The Centre for Policy Dialogue’s (CPD) has organised a media briefing on the release of the State of the Bangladesh Economy in FY2017-18 (Second Reading) and CPD’s Budget Recommendations for FY2018-19. The event was held at CIRDAP Auditorium, Dhaka on 17th April 2018.

Published in The Daily Star on Wednesday, 18 April 2018

Banking sector now an orphan: CPD

Star Business Report

The banking sector, which is currently going through choppy waters thanks to rising loan irregularities and deteriorating corporate governance, is being enabled by those who were supposed to keep it in check, said the Centre for Policy Dialogue.

“Now I think the banking sector has turned into an orphan and its protectors are abusing it,” said CPD Distinguished Fellow Debapriya Bhattacharya at a press conference yesterday.

The independent think-tank organised the meet at the Cirdap auditorium to share its recommendations for fiscal 2018-19’s national budget.

Bhattacharya’s comments come as the finance ministry, under pressure from directors of private bank, in a flurry of moves earlier this month undid the tight monetary stance announced in January for the second half of fiscal 2017-18.

“This has seriously undermined the independence of the central bank and has dented its credibility,” the CPD said.

The banks’ cash reserve requirement, which is a specified minimum fraction of the total deposits that banks must hold as reserves either in cash or as deposits with the central bank, was cut by one percentage point and set at 5.5 percent.

The repo rate, which is the rate at which banks take loans from the central bank, was lowered to 6 percent from 6.75 percent.

From this month, the private banks can keep 50 percent of the government funds. Previously, they could hold 20 percent of the funds for annual development programme and 25 percent from the revenue budget.

From this month, the private banks can keep 50 percent of the government funds. Previously, they could hold 20 percent of the funds for annual development programme and 25 percent from the revenue budget.

The CPD said the decision to slash the CRR is likely to encourage the poorly performing private banks to continue with their business-as-usual practices.

The CRR cut may also encourage banks to lend more aggressively and indiscriminately, which would also raise the risk of an increase in classified loans, it added.

At the end of December last year, the overall non-performing loan ratio in the banking sector stood at 10.70 percent, up from 10.10 percent six months earlier.

“The attempt on the part of the finance ministry to rescue the private banks through CRR reduction was in fact similar to government’s recapitalisation support for the state-run banks.”

The civil society body said the central bank should investigate whether the recent liquidity crunch was brought about by loan defaulters who chose to repay their loans from state banks by borrowing from private ones.

Typically, a liquidity crisis is a symptom of a disease, Bhattacharya said. “But this is not a disease. The disease is that you have created a challenged banking system.” He also warned of capital flight given the stagnancy in private investment, private sector credit growth and surging imports. “If private sector investment remains stagnant, where has all the private sector credit gone?”

Private sector credit grew 18 percent in February, according to data from the Bangladesh Bank.

Both the state and private banks are giving credit to the private sector. “Yet, private investment is not picking up. How is it possible?”

Private investment is estimated to increase 0.2 percentage points to 23.3 percent this fiscal year.

On the other hand, import is rising fast. In the first eight months of the fiscal year, import grew 26 percent year-on-year to $35,820 million, according to data from the BB.

Historically, trade misinvoicing and capital flight are found to be more extensive during the election year, the CPD said.

It is important to see whether capital is being siphoned off in the name of capital machinery imports, Bhattacharya said.

Subsequently, he suggested coordinated efforts by policy agencies including the BB and the National Board of Revenue to curb illicit financial flows and making effective the revenue authority’s Transfer Pricing Cell.

The CPD also warned about the bullish trend in stock market ahead. “It raises concerns of outflow of capital,” Bhattacharya said.

In its analysis, the CPD also questioned this year’s 7.65 percent economic growth estimate put forward by the Bangladesh Bureau of Statistics, following in the lead of the World Bank and the Asian Development Bank.

It also cautioned on rising import payments and pressure on the balance of payments, volatility in foreign exchange market and depreciation of taka against the US dollar as well as increase in inflation.

The think-tank recommended the BB pursue a cautious monetary policy to curb inflation and ease the pressure on BoP.

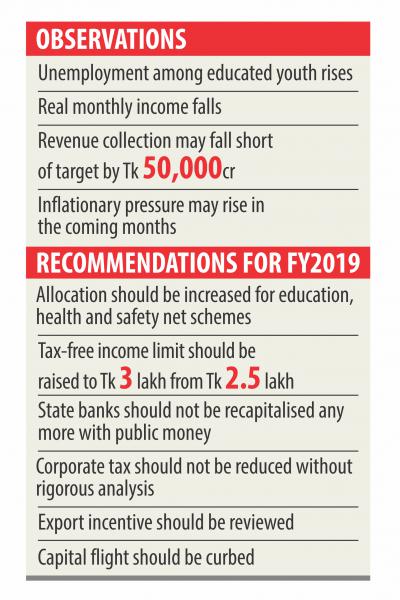

It also recommended restraining the influence of vested interest groups while formulating national economic policies, vigilance over the role of commercial banks and an end to recapitalisation of state banks with taxpayers’ money.

Between fiscal 2009-10 and fiscal 2016-17, the government allocated Tk 15,705 crore for the purpose of recapitalising the state lenders.

“Such support has not improved the performance of these banks,” said CPD Research Fellow Towfiqul Islam Khan, who presented the analysis on the state of economy and recommendations for budget for fiscal 2018-19.

Rather, the amount of the non-performing loans had piled up on a continuous basis over the past years.

“The practice of bailing out the losing banks with public money is economically unjustified and morally incorrect,” he said.

As alternative avenues, the CPD proposed using revenue to increase capital, exploring private investors to buy bank shares or merging with other banks.

The number of banks is very high given the size of the economy, said CPD Executive Director Fahmida Khatun.

“So no new bank is needed. If any bank sinks, let it sink. If any bank wants to merge it can. We support reducing the number of banks to enhance efficiency in the banking sector.”

GROWTH AND JOB CREATION

Despite the high GDP growth, not enough number of jobs was created in the industrial sector; most of the employment was created in service sector, the CPD said.

Besides, disparities exist among regions in terms of employment generation, it said, adding that the number of jobs increased only in Dhaka, Chittagong and Rangpur divisions. Employment fell in the south and southwest, north and northeast divisions, it added.

Unemployment rate among the relatively more educated labour force, particularly with secondary and higher secondary and tertiary education, had risen, said the CPD referring to the Labour Force Survey data published recently by the BBS.

The major concern is joblessness among educated youth.

The higher the education the higher the rate of unemployment, Islam said.

Unemployment among the educated youth rose in fiscal 2016-17 from a year earlier. In addition, the average real monthly income fell in fiscal 2016-17 from the previous year. Bhattacharya termed the trend as income-less jobs.

Real income of females has declined at higher rate than the males. Income in rural areas has dropped higher than in urban areas, he said.

“You have so far heard about jobless growth. Today, we say income-less employment. Whatever the rate of economic growth, its results are important,” Bhattacharya added.

It is important to look into the quality of growth, said CPD Distinguished Fellow Mustafizur Rahman.

“The real income of working class persons has declined. So, it is time to hold a debate on how far the growth could benefit people,” he added.

CPD Research Director Khondaker Golam Moazzem also spoke at the briefing.

Published in The Daily Sun on Wednesday, 18 April 2018

Working people’s real income falls: CPD

Bangladesh is sliding towards an ‘incomeless employment’ as real income of working class people has declined, UNB reports.

Analysing the state of the Bangladesh Economy in the fiscal year of 2017-18, Centre for Policy Dialogue (CPD) on Tuesday said this.

Dr Debapriya Bhattacharya, distinguished fellow of CPD came up with the remark during a programme in the city presenting CPD’s recommendations for fiscal 2018-19 budget.

He said though employment generation marked some increase in FY2017, the real income has declined.

“Female workers and rural workers are facing more decline in their real monthly income while the unemployment rate among the youth with higher education is increasing”, he said adding that, regional discrimination is also there as the decline is higher among the people from North Bengal and South-East Bengal.

According to CPD report, the real monthly income of female suffered 3.8 per cent erosion, while that of man suffered 1.9 per cent erosion, and in urban area, male workers monthly income increased 0.9 per cent while in rural area male workers face 4.1 per cent erosion.

More than one-third of the total youth labour force with higher education remained unemployed, according to CPD.

Dr Debapriya also termed the current state of banking sector as an ominous sign for the country’s economy.

He said, a handicapped banking system is building up.

Fearing the possibility of money laundering before the upcoming election, Debapriya said, the banking sector of Bangladesh has been plagued by financial scams, non-performing loans, inefficiency, and slack monitoring and supervision.

“Every time before election, the remittance increases but more money gets laundered”, he said adding that money laundering happens through banking sector, unstable capital market and high import payments.

“As institutional investors like banks play a significant role in controlling the capital market, proper monitoring should be there”, said Dr Khondaker Golam Moazzem, CPD Research Director.

In the analytical presentation, CPD urged the government to design the budget for stable macro-economy.

The organization also recommended to increase allocation for social security and to keep Rohingya crisis in mind while preparing the budget.

According to CPD, estimated 1.1 billion US$ will be required to cover the expenditure for the Rohingya on account of food security, sanitation, shelter, site management and health. Information on the flow of international fund, the usages of the fund for Ronghyas should be made readily available, it said.

Transparency in the allocation of budget, at the ministerial level, in view of the Rohingya crisis, should be ensured, urged CDP in the recommendation.

According to the think tank, Bangladesh Bank must pursue a cautious monetary policy in the coming months, the central bank should consider discouraging imports of consumer and luxurious commodities by raising L/C margins for import, and the budget for FY2019 should consider raising the tax-free income ceiling to Tk 3 lakhs in order to provide respite to lower middle income households.

It also recommended that government should consider reducing the personal income tax rate for the first slab to 7.5 per cent from the prevailing rate of 10 per cent, the adjustments of corporate tax rates should be done in a staggered way over the medium term in order to absorb any revenue shock.

CPD has also come up with some recommendations in the run-up to the election.

According to them, independent and rigorous economy-wide analyses should be conducted for all types of reforms, emphasise should be given on timely implementation of VAT and SD Act 2012, establishing a Public Expenditure Review Commission for ensuring accuracy of cost of estimation of public investment projects, considering establishment of a permanent Local Government (Finance) Commission towards effective devolution of power and introduction of appropriate financing modalities for local government.

The speakers stressed on looking at the qualitative result of GDP growth and how the increasing GDP is having its impact on general people’s lives.

Among others, CPD Distinguished Fellow, Professor Mustafizur Rahman, and its Executive Director, Dr Fahmida Khatun, also spoke in the occasion while its Research Fellow, Towfiqul Islam Khan gave the presentation.

Published in Dhaka Tribune on Wednesday, 18 April 2018

Low income employment replacing jobless growth

‘The employment generated in the last two fiscal years was in the informal sector, where workplace status and labour rights are of poor quality’

The Centre for Policy Dialogue (CPD) has questioned the outcome of GDP growth saying the country has entered into income-less employment from an era of jobless growth.

CPD explained what they meant by “income-less employment” by saying that previously jobless growth accompanied GDP growth. Now there is low income employment growth.

The independent think-tank said, according to the latest labour force survey, around 1.3 million additional jobs were created between 2015-16 and 2016-17. However, the real income of people has declined.

CPD revealed the above at a budget recommendation press conference at CIRDAP Auditorium on Tuesday.

Dr Debapriya Bhattacharya, distinguished fellow of the CPD, said: “To date, we ran after higher GDP – which is important – but the more important thing is decent employment.”

“The employment generated in the last two fiscal years was in the informal sector, where workplace status and labour rights are of poor quality.”

He said: “We can debate the GDP growth rate, but more importantly, we have to look into the outcome of it. According to our findings, the country is generating low income employment instead of jobless growth.”

He further said: “As we are not well equipped to measure GDP, we have to analyze economic development by matching growth, income, job, and production rates.”

“If the four components do not match up, it indicates that the development is a matter of concern.”

Towfiqul Islam Khan, a research fellow at CPD, presented budget recommendations while he described how low income employment has been generated in the country.

He mentioned four trends: 1) a majority of additional jobs have been created in informal sectors such as services, 2) there has been an increase in the unemployment rate among the relatively more educated labour force, 3) there has been more employment of men compared to women and more employment of people in urban areas compared to those in rural areas, and 4) disparities between regions in terms of employment generation persist.

“More than one-third of the total youth labour force [34.3%] with tertiary education remained unemployed during the 2016-17 fiscal year,” said Towfiqul.

He urged the government to refocus development objectives from the existing “GDP growth acceleration”-centric strategy to a “high economic growth from decent employment”-centric strategy to reduce low income employment.

“Budgetary allocations for social sectors must be coherent with the overall development needs of the economy,” he added.