Published in The Daily Star on Wednesday, 1 June 2016

More individuals rank among the wealthy

Sohel Parvez

The National Board of Revenue found an additional 779 individuals with more than Tk 2 crore in net worth last fiscal year, in its hunt for more taxes from the wealthy.

The National Board of Revenue found an additional 779 individuals with more than Tk 2 crore in net worth last fiscal year, in its hunt for more taxes from the wealthy.

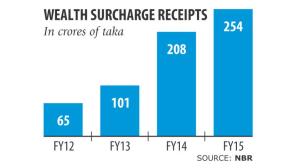

With the newcomers, the number of people paying wealth surcharge rose to 10,931 in fiscal 2014-15 from 10,152 a year ago, bringing the state coffers Tk 254 crore, which is a 22 percent rise year-on-year, according to the NBR.

Tax analysts said the number of individuals and the amount of collected surcharge is much lower than the actual numbers.

“The actual number of wealthy people is much higher. It happens because a big portion of property is shown at acquisition value,” said Syed Md Aminul Karim, a former member of the tax policy at NBR.

“Many people bought property in Dhanmondi, Gulshan and Motijheel areas three to four decades ago and their net wealth is still assessed based on purchase prices at the time. If the NBR updates property value, a higher amount of surcharge will come to the coffers.”

Land prices, particularly in Dhaka, surged in the last two to three decades amid rising population and real income.

Between 1972 and 2010, land prices in the capital grew by 100-125 percent a year, Sadiq Ahmed, vice chairman of the Policy Research Institute of Bangladesh, told The Daily Star earlier.

Similarly, apartment prices also rose over the years.

Karim said NBR would get at least Tk 1,000 crore in surcharge if it updated property value based on the income and wealth statements submitted by taxpayers.

“A property valuation unit should have been formed at the NBR. This can also be done now. This area has a very high revenue potential.”

The government introduced wealth surcharge in fiscal 2011-12 as an alternative to wealth tax, to ensure equitable distribution of wealth and reduce economic disparity.

In the first year, the state got only Tk 65 crore after the government imposed a 10 percent surcharge on net wealth worth over Tk 2 crore.

Later, new slabs were created to collect the tax at a higher rate from the wealthy.

In the outgoing fiscal year, a person with a net wealth of over Tk 2.25 crore but less than Tk 10 crore faces a 10 percent surcharge on their payable tax. A 15 percent surcharge is applicable to net wealth of more than Tk 10 crore, but less than Tk 20 crore.

Persons having a net wealth of more than Tk 20 crore but less than Tk 30 crore face a 20 percent surcharge; it is 25 percent for those with a net wealth of more than Tk 30 crore.

Ahsan H Mansur, executive director of PRI, termed the imposition of wealth surcharge on payable tax as a wrong way to collect revenue. “This is not becoming a tax on wealth,” he said.

The rate of income tax has been increased by imposing the surcharge on payable income tax, he added.

He suggested NBR properly value property because people who buy land or apartments at a higher price now come under the wealth surcharge tax net. But those who bought properties earlier at lower prices remain out of the purview, he added.

Towfiqul Islam Khan, research fellow at the Centre for Policy Dialogue, sees the rise in the number of persons paying surcharge and the revenue collected as positive.

“In an absence of appropriate property taxes, such surcharge can contribute to socio-economic justice in Bangladesh. There is no doubt that more rich people can be brought into the surcharge category. The NBR should continue its efforts.”