On the other hand, trades in the US dollar involve costs related to currency hedging, he said.

The move comes as India pushes to make the rupee a global currency. The Reserve Bank of India (RBI) has already put in place a mechanism to settle international trade in the currency.

The central bank of India has allowed banks from 18 countries to make payments in the rupee. The countries include Sri Lanka, Israel, Russia, Germany, Singapore and the UK. Now, Bangladesh has been included in the list.

“India wants to make the rupee a tradable currency. So, the launch of trade settlements with Bangladesh in the rupee is a good initiative from their perspective,” said Mamun Rashid, a trade analyst.

He said the initiative is good but its effectiveness will depend on the private sector since exporters will decide whether they will accept their earnings in the rupee instead of the US dollar.

“In our previous experience with China, we saw the Chinese private sector prefer the US dollar instead of the renminbi. So, it is important to see how the private sector in India reacts.”

He said the rupee and the taka have not fluctuated against the US dollar at the same pace, so a higher depreciation of the Bangladeshi currency may work in its favour.

However, the rupee can also fluctuate, he said.

The losses stemming from the currency conversion for Bangladeshi traders might still be there despite using the rupee.

This is because if an Indian buyer enters into a deal with a seller from Bangladesh, the former will have to convert the rupees into the USD first. The Bangladeshi seller will get payments in the American currency and will convert them into the taka to use them.

Now, Indian importers will not face such a conversion since the rupee will be used during the transaction, while it remains the same for Bangladeshi companies. For them, only the currency changes.

Bangladesh’s annual imports from India stand at around $20 billion. So, the demand for the US dollar will be there among importers.

Md Fazlul Hoque, a former president of the Bangladesh Knitwear Manufacturers & Exporters Association, says he is not sure how the mechanism will reduce the pressure on the forex reserve.

He said most of the exporters except those in the agro-based sector are dependent on global markets for raw materials. And they will continue to need US dollars to purchase raw materials from other countries.

The central bank will have to be careful so that this group of exporters can’t receive payments in the INR against their shipments to India since the reserve will fall if such happens, he said.